The UK automotive industry has called for ‘urgent government intervention’ to safeguard the sector and Britain’s zero emission vehicle transition.

The call comes following the news that Stellantis to close a UK plant (Luton) and said that its decision came in the context of the UK’s Zero Emissions Vehicle (ZEV) Mandate which has been criticised by UK manufacturers who say it will impose huge costs at a time when market demand for BEVs is undershooting expectations.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

The Society of Motor Manufacturers and Traders (SMMT) said its analysis suggests weak demand for EVs and the need to fulfil ever-rising sales quotas will cost the industry some GBP6bn in 2024, and even more next year – with the potential for devastating impacts on business viability and jobs.

Heavy discounting of BEVs

Further, the SMMT points out that the mandated targets have given manufacturers no option but to subsidise sales, incentivising fleet, business and consumer EV sales through an estimated £4 billion worth of discounts. Despite this, the industry looks likely to fall short of the 22% EV market share demanded, potentially creating a £1.8 billion bill for compliance for those missing their targets for cars alone, either to government or to competitors, most of whom manufacture their EVs abroad. Van manufacturers will face further costs, with market demand drastically behind the ambition set by the mandate.

The result, the SMMT maintains, is a total ‘compliance bill’ of almost £6 billion in 2024 alone, with costs set to mount next year. With global manufacturers already making production cutbacks due to weak EV demand, losses of this scale could force brands to withdraw from the UK market and cause global investors to ‘question the UK’s appeal as a manufacturing destination,’ the SMMT warns.

Mike Hawes, SMMT Chief Executive, said: “We need an urgent review of the automotive market and the regulation intended to drive it. Not because we want to water down any commitments, but because delivery matters more than notional targets. The industry is hurting; profitability and viability are in jeopardy and jobs are on the line. When the world changes, so must we. Workable regulation – backed with incentives – will set us up for success and green growth over the next decade.”

The UK’s ZEV Mandate – how it works

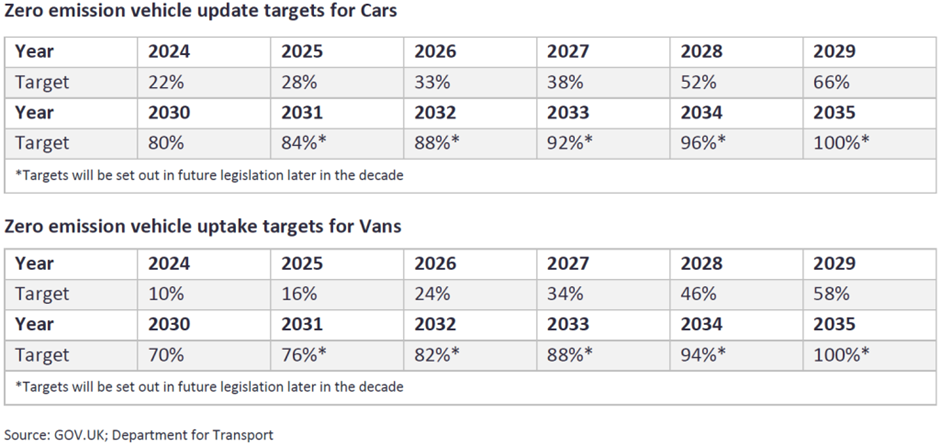

The UK Government’s Zero Emission Vehicle (ZEV) Mandate targets EV share numbers and will fine OEMs for non-compliance.

While BEV car sales in the UK have reached almost 300,000 in the first ten months, that represents 18.1% of the market – an increase on 2023, but still significantly short of the 22% target for this year (and of the 28% which must be achieved in 2025) under the ZEV mandate.

Manufacturers that fail to meet the compliance levels or do not sell enough ZEVs face penalties of GBP15,000 (USD20,000) for every non-ZEV unit sold over their mandated allowance. There is an option to buy ‘credits’ from manufacturers exceeding the share target (for example from BEV-only makers such as BYD or Tesla), but volume OEMs argue that means they are effectively subsidising their competitors.

While the UK Government has said it will talk to the industry about how the ZEV Mandate works – suggesting there could be some flexibility in its application to help the industry – it has also said it wants to keep to the overall targets as part of the UK’s net zero commitments and to maintain the phasing out of petrol and diesel only powertrain vehicle sales by 2030.

When the UK’s ZEV mandate was unveiled, the industry anticipated that 457,000 electric cars would be registered in 2024, which should have accounted for 23.3% of all new car registrations. However, the SMMT said the latest outlook shows 94,000 fewer cars will be registered, totalling just 363,000 with a market share of 18.7%. The situation is even worse for vans with the outlook halved to just 20,000 units expected to be registered this year, a 5.7% market share against a 2024 ZEV Mandate target of 10%.