Panasonic Corp., the leading supplier of Li-ion batteries to Tesla in the US is said to be engaged in talks with the government over establishing a new battery production site in the US.

The new manufacturing site will reportedly largely cater for the 4680-battery cell demand from Tesla and potentially other electric vehicles (EVs) manufacturers. There’s no official confirmation from the battery supplier on the US plans. The latest announcement from Panasonic relates to a 4680-prototype production line in Japan and mass production of the 4680-battery cell at Wakayama, Japan starting in April 2023. However, there are substantial reasons to believe that a new facility in the US could be on the cards.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Tesla’s new 4680-format cylindrical cell is promised to bring a multitude of benefits to its EVs and is key to Tesla’s $25,000 affordable EV ambition. For one, the larger form factor means fewer cells are needed for each battery pack, reducing production time, and less packaging material is needed for a given volume of active battery material, increasing pack-level energy density. However, since the format’s launch at Tesla’s Battery Day in September 2020, 4680s have yet to begin mass production.

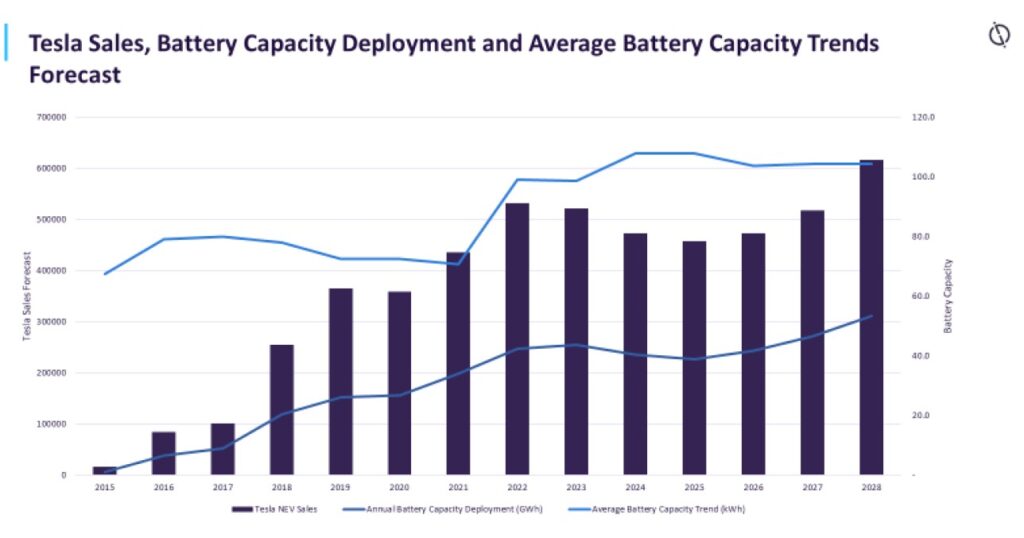

The OEM is taking a twin-pronged approach to 4680 supply – aiming to manufacture some cells in-house at its Kato Road battery facility in Fremont, California – with the remaining demand met by existing third-party suppliers, with the likes of Panasonic, LG Energy Solution and Samsung SDI all preparing sample cells in 2021. Tesla’s Chinese supplier CATL is not expected to be at the forefront of 4680 production because the company mainly makes prismatic-format cells. Also, Tesla’s in-house battery production plans at the upcoming ‘Gigafactory Texas’ in Austin will materialise only in the long-term given the high investments and manufacturing complexity, and procurement from third-party suppliers may remain the most immediately attainable option in the present.

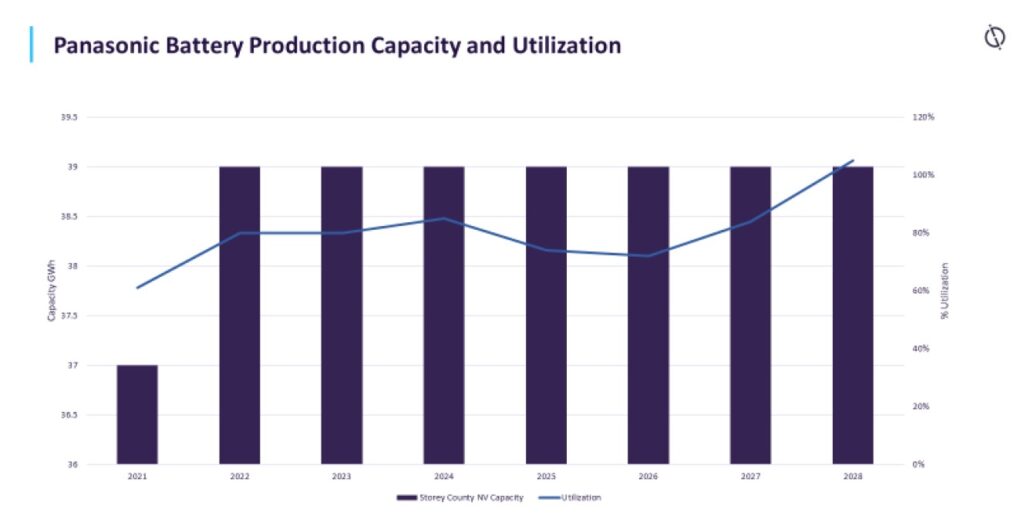

This could be where Panasonic, its long-standing partner in the US, comes in. The supplier had adjusted its production capacities in the past to meet Tesla’s dynamic sales volumes. However, with the battery plant in Nevada getting close to its production capacity, a potential expansion or new facility development seems to be on cards to meet the future demands which will see a higher average battery capacity per vehicle. For the new facility, Panasonic is rumored to have earmarked sites in Oklahoma or Kansas, i.e. close to Tesla’s new plant in Austin, Texas.

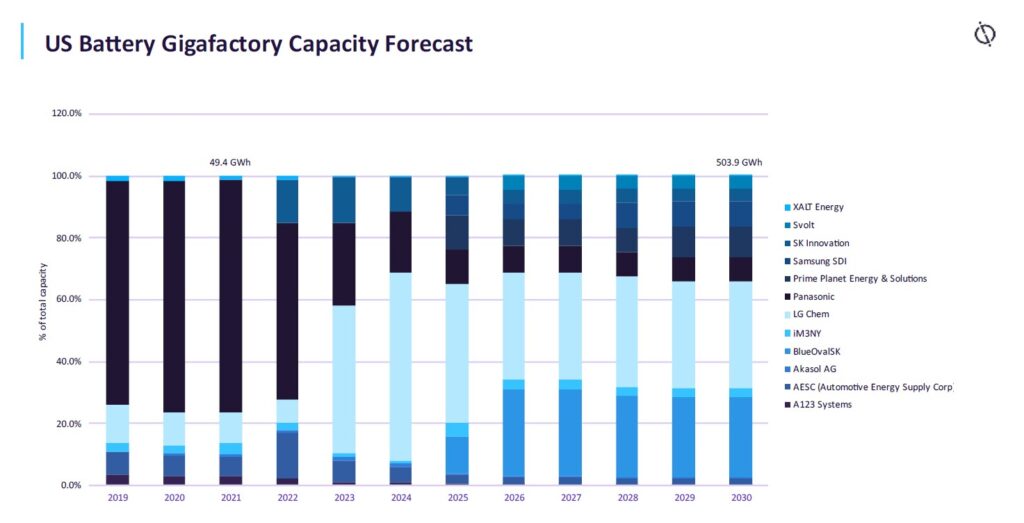

Prima facie, the potential investment looks more Tesla-focused based on the above findings, it could also be a case that Panasonic may eye other OEMs as well. The US is emerging as a lucrative EV market with high focus from the federal and state government on the matter. The country has set an ambitious target of making half of the new vehicles sold to be fully electric by 2030. Other battery suppliers such as LG, AESC and CATL have recently scaled up in the US to realise the opportunity, while Panasonic has been a bit of a bystander and catered almost exclusively for Tesla. The total battery plant capacity in the US is expected to expand from 49.4 GWh in 2021 to 503.9 GWh by 2030 according to GlobalData. LG Chem and SK Innovation are anticipated to take the centre-stage by 2030.