India and China vehicle markets off to strong starts in 2024

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

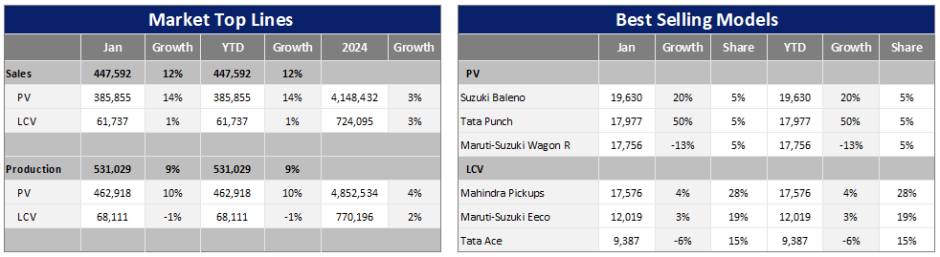

After India’s vehicle market hit a new record in 2023, the market has made a solid start to the new year, according to GlobalData analysis. Light Vehicle (LV) wholesales in January rose by 33% month on month (MoM) to 448k units. Not only that, but the January tally was also up by 12% year on year (YoY), even though year-ago sales were also strong.

India LV sales are expected to increase by 3% YoY to a record high of 4.9 million units this year.

The downside risks to the 2024 forecast arise from still high interest rates and an increasingly uncertain global outlook, while an upside risk comes from a spate of new model launches/updates as well as consistently strong demand for SUVs.

MORE: India light vehicle market strong this year (includes data)

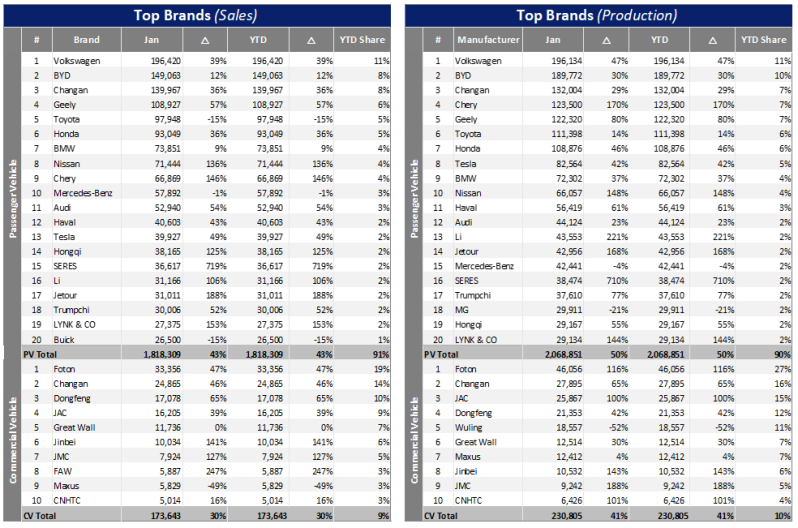

China’s auto market soared at the beginning of 2024, according to GlobalData’s latest report. Total Light Vehicle (LV) retail sales (i.e. wholesales excluding exports) reached 2.0 million units in January with significant growth of 42% year-on-year (YoY). And it is always interesting to browse the brands…

MORE: The Chinese market remains strong in 2024

A word of caution though. China’s market has been swinging around in recent years – something of a rollercoaster ride. Trends at the beginning of the year can be further complicated by the timing of the Chinese Lunar Year holidays (they move every year). February’s wholesales followed our earlier report this week and duly showed a reversal after January’s year-on-year gains.

More: China sales fall in February

US vehicle production outlook

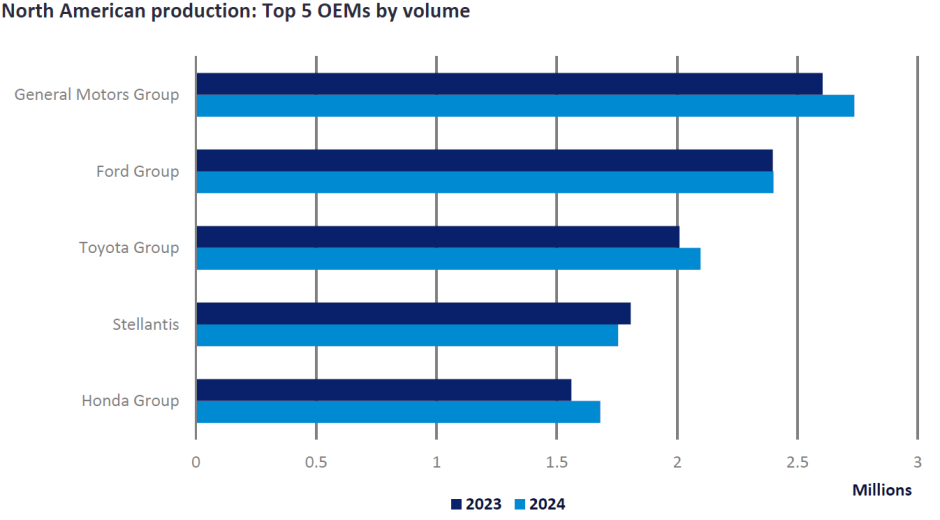

Light Vehicle production in North America for 2023 rose by 9.5% YoY – nearly 1.4 million more vehicles than in 2022. This growth was achieved by vast improvement in the supply of semiconductors, along with fewer parts supply issues, in general, and a stronger-than-expected regional demand environment, despite headwinds from pricing, interest rates, and economic uncertainty.

Improvements in production disruptions and continuing regional demand growth underpin production in 2024.

MORE: After a strong 2023, what’s next for North American production in 2024?

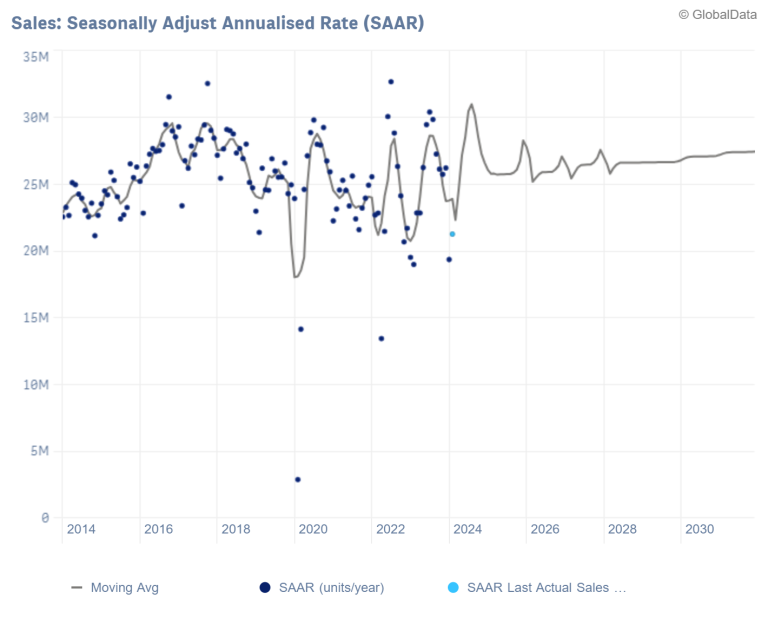

Still on the US, automotive executives are changing their tune on future growth targets following the recent sales slowdown. That’s still a moderating trend on a high point, though.

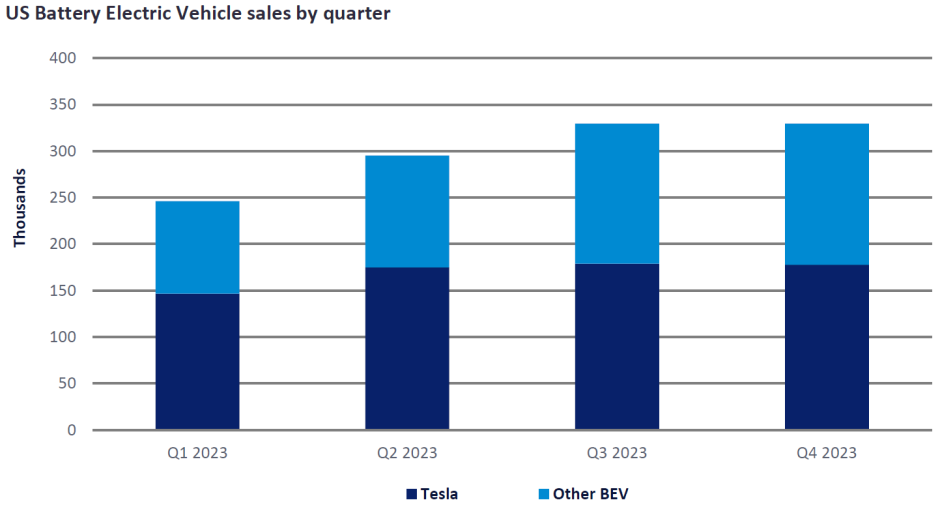

2023 BEV Light Vehicle sales exceeded 1.2 million units – the first year to surpass the million-unit mark – and closed with a 7.7% market share. Tesla made up half the volume after setting an aggressive sales growth target supported by multiple price cuts throughout the year.

MORE: Will US Battery Electric Vehicle sales stagnate in 2024?

Mini starts making new Cooper at Oxford

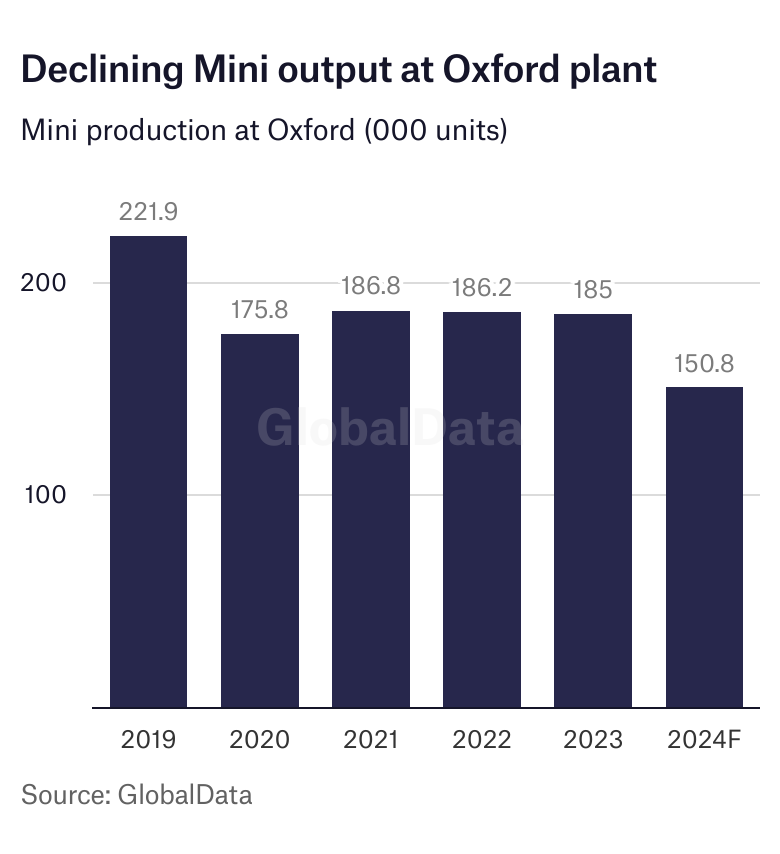

This week, BMW started production of the fifth generation Mini Cooper hatchback in Oxford, England. Mini’s Oxford plant has seen a decline to overall output as BMW has reconfigured its Mini global production base for new models and the transition to electric.

However, the Oxford plant will start making the first of two EVs in 2026. The Cooper line of cars is to be joined by a second electric vehicle, that being the yet to be revealed Aceman. Named after a concept from 2022, this larger car is expected to be revealed in April (2024).

Positioned above the new smallest models, the Aceman can be considered a successor for the Clubman.

MORE: BMW starts Mini hatchback output

EV charging infrastructure in Britain

The UK ranks 23rd among 30 analysed countries in Europe for the average purchase incentives offered for electric vehicles (EVs), according to a recent survey conducted by UK-based online marketplace Leasing Options.

MORE: UK’s EV purchase incentives lag behind European counterparts: study