Domestic sales by South Korea’s five main automakers combined plunged by 17% to 101,475 units in October 2025 from 122,880 units a year earlier, according to preliminary wholesale data released individually by the manufacturers. The data do not include sales by South Korea’s low-volume commercial vehicle manufacturers, including Tata-Daewoo and Edison Motors, while import brands are covered in a separate report later in the month.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Last month’s sharp decline was attributed to the ‘Chuseok’ national holidays, which this year fell in October compared with in September last year (this year’s September market was correspondingly up). The market last month continued to be supported by the recent roll-out of new products, particularly by the country’s largest automakers, Hyundai and Kia.

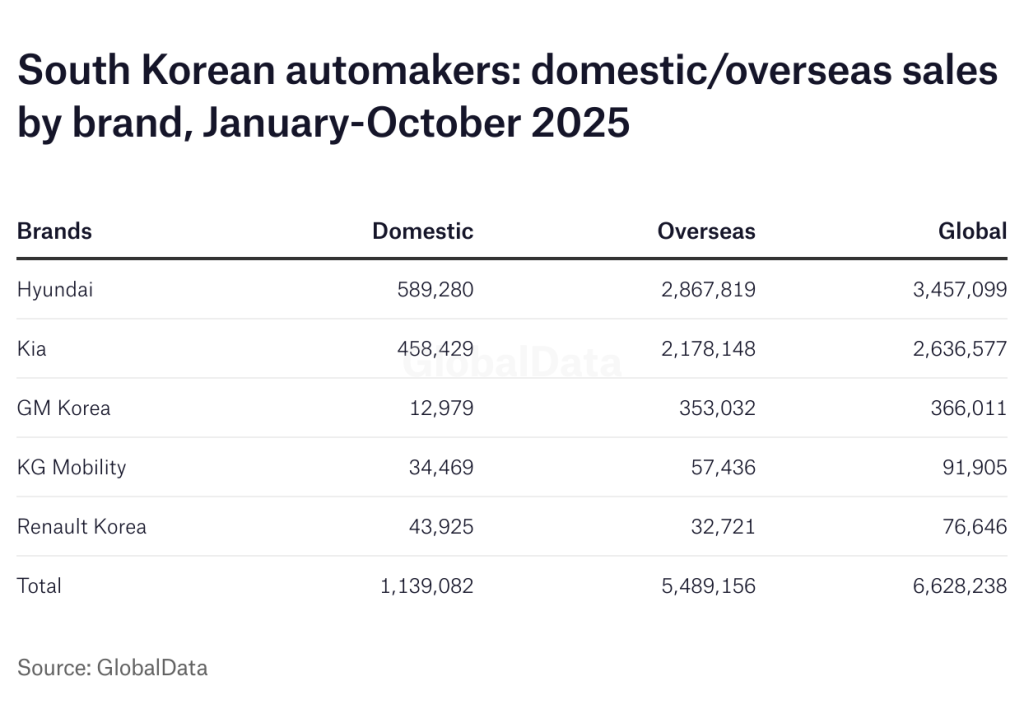

In the first ten months of the year, the country’s five main automakers reported a 4.6% increase in domestic sales to 1,139,082 units, up from 1,114,278 units in the same period last year. Hyundai reported a 1.5% increase to 589,280 units, while Kia’s sales increased by 2% to 453,943 units. GM Korea was the worst performer, with sales plunging by 39% to 12,979 units, while KG Mobility reported a 16% drop to 34,469 units. Renault Korea was the best-performing brand in terms of growth, with domestic sales rising by 73% to 43,925 units year-to-date, following the recent launch of the Geely-based Grand Koleos Hybrid and the Scenic E-Tech.

Global sales by the country’s “big-five” automakers, including vehicles produced overseas, increased slightly to 6,628,238 units in the first ten months of 2025 from 6,601,844 units a year earlier – with overseas sales were also marginally up at 5,489,156 units from 5,482,743 units.

Hyundai Motor’s global sales fell by 6.9% to 351,753 vehicles in October 2025 from 377,917 a year earlier, with domestic and overseas sales both sharply lower. In the first ten months of the year, the company sold a total of 3,457,099 vehicles globally, up slightly from 3,453,637 units sold in the same period last year.

Domestic sales plunged by 17% to 53,822 units last month from 64,912 a year earlier, with sales affected by the annual ‘Chuseok’ national holidays, resulting in a 1.5% increase to 589,280 units in the first ten months of the year from 580,517 previously. Overseas sales declined by almost 5% to 297,931 units in October from 300,730 units a year earlier, while year-to-date volumes were just slightly lower at 2,867,819 from 2,873,120 units, underpinned by strong growth in North America.

The company’s new EV plant in the US state of Georgia became operational last October, producing the Ioniq 5, followed by the Ioniq 9 earlier this year. A Kia model is also set to go into production in 2026. The automaker said it will expand capacity at the plant to 500,000 units per year later in the decade, from 300,000 at present. The automaker said in August that it had agreed to increase its planned investments in the US by 24% to US$ 26 billion, to expand production and local content in the country.

Hyundai remains on track to achieve the target it set for itself earlier this year of 4,174,000 global vehicle sales in 2025, including its Genesis luxury brand, representing a slight increase over 2024 volumes.

Kia reported a slight decline in global sales to 263,904 vehicles in October from 265,344 a year earlier, despite a sharp fall in domestic sales, supported by the recent launch of new battery electric vehicle (BEV) and hybrid models. The company also reported strong demand for core SUVs such as the Sportage and Seltos, with 47,341 and 25,406 global deliveries, respectively. In the first ten months of the year, Kia’s global sales rose by 2.3% to 2,636,577 units from 2,584,659 a year earlier.

Domestic sales fell by 13% to 39,112 units in October from 45,095 units a year earlier, with sales held back by the annual ‘Chuseok’ national holidays. The Sorento was Kia’s best-selling domestic model last month with 6,788 deliveries, followed by the Carnival with 4,515 units and the Sportage with 4,055 units. Domestic sales in the first ten months of the year increased by 2% to 453,943 units from 445,925 a year earlier. The company sold a further 4,486 special purpose vehicles (SPVs) in this period, down from 4,930 a year earlier, most of which were military vehicles delivered domestically.

Overseas sales rose by 2.1% to 223,014 units in October from 211,060 a year earlier, and were up by over 2% to 2,178,148 units year-to-date from 2,133,804 units. The Sportage was the brand’s best-selling model overseas last month with 43,286 deliveries, followed by the Seltos with 22,041 units. In August, the company began production of its EV4 hatchback at its manufacturing hub in Slovakia, its first BEV model to be produced in Europe.

Kia is targeting a 4% increase in global sales to 3,216,200 units in 2025, including 550,000 domestic sales, 2,658,000 overseas sales, and 8,200 SPV sales, supported by the recent launch of the new K4 and revamped K5 sedans and the Syros SUV in India. The automaker also launched the new Tasman pickup truck, and the EV4, EV5 and PV5 battery-powered models this year. Longer term, it aims to sell 4.3 million vehicles globally by 2030, including 1.6 million BEVs.

GM Korea’sglobal sales declined by 21% to 39,630 units in October from 50,021 units a year earlier, reflecting sharply lower domestic and overseas sales. Deliveries in the first ten months of the year were almost 8% lower at 366,011 units from 396,608 units. The locally-produced Trax crossover vehicle and the Trailblazer SUV are by far the company’s best-selling models, with most output shipped overseas.

Domestic sales continued to drop sharply last month, falling by almost 40% to 1,194 units from 1,974 units a year earlier, with year-to-date sales down by 39% to 12,979 units from 21,202 units, as the automaker struggled with rising competition from other domestic manufacturers and from importers.

Exports plunged by 20% to 38,436 units in October from 48,047 a year earlier, and were 6% lower at 353,032 units year-to-date from 375,453 units. Around 85% of output was shipped to the US last year.

KG Mobility (KGM) reported a 3% rise in global sales to 9,517 vehicles in October from 9,245 units a year earlier, reflecting sharply higher exports. Total sales in the first ten months of the year rose by just over 2% to 91,905 units, compared with 89,828 a year earlier. The company, previously known as Ssangyong Motor, was acquired in late 2022 by a consortium led by local steel and chemicals firm KG Group.

Domestic sales declined by over 21% to 3,537 units last month from 4,504 a year earlier, and were down by over 16% to 34,469 units year-to-date from 41,197 units, as the automaker struggled to keep up with rising competition from other domestic manufacturers and import brands.

Overseas sales increased by 26% to 5,980 units in October from 4,741 a year earlier, resulting in an 18% rise to 57,436 units year-to-date from 48,691 units a year earlier, as the company continued to expand its global market coverage.

KGM plans to further expand its zero-emissions vehicle range, following the launch of a new minivan version of the Torres EVX battery-powered SUV last October and the new battery-powered Musso EV pickup truck earlier this year. The company has entered into a strategic partnership with China’s Chery Automobile Company, involving vehicle and platform sharing aimed at helping it to strengthen its SUV line-up. The deal will also give KGM access to readily available new energy vehicle (NEV) technologies. The automaker recently said it aims to introduce at least eight new models by 2030.

Renault Korea‘s global sales plunged by 42% to 7,201 units in October from 12,456 units a year earlier, with both domestic sales and exports falling sharply. In the first ten months of the year, global sales were slightly lower at 76,646 units from 77,112 previously.

Domestic sales dropped by 40% to 3,810 units last month from 6,395 units a year earlier, while year-to-date volumes rising by 73% to 43,925 from 25,437 units – following the launch of the new Geely-based Grand Koleos Hybrid SUV and the Scenic E-Tech BEV earlier this year.

Exports plunged by 44% to 3,391 units in October from 6,061 a year earlier, and were down by 37% to 32,721 units in the first ten months of the year from 51,675 units. The company announced plans to target new export markets in Latin America and the Middle East next year.

The company recently restructured its assembly plant in Busan, resulting in more production being allocated for the local market. A model based on the battery-powered Geely Polestar 4 is scheduled to go into production later this year.