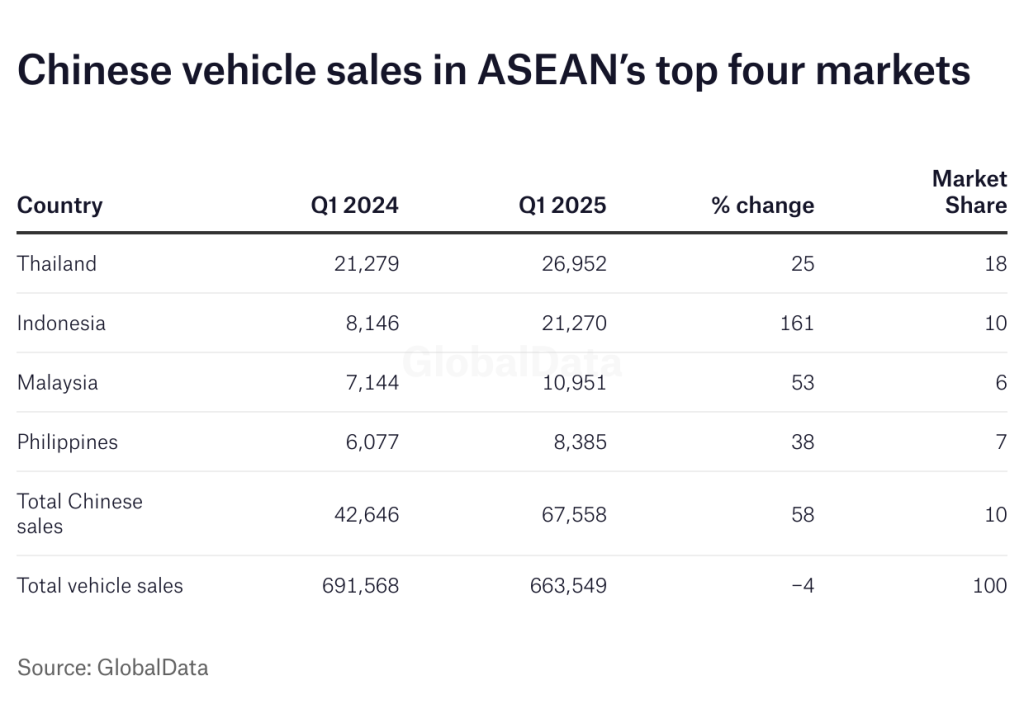

Sales of Chinese-branded vehicles in South-east Asia’s four main markets, including Indonesia, Malaysia, Thailand and the Philippines, rose by over 58% to 67,558 units in the first quarter of 2025 compared with 43,646 units in the same period last year, as the country’s automakers continued to step up their global expansion in a bid to reduce their dependence on their home market.

Many Chinese brands only entered markets in the region in the last year, while existing players continued to expand their sales networks. In total, there are around two dozen Chinese brands active in the South-east region at present, accounting for over 10% of the region’s sales in the first quarter of 2025 – up from just over 6% in the same period last year, in markets that for many decades have been dominated by Japanese brands.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Governments in the region are offering generous incentives to attract new automotive sector investment, particularly for the production of battery-powered and hybrid-electric vehicles and related supply chains, as part of their commitments to reduce carbon emissions. Competition for this investment is tough, with some countries offering temporary exemptions on import tariffs ahead of local production and other tax incentives.

China is the world’s largest producer of hybrid and electric vehicles and its manufacturers have been quick to take up the incentives on offer. In most countries in the region, they already dominate the fledgling BEV markets, in the absence of any significant competition from the Japanese.

Thailand remains the region’s largest market for Chinese-branded vehicles, with first-quarter sales amounting to just under 27,000 units – up 27% year-on-year, to account for almost 18% of total vehicle sales in the country. BYD and its Denza brand together accounted for over 11,140 sales, followed by SAIC Motor and GAC-Aion with 4,760 and 3,091 units respectively.

Indonesia was the second-largest market for Chinese automakers in the first quarter, after sales grew by 161% to 21,270 units. They accounted for just over 10% of the total market, up from less than 4% a year earlier. Around half of the brands active here entered the market only in the last year, targeting mainly the BEV segment. This includes BYD which sold 8,820 BEVs in the first quarter. Wuling was the next best-selling Chinese brand with 4,882 sales, followed by Chery with 4,554 units – including models sold under its Omoda, Jetour and Jaecoo brands.

Malaysia was the third-largest market in the region for Chinese brands, with first-quarter sales rising by 53% to 10,951 units. They accounted for less than 6% of total sales, however, the lowest penetration rate among the four markets surveyed, with Chery by far the largest player with some 6,826 sales. The data do not include sales by Proton, which sources a growing number of models from China’s Zhejiang Geely Holding Group, which has a 49.9% stake in the company.

The Philippines is the smallest market for Chinese brands among the four countries, albeit with sales rising by 38% to 8,385 units in the first quarter – accounting for just over 7% of total vehicle sales in the country. SAIC’s MG was the best-selling Chinese brand with 2,422 sales, followed by BYD with 2,210 units.

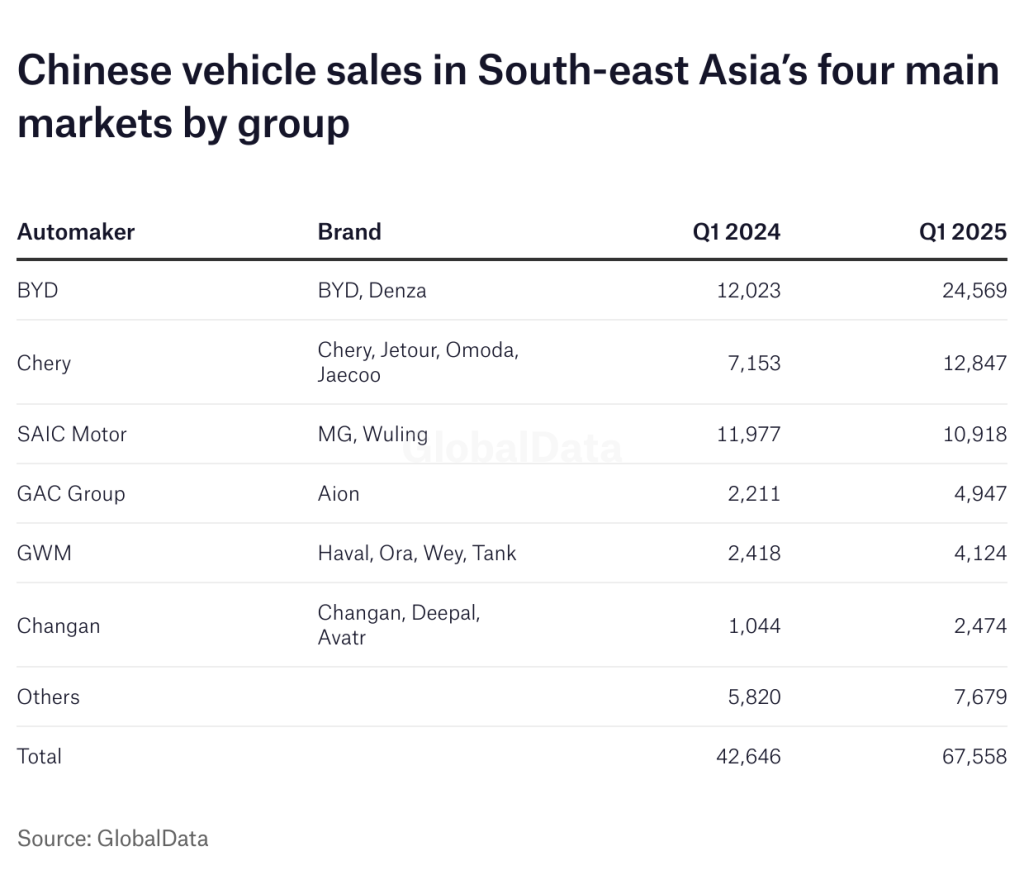

The top three automotive groups accounted for over 70% of Chinese vehicle sales in the four countries surveyed. These included BYD, Chery and SAIC Motor.

BYD was behind most of the Chinese volume growth in the region in the first quarter of 2025, with its sales more than doubling to 24,569 units – thanks mainly to its entry into the Indonesian market last year. Here it is building an assembly plant which is scheduled to be completed by the end of 2025. The company sold 8,820 vehicles in the country in the first quarter versus none a year earlier, while sales in the Philippines jumped from 57 units to 2,210 units as the company continued to roll out its sales network. Sales in Thailand increased by 11% to 11,140 units, while in Malaysia volumes were up by 25% to 2,397 units.

Chery was the second-largest Chinese automaker in the region, after its sales rose by 80% to 12,847 units in the first quarter. The company’s largest market is Malaysia, where its sales rose by almost 50% to 6,826 units – accounting for more than half its sales in the region. In Indonesia, the company delivered 4,554 units, a threefold increase year-on-year, while in Thailand and the Philippines its sales were more limited at 1,467 units combined.

SAIC Motor came in third, albeit with sales falling by almost 9% to 10,918 units in the first quarter of 2025. The company is one of the longest-established Chinese automakers in the region, after its majority-owned SAIC-GM-Wuling joint venture built a plant in Indonesia in 2016. Here it sold 4,882 Wuling-branded ICE, hybrid and BEV vehicles in the first quarter of the year. Its other main market in the region is Thailand, where it sold 4,760 vehicles under the MG and Wuling brands.