China’s new vehicle market rose by nearly 1% to 2.53 million units in January 2022 from 2.50 million in the same month of last year, according to passenger car and commercial vehicle wholesale data released by the China Association of Automobile Manufacturers (CAAM).

This was the first year-on-year rise in nine months for the Chinese vehicle market, after sales in the second half of last year were affected by supply chain shortages, particularly semiconductors, as well as localized covid shutdowns in some key cities and other issues including energy shortages.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Economic growth slowed to 4% in the fourth quarter of last year, resulting in full-year growth of 8.1%. Vehicle sales last year increased by 3.8% to 26.3 million units, mainly due to a strong rebound in the first quarter of the year, after three years of decline.

Passenger vehicle sales in January increased by almost 7% to 2.19 million units, although commercial vehicle sales plunged by 26% to 340,000 units. NEV sales continued to drive the market forward, with sales rising by 140% to 431,000 units, while overall vehicle production last month rose by 1.4% to 2.42 million units.

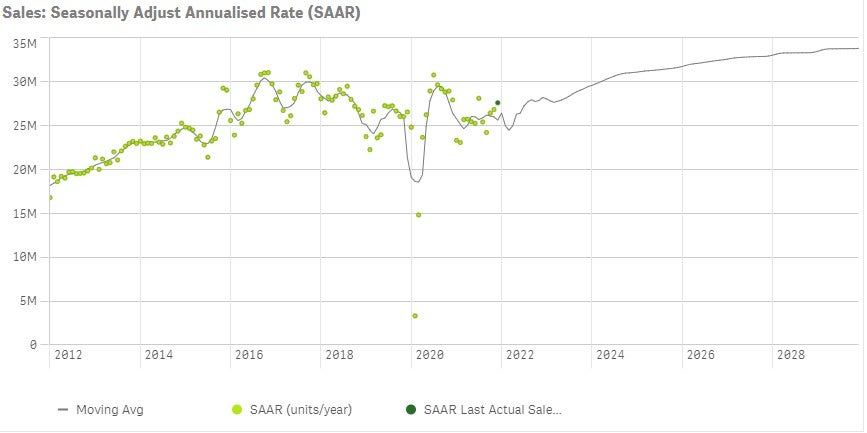

CAAM expects the vehicle market to expand by over 5% to 27.5 million units in 2022, underpinned by strong pent-up demand, monetary easing and other economic stimulus.

The Chinese vehicle market ended 2021 on a robust note, as supply issues continued to ease. The December selling rate surged to 27.6 mn units/year, up 2.9% from November, and marked the second highest rate in 2021.

GlobalData forecasts that the Chinese light vehicle market will rise by 4.5% to 26.6 million units in 2022.

Manufacturer performance

The country’s largest vehicle manufacturing group, SAIC Motor, saw its global sales rose by 13% to 455,552 units in January – including almost 82,000 overseas sales. Its SAIC-Volkswagen joint venture reported a 52% rebound in sales to 130,607 units and SAIC-GM-Wuling’s deliveries were up by 18% at 110,057 units, while SAIC-GM saw its volumes drop by 15% to 110,007 units. Its wholly-owned SAIC-Maxus subsidiary increased its sales by 25% to 21,037 units.

SAIC said its newly established SAIC-Audi joint venture aims to sell 50,000 vehicles in China in its first year of operation, in 2022. The company will have three main models available in this market this year, the A7L, Q5 e-tron EV and a full-size SUV, with a network of some 120 sales outlets expected to be in place by year-end.

FAW Group, the country’s second-largest automotive group, reported 311,508 sales last month – including 42,158 Hongqi branded models and more than 28,000 Jiefang trucks. Its foreign joint ventures accounted for most of its sales, including FAW-Volkswagen with 182,977 sales and FAW Toyota 51,741 units.

Geely Auto said its global sales increased by 6% to 146,380 units last month, while Great Wall Motor said its global sales increased by over 16% to 111,778 units, including 12,750 overseas. BYD Auto reported a 368% surge in new energy vehicle sales to 92,926 units – including 46,386 battery-powered models.