The number of the smallest, entry-level cars has been on the decline in Europe. In this Analyst Briefing, we will explore the factors leading to the disappearance of small cars, how the supply crisis accelerated this trend, and why they all tie back to the same overarching theme – profit and margins.

EU legislation

The entry point to car ownership usually starts with A-segment hatchbacks, such as the Renault Twingo and Volkswagen Up! but an entry-level price tag leads to very limited profit margins for the manufacturer. In Europe, these tight margins are being further squeezed by EU legislation covering the latest safety and emissions standards. For example, to meet new regulations for CO2 emission reduction, manufacturers are adding hybrid and battery electric technology to vehicles, which increases production costs. However, the smallest cars are worst placed to absorb these extra costs, as the price sensitivity at this end of the market means that increases are less tolerated by buyers.

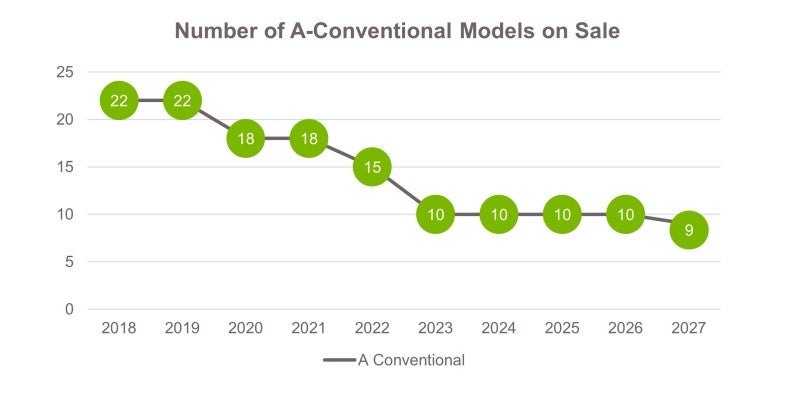

The Conventional (which includes hatchbacks, sedans, and wagons) A-segment is therefore caught between the expensive need to adhere to EU legislation and the inability to pass these costs on to buyers. So, we are seeing a sharp decline in the number of models on sale in this segment (see chart below), as manufacturers are opting not to continue producing the smallest cars for diminishing returns.

SUVs and the microchip shortage

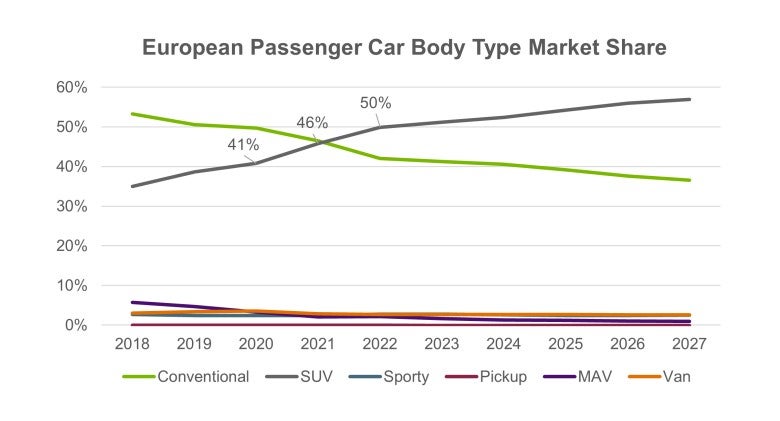

SUVs are now the most popular body type in Europe and so developing model activity here is critical. The chart below shows an acceleration in the market share of SUVs, partly thanks to components, including microchips, being prioritised to higher-margin vehicles (which SUVs are by nature) during supply shortages. Using a richer model mix allowed manufacturers to offset lower sales while maintaining healthy profits.

However, while larger segment SUV models provide strong margins, profitability from A-Segment SUVs is again more limited for the same reasons above, related to EU legislation. The A-segment is the worst positioned to benefit from the growth of the SUV body type, too.

Electric vehicles

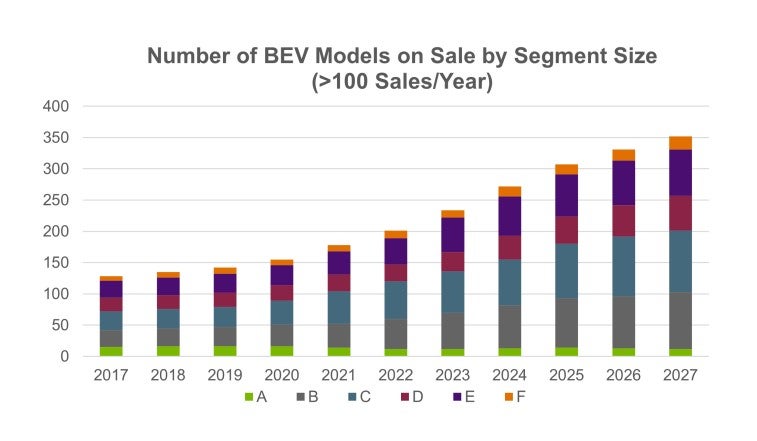

The transition towards electric vehicles is also a difficult hurdle for the smallest cars. Currently, battery electric vehicle (BEV) versions of the same car cost more than the internal combustion engine (ICE) version, mostly due to the price of the battery and other valuable materials involved. The difference in BEV and ICE car pricing has led to electric car development being focussed on larger segments where price points and margins are able to cover the extra cost.

Price is not the only issue that small cars are facing in the transition to BEVs. Practicality is a real concern for the limited battery size possible within an A-Segment car. The driving range for a BEV this size is already less than ideal for most users, but real-world usability would be further penalised by extra load and cold weather effects. There is an argument that the smallest electric cars, with restricted driving ranges, could be used for city driving with short trips. However, this still deters buyers who need a small car to cover all types of usage, including occasional long-distance trips with weighty luggage.

Conclusion and forecast

Until these issues are resolved, our forecast sees Europe’s shift to BEVs likely to support larger segments, while the unprofitable A-segment is left behind. Recovery could be on the cards much later in the forecast, in a scenario where price parity between electric and internal combustion engine-powered vehicles allows the smallest cars to make a resurgence, as demand will always remain for the most entry-level vehicles. However, it may not appeal to manufacturers to redevelop this segment at all if profitability is healthy without it.

Sammy Chan, Manager Sales Forecasts, LMC Automotive (a GlobalData company)

This article was first published on GlobalData’s dedicated research platform, the Automotive Intelligence Center