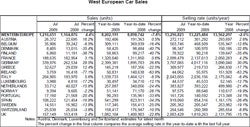

Car sales in Western Europe grew by 4.4% in July, the second consecutive month with a year-on-year increase, according to data released by JD Power Automotive Forecasting.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

The market was, once again, propelled by scrappage incentives, most notably in Germany where July car sales were up by 29.5% over the same month of last year. JD Power said the pace of the German market remained strong last month as the scrapping incentive and manufacturer discounts continued to boost sales.

The German seasonally adjusted annualised selling rate, while easing compared to recent months, remained decidedly high at 3.8m units.

JD Power says that the scrapping incentive in Germany, combined with the manufacturer incentives, is continuing to distort the market — with many cars enjoying substantial (30% plus) discounts and some model prices effectively being halved.

Elsewhere, incentives are also having a positive effect. In Italy, sales were up 5.6% despite the difficulties faced by the wider economy. In France, the selling rate for last month stood at 2.1m units/year, a fairly impressive achievement with the backdrop of economic recession.

The UK posted its first year-on-year rise since April 2008, with sales helped by the recently introduced scrapping scheme. The implied selling rate for July edged just over 2m units/year, benefiting from a stronger retail market.

In Spain, there was less to cheer about. The Spanish car market nose-dived in the latter half of 2008 and has more recently seen the selling rate languish at levels not previously seen since the mid-1990s. A selling rate of 920,000 units/year for last month highlights the current weak state of the market, even if it is the highest selling rate so far this year.

The West European market looks set to fall only a little short of the 2008 result for 2009 as incentives partly offset the general economic gloom.

However, JD power stresses that there is bound to be payback when these incentives are removed.

But which schemes will be removed and which renewed? France, Italy and Spain have a history of incentive renewals and so a continuation of these schemes is certainly possible.

However, it is again the German market that will make the difference and if, as expected, this scheme is not renewed, a West European market contraction in 2010 of a greater degree than this year would appear inevitable, JD Power says.

JD Power forecasts that the West European car market will fall 2% to 13.29m units in 2009.