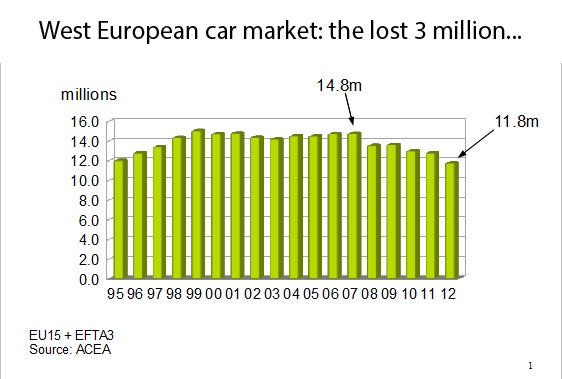

As the middle of the year gets closer, the the European automotive marketplace isn’t getting any easier. By last year, Western Europe’s car market had lost 3m units since its 2007 peak (a heady 14.8m units). This year is likely to see the market decline by a further 5% or so to not much more than 11m units.

Is it a tough market? A ‘bloodbath’ even? You betcha. Ford turned in some good first quarter financial results recently, but is staring at a USD2bn loss in Europe this year and admits that its target is to get back to profitability in Europe mid-decade. Even market leader Volkswagen is finding it hard going – especially now that the German car market is turning down, Germans spooked by the uncertainties that persist over the eurozone and future bailouts. And Ford and Volkswagen are two car companies in relatively good shape.

What are the volume car manufacturers to do about excess manufacturing capacity in Europe? There is certainly a reluctance to shut plants outright and to quickly adjust – slim down – the way the North American industry did not so long ago. Europe is a fragmented place where nations still matter and run economies. The cynics will say that in some countries it is still politically very difficult to shut plants, especially so at a time of high and rising unemployment.

Renault, under the auspices of a productivity agreement with French labour unions (rubber stamped by French politicians), is certainly doing its best to keep plants in France running and we heard last week about the plan to make the next Nissan Micra in France.

So, you make Nissans in France – that would otherwise have been made elsewhere – to soak up some overcapacity at a Renault plant. It must raise a question: is political expediency getting in the way of good business practice? Is shifting production from one place to another merely dodging the underlying issue?

The Chennai plant where the current Micra is made is very low-cost, specialises in small cars and is an Alliance plant designed to be relatively labour intensive (a good thing in a developing place like India where labour is relatively cheap and the authorities want higher employment, are keen to attract multi-national manufacturing companies). The strategy has been to build Chennai as a low-cost small car manufacturing hub for Nissan. Taking some Micra volume away from that plant (though it will continue to make the next gen Micra for local markets) could impact volumes and unit-cost assumptions. Nissan may have more rejigging to do as a result.

Renault-Nissan has an enviable global manufacturing footprint and global architectures for its vehicles across the world that make plant-product-brand mix easier to mess with now than ten years ago. The hope has to be that long-term cost competitiveness is not being compromised for political reasons.

General Motors must also be thinking hard about making Chevrolet models at under-utilised Opel/Vauxhall plants. The German government is, as always, highly sensitive to anything that General Motors might want to do with Opel. Analysis by LMC Automotive suggests that shutting Bochum – on current plans – may well not be enough to get GM’s European operations profitable again. But where else could the axe fall? Politicians must be wondering. One immediate measure might be to throw some Chevrolets in to the mix. Can Chevrolets fill the capacity gap? They might help, but again, what are the effects of that elsewhere and is it consistent with the company’s manufacturing strategy? And what if you add in PSA – GM’s embryonic strategic alliance partner – manufacturing capacity to the mix? How many manufacturing plants in Europe do you really need?

Similar issues apply at Fiat, where Sergio Marchionne – despite some tough talking – has struggled to deal with overcapacity (and who’d have thought a few years ago that Fiat would eventually be effectively kept alive by Chrysler?). And is shutting Aulnay really enough for PSA?

Manufacturing capacity at plant level is a notoriously difficult thing to measure definitively (two-shifts or three, what’s really fixed and so on) but as as a rule of thumb, plants should operate at around 80% capacity utilisation to break even. Some plants in Europe are at nearer 20%.

There is still a general reluctance to shut capacity, especially during a severe recession. Opposition can be strong and potentially even more damaging than keeping a plant ticking over for a while longer or until the market picks up.

Fixed capacity is just that. But it may be more flexible in some cases than others, depending on how an OEM has set up its manufacturing structures – powertrains, platforms, degree of modularity on major component sets. In some cases, there are also big investments in plant and machinery to amortise, supply chains (like adjacent or nearby supplier parks) to consider. Shutting a plant is not just politically difficult, there are lots of operational factors to take account of, besides just a low ‘rate of capacity utilisation’. No-one said it was simple.

The problem is the duration of this slump in Western Europe and the need to revisit assumptions on capacity and market volumes. If you are losing money and operating plants at a loss, the big question is how long can you do that if the market recovery is being pushed back further. The economic forecasts are stark: the competitive environment for selling cars in Western Europe will remain very tough for a while yet.

More tough decisions lay ahead in the automotive business in Europe.

(I expect to receive a comprehensive update on the European capacity situation later this month at an LMC event – further details here.)

|