After two and a half years of facing one major setback after another, the global light vehicle market continues to struggle to gain any real traction. Even though it has posted stronger selling rates in recent months, that is primarily a result of a rapid improvement in the China market, which itself is benefitting from a temporary purchase tax cut on cars. Across much of the world, supply bottlenecks remain the key reason for holding back better sales results. However, as Europe and North America head into the winter months, economic prospects look increasingly dismal in the face of stubbornly high inflation, and underlying demand for new vehicles is inevitably being eroded.

Vehicle buyers will, no doubt, look back with fondness at the deals available pre-pandemic, with a lack of parts more recently leading OEMs to concentrate on the real money spinners in their ranges, the higher-margin, higher-priced variants. For example, in the US, average vehicle prices broke through the US$40,000 threshold for the first time in July 2021 and continued to climb to year-end, and beyond. The latest data shows average prices at just over US$46,000, somewhat higher in year-on-year terms, though there are at least now signs that this price growth is levelling off. And while US prices have gone up, incentives offered by OEMs have fallen to record lows. It is not just a US phenomenon, or indeed a new vehicle phenomenon— in the UK, for example, used car prices have jumped by a quarter in the last two years as prospective new car buyers have increasingly looked to the used car market, while many on new vehicle finance plans have bought out their current car. So, not only is it more difficult to get hold of a vehicle, but it is also more expensive.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

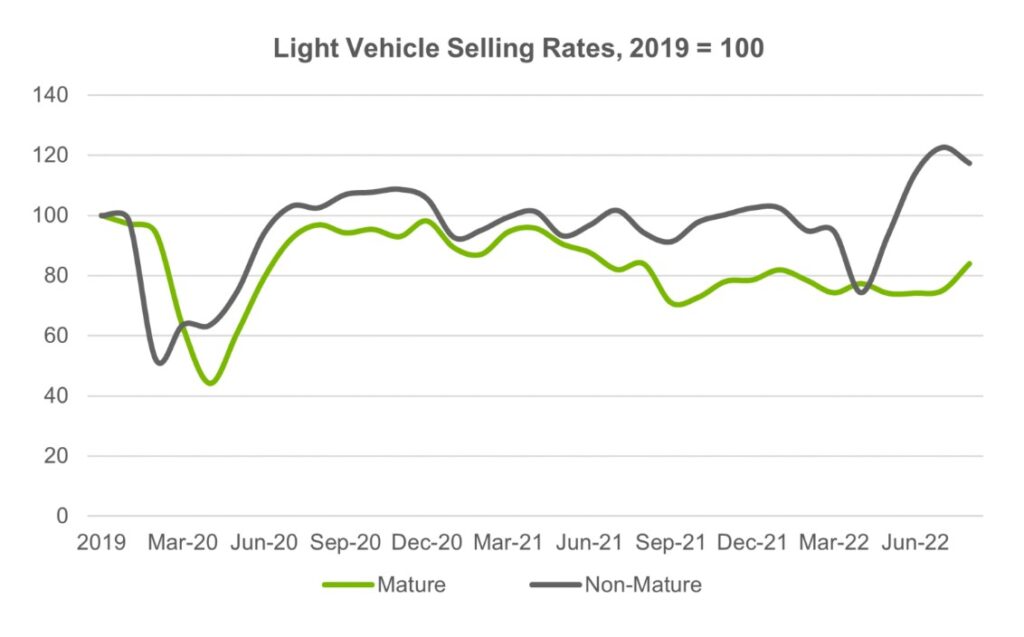

Geographically though, there is a clear contrast between mature markets and non-mature ones — the former group finding the going far tougher than the latter – mature markets operating at three-quarters of 2019 levels, while the non-mature markets have, in aggregate, seen volumes fully recover. Heavier chip content in mature market products may well help explain some of this sluggishness.

Supply-side disruptions mask the true strength of underlying demand in the global monthly sales statistics. However, this demand is no doubt softening as the global economic outlook deteriorates and customers’ appetites for making a big-ticket purchase, such as a new car, are tempered. Household budgets will be increasingly squeezed as inflation bites and central banks push up the cost of borrowing. As a result, demand will continue to evaporate — while not currently our baseline assumption, next year could yet see falling demand coming down to meet rising supply with balance occurring at a still-reduced level. One saving grace of the weakness in vehicle production since last year is that we have seen a build-up of waiting lists for new vehicles, with these order backlogs ensuring a substantial flow in sales for some time.

While supply chain challenges are anticipated to ease during 2022, they are unlikely to be resolved and the ongoing headwind of higher costs for energy, logistics, and materials is expected to continue exerting pressure on profits and end-user pricing. A deteriorating global economic outlook has helped drive prices down for industrial metals such as steel and aluminium, providing some cost relief to the auto industry. However, prices of electric-vehicle-focused commodities, particularly lithium, remain elevated, principally through continued supply deficit concerns.

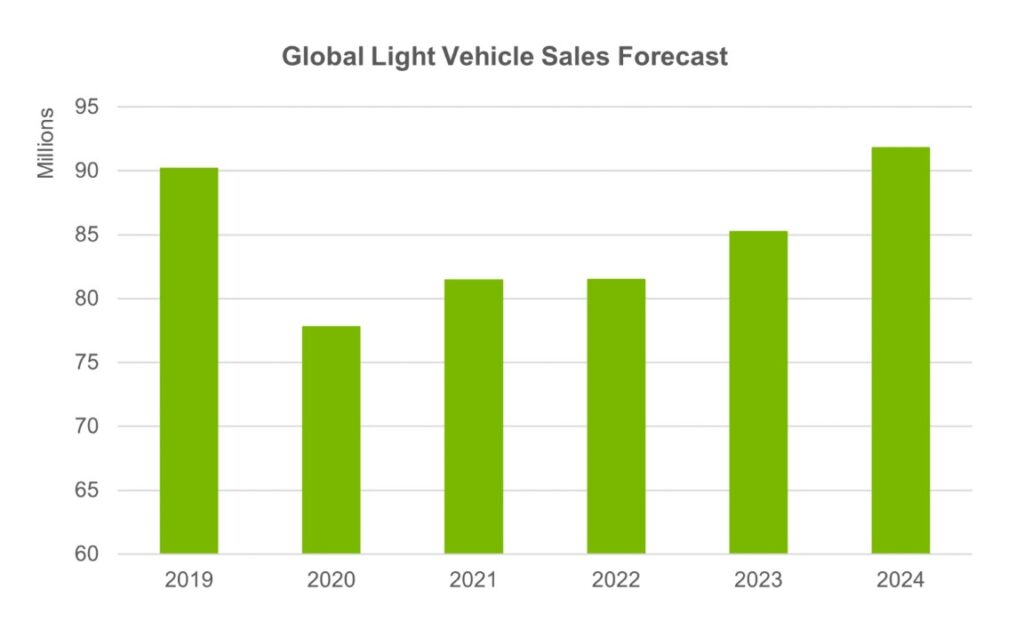

Aside from a few exceptional months recently, the global light vehicle market remains well below the 90+ million-units level seen prior to 2020. The Russian invasion of Ukraine only added to the disruption faced by the supply chain with our latest global LV sales forecast for 2022 now five million units lower than our pre-conflict view (January 2022). The expectation of increased semiconductor supply should see the easing of some of the more extreme pricing over H2 2022 and 2023, as OEMs’ concentration on the highest margin vehicle inevitably eases. However, pre-pandemic global market volumes are not forecast before 2024, with risks remaining skewed to the downside, particularly given the potential for a much harder economic downturn.

Jonathon Poskitt

Just Auto editor David Leggett adds:

Market geography has never been more important – at first sight – than right now. The mature markets and non-mature markets split that Jonathon talks about highlights very divergent trends that will be shaping operational performances for companies in the sector

Companies such as Volkswagen will benefit from stronger sales in China (although Covid-related lockdown reverses are still a major risk there). Others (notably Japanese OEMs) will see volume lifts from higher sales in other Asian markets, especially in southeast Asia. But problems of tight supply remain an issue in mature markets such as North America and Western Europe. Moreover, the dent to the global volume pie remains large, with 2022’s global market at under 82 mn and some 14% below 2017’s peak when it seemed to be heading inexorably towards 100 mn a year.

There are indications, however, that the worst of the semiconductors shortage is now behind us with a gradual easing in prospect through the remainder of the year. One upside of backed up orders is that activity in factories can be ‘smoothed’ just as the emphasis switches to broader demand concerns and slowing economies due to a toxic combination of surging energy prices, lower household incomes, higher interest rates and significant ongoing geopolitical worries (all of which look set to be with us in 2023).

The big question is this: Will companies have to make significant changes to their global manufacturing footprints? It hasn’t really happened yet, but the drop-off in volumes from 2019 is large and tinkering with model-mix has its limits as demand weakens. They will be reluctant to do so, but the pressures will be building next year, especially if risks start to rise on the 2024 outlook. If the divergent trends in the global market continue, the mature markets will be the ones that feel the pressures most.