Equities analyst Sabine Blümel has told just-auto that Volkswagen may be interested in parts of Fiat-Chrysler, as rumoured, but would have to be careful to avoid potential problems with such an acquisition.

“There are a number of possible problems that could make an acquisition scenario bad for Volkswagen,” she cautions.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

“The management at the VW Group has a lot on their plate and are already over-stretched,” she says. Current challenges for the Wolfsburg giant include the integration of recent acquisitions, including the truck manufacturers Scania and MAN, implementing a global growth strategy and effectively managing a vast and complex business of multiple-brands across the world.

“And, not least, there is the need to sort out low profitability at the VW car brand,” Blümel points out. “The operating margin was just 1.8% in the first quarter, which is only partly due to emerging markets, but also due to the poor performance in the US and structurally high fixed costs.”

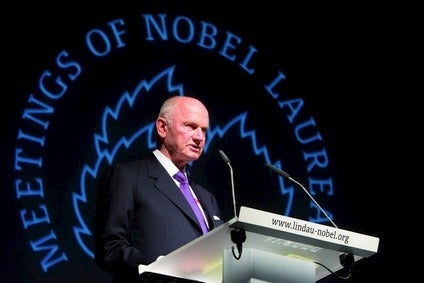

VW Group CEO Martin Winterkorn recently announced an EUR 5bn cost cutting programme.

“VW is also currently not in a position to finance a huge acquisition without yet another capital increase,” Blümel says.

She also sees two possible scenarios implied by the rumoured discussions. One is that VW sees value in swallowing the whole of Fiat-Chrysler. “This is possible but pretty unlikely,” Blümel maintains. “It would also be extremely bad news for VW. Ferdinand Piech has always been extremely sceptical about the industrial logic of a combination of Fiat and Chrysler. He has said that the combination of two of the weakest OEMs is unlikely to create an automotive powerhouse. There could also be considerable competition law issues in Brazil and LATAM in general, where Fiat and VW are number one and number two in automotive markets.”

A more likely scenario sees VW looking to cherry pick certain assets or brands from Fiat-Chrysler.

“These rumours are not new, and in the past, Piech has publicly stated his interest in parts of the Fiat group, such as Alfa and Ferrari and also Chrysler. Again, I’d consider this a bad move for VW.

“The rationale of a Chrysler acquisition is that it would give VW access to Jeep’s SUVs and a distribution network in the US, thus solving VW’s problems in North America. However, Chrysler has a lot of issues and is considerably less profitable than Ford and GM in North America.”

What about Alfa Romeo? “Alfa Romeo is just a name – with only 75,000 units sold in 2013. Although VW should be able to rebuild it as a premium brand, would it be worth the trouble? It would entail huge costs, further increase in complexity within the VW Group and creates the danger of some cannibalisation of the Audi brand.”

Blümel says that the rumours of discussions are not surprising. “People, shareholders and managers in the automotive industry are talking to each other all the time. Nothing can be ruled out, but I think the business case here is far from clear.”

See also: ITALY: Fiat denies merger talks with VW