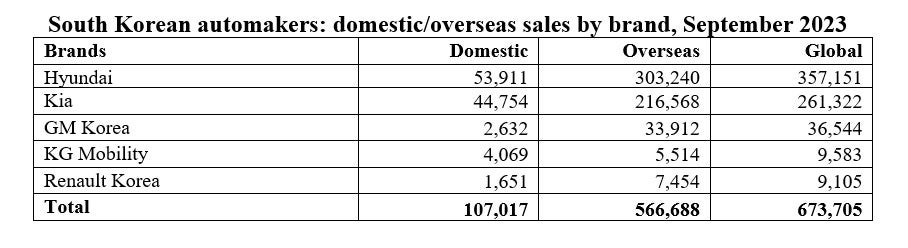

Domestic sales by South Korea’s five main automakers combined fell by 6% to 107,017 units in September 2023 from 113,806 a year earlier, according to preliminary wholesale data released individually by the manufacturers. The data do not include sales by South Korea’s low-volume commercial vehicle manufacturers such as Tata-Daewoo and Edison Motors.

The vehicle market has begun to weaken in recent months as consumers and local businesses come under increasing pressure from higher borrowing costs following last year’s sharp interest rate hikes – from 1.25% to 3.5% currently. The strong market growth seen in the first half of 2023 was mainly driven by an easing of last year’s supply chain bottlenecks, which has allowed automakers to fulfil order backlogs, and also significant new model activity – particularly by the leading domestic automakers.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

GlobalData forecast

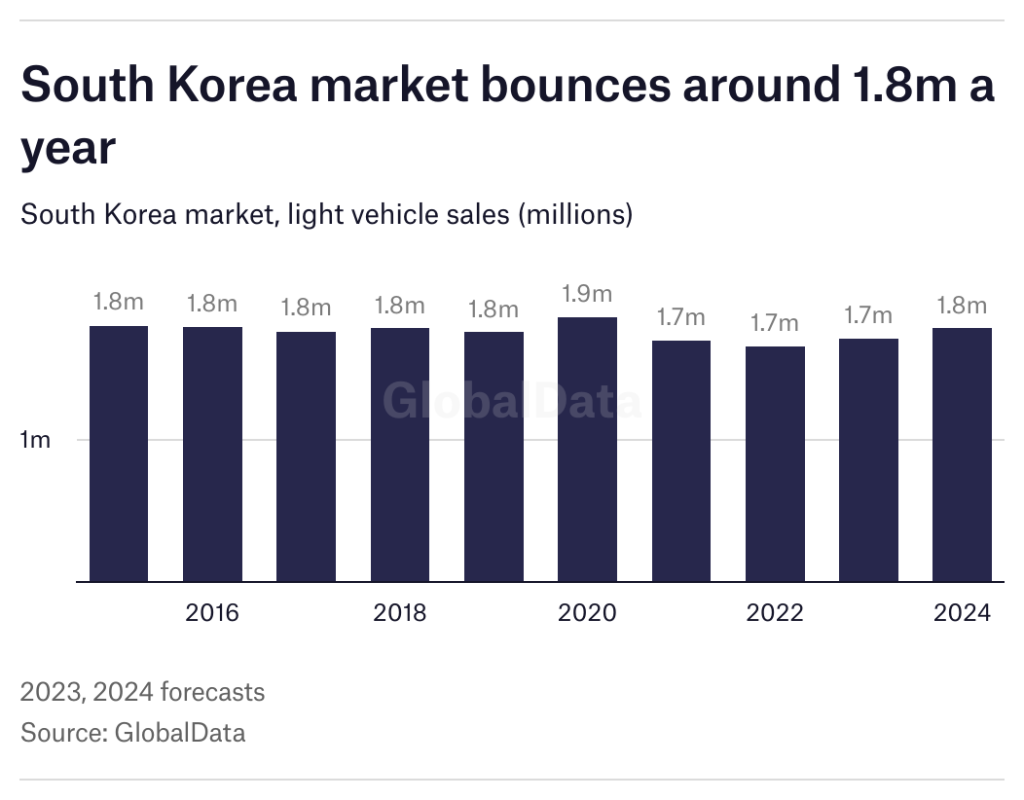

September’s market decline follows a weaker-than-expected August. Given recent market weakness and a slowing economy, GlobalData has made some downward adjustments in the 2023-2026 forecasts. Sales of light vehicles in Korea are now projected to increase by 4.2% (compared to the previous 5%) to 1.72 million units this year. The 2024 forecast of 1.79 million units (+4%) also carries some downside risk. In the near term, demand is expected to continue to lose steam in the face of higher interest rates, a slowing job market, and an increasingly cloudy global outlook – in particular, China’s economic slowdown and higher US interest rates.

Manufacturer performance

In the first nine month of the year domestic vehicle sales were still up by almost 8% at 1,090,614 units from 1,010,868 units in the same period of 2022. The market was lifted mainly by Hyundai Motor, which reported a 13% sales rise to 563,519units, and by Kia Corporation with an 8.5% increase to 429,927 units. GM Korea’s sales were down just slightly at 29,056, underpinned by the introduction of the new Trax crossover model at its Changwon plant in February, while KG Mobility enjoyed a 4% rise to 50,984 units as confidence in the brand returned following last year’s takeover by the local KG Group.

Renault Korea, which is struggling to keep pace with rising competition in this market, reported a 57% plunge in local deliveries to 17,128 units year-to-date.

Global sales among the country’s “big-five” automakers, including vehicles produced overseas by Hyundai and Kia, increased by just under 2% to 673,705 units in September from 661,619 units a year earlier, while cumulative nine-month sales were 10% higher at 5,987,812 from 5,431,115 units – helped by improved supplies of semiconductors following last year’s shortages. Overseas sales increased by over 3% to 566,688 units last month from 547,873 units, while year-to-date volumes were almost 10% higher at 4,897,378 units from 4,460,004 units.

Hyundai Motor’s global sales were slightly lower at 357,151 units in September from 357,555 a year earlier, with weaker domestic sales largely offset by stronger overseas volumes. Total deliveries in the first nine months of the year were up by almost 8% at 3,127,001 units from 2,904,051 in the same period of last year, as the automaker recovered from last year’s component shortages.

Domestic sales fell by over 5% to 53,911 units last month from 56,910 units a year earlier, although cumulative nine-month sales were still up by 13% at 563,519from 496,835 units – reflecting strong demand for the all-new Grandeur sedan and the company’s strong SUV range. Hyundai launched the all-new Kona compact SUV range earlier this year, including an all-electric variant, and the all-new Santa Fe mid-sized SUV in August.

Overseas sales increased by less than 1% to 303,240 units in September from 300,645, while year-to-date volumes were up by 6.5% at 2,563,482 units from 2,407,216 – reflecting strong demand for its SUVs in key regional markets including North America and Europe and in India.

Hyundai looks like it will struggle to achieve its target of increasing global sales by 10% to 4.32 million units in 2023, including 3.54 million overseas sales and 781,000 in its home market. In August, the company said it plans to improve its product mix by increasing production of higher-margin models such as SUVs and EVs. It is scheduled to launch the N brand’s first EV model, the Ioniq 5 N, in the domestic market later this year and in global markets from next year.

Kia’s global sales increased by almost 5% to 261,322 vehicles in September from 249,458 a year earlier, reflecting higher domestic and overseas sales. Total sales in the first nine months of the year were up by over 8% at 2,354,072 units from 2,171,538 units, driven by strong demand for SUVs including the new Sportage and the new K3 sedan.

Domestic sales increased by just over 11% to 44,754 units last month from 40,159 a year-earlier, with the Sorento and Seltos SUVs the brand’s best-selling models. Cumulative nine-month sales increased by 8.5% to 429,927 units from 396,401 previously.

Overseas sales rose by over 3% to 216,568 units in September from 209,299 units and by 8% to 1,924,145 units year-to-date from 1,775,137 units, reflecting robust demand for SUV models such as the Sportage and Seltos in key regional markets including North America, Europe and India.

Kia said it aims to increase its global sales over 10% to 3.2 million units in 2023, including 585,120 domestic sales and 2.61 million units overseas. The automaker continues to expand its EV range in global markets, with the new EV9 SUV scheduled to be launched in North America and Europe in the fourth quarter of 2023 followed by the EV5 compact electric SUV and the EV6 electric sedan next year. The new Carnival MPV and K5 compact sedan will be rolled out globally from the current quarter.

Kia’s medium-term target is to sell 4.3 million vehicles annually by 2030, of which 1.6 million units are expected to be battery electric vehicles (BEVs).

GM Korea’sglobal sales jumped by 50% to 36,544 vehicles in September from 24,422 a year earlier, reflecting strong export sales following the introduction of the new Trax crossover vehicle at its Changwon plant in February. Cumulative nine-month sales were up by 69% at 323,319 units from 191,452 a year earlier.

Local sales fell by 34% to 2,632 units last month from 4,012 a year earlier and were slightly lower at 29,056 units year-to-date from 29,270 – underpinned by the new Trax and Bolt EV. Other GM models sold locally include the Colorado and Sierra Denali pickup trucks and the Equinox, Traverse and Tahoe SUVs, with the Cadillac Lyric scheduled to be launched later this year.

Exports surged by 66% to 33,912 units in September from 20,410 a year earlier and by 81% to 294,263 year-to-date from 162,182 units.

KG Mobility’s global sales fell by 15% to 9,583 vehicles in September from 11,262 units a year earlier, with strong exports offsetting a sharp decline in domestic sales. The company was acquired last year by a consortium led by local steel and chemicals firm KG Group. Total sales in the first nine months of the year were up by 20% at 96,219 units from 80,188 units previously.

Domestic sales plunged by 47% to 4,069 units last month from 7,675 units a year earlier, but were still up by 4% at 50,984 units year-to-date from 48,875 units. Last month the company launched the new Torres EVX SUV, powered by a lithium iron phosphate battery pack, its second battery-powered model after the Korando Emotion which was launched in early 2022.

Exports jumped by 51% to 5,514 units last month from 3,647 units, helped by the recent launch of the Torres SUV in Europe, and by 44% to 45,415 units year-to-date from 31,583 units. Over the last year the company has secured significant export contracts from Middle-Eastern distributors, including an order for 170,000 CKD kits to Saudi Arabia over a nine-year period starting this year and a further 7,000 built-up vehicles to be exported to the UAE.

KG Mobility is in the process of finalising the acquisition of bankrupt Edison Motors Company Ltd, a local electric commercial vehicle manufacturer that just two years earlier had successfully bid to acquire KG Mobility (then known as Ssangyong Motors) from bankruptcy but failed to complete the acquisition.

Renault Korea‘s global sales plunged by 52% to 9,105 vehicles in September from 18,922 units a year earlier, with local sales and exports both declining sharply. Total sales in the first nine months of the year were down by 29% at 87,201 units from 123,373 units.

Local sales fell by 67% to 1,651 units last month from 5,050 a year earlier, as the company struggled with rising competition from domestic manufacturers and from other imported brands, while year-to-date sales were down by 57% at 17,128 from 39,487 units. Exports fell by 46% at 7,454 units in September from 13,872 a year earlier and by 17% at 70,073 year-to-date from 83,886 units.

Renault Korea plans to add more hybrid vehicles to its line-up to help revive sales, with a version of the XM3 compact SUV the only hybrid model currently available in the country. The company had previously announced it is making preparations to produce a Geely-based hybrid model at its Busan plant. In a more recent statement, the company’s CEO revealed plans to add a mid-sized hybrid SUV model to its lineup in the second half of next year under its Aurora 1 programme.

Renault Korea is also looking to produce EVs in South Korea at a later state and has been discussing sourcing batteries from local producers including LG Energy Solution, SK On and Samsung SDI.