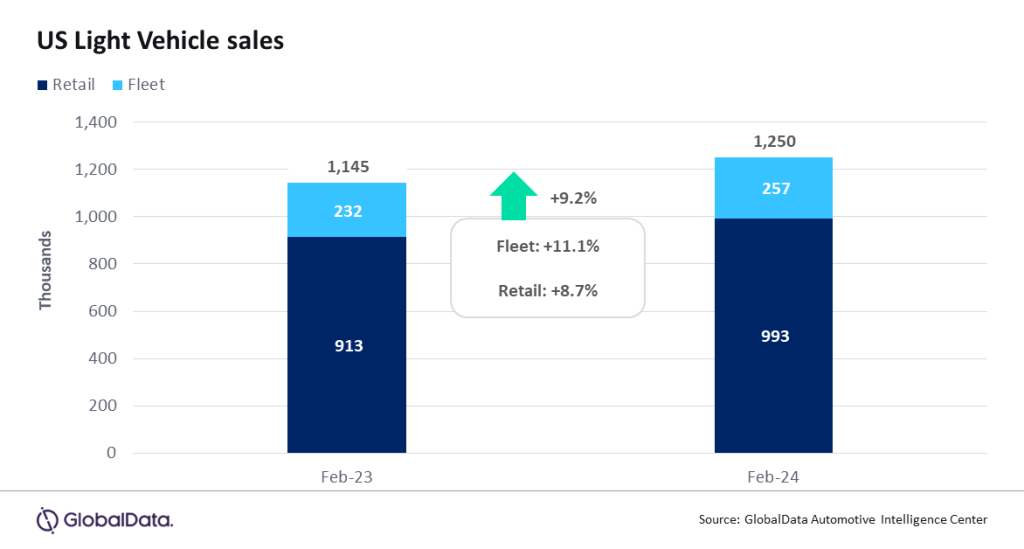

According to preliminary estimates, US Light Vehicle (LV) sales grew by 9.2% year-on-year (YoY) in February, to 1.25 million units. The market has now been growing in YoY terms for 19 consecutive months. In February, the YoY position was helped by relatively weak year-ago sales and an additional selling day as compared to February 2023; nevertheless, the month’s performance comfortably exceeded expectations.

US LV sales totaled 1.25 million units in February, according to GlobalData. The annualized selling rate was 15.8 million units/year in February, up from 14.8 million units/year in January. The daily selling rate was estimated at 50k units/day in February, compared to 42.4k units/day in January. While December represented an outsized surge in activity, before a payback effect was then seen in the market in January, in February, sales rebounded once again. According to initial estimates, retail sales totaled 993k units in February, while fleet sales accounted for approximately 257k units, representing around 20.6% of total sales.

David Oakley, Manager, Americas Sales Forecasts, GlobalData, said: “February saw mixed results across the industry, but most OEMs posted YoY growth. In some cases, we are seeing a reversal of fortunes, as brands that were riding high previously are now seeing more sedate sales, while those that struggled due to low inventory levels even into early 2023 are generally making gains now. We are starting to observe a renewed focus on incentives and pricing, as dealers are no longer in the enviable position of being able to sell all vehicles that come onto their lots in record time. The rebalancing of supply and demand is also increasingly causing OEMs to look more actively at retail versus fleet volumes, with the latter being an option that was utilized to a larger extent in February than has typically been the case recently. Overall, the economy remains buoyant for now, and the auto industry is once again demonstrating its ability to adapt to the circumstances of the moment”.

At an OEM level, General Motors (GM) led the sales rankings, beating Toyota Group by around 14k units. GM and Toyota Group have now alternated the leading position in the market for the past four months. Ford Group came in third, on 168k units. At a brand level, Ford outsold Toyota, albeit by the slimmest of margins – only 43 units -with both brands selling just over 159k units in February. This is the first time that Ford has topped the rankings since April 2023. Chevrolet was the third most popular brand, on 132k units. For the fifth consecutive month, the Toyota RAV4 was the bestselling model, with 43k units, as it continues to benefit from high levels of both import and domestic sales. The Nissan Rogue came in second on 35k units, seemingly boosted by a surge in fleet sales. Perhaps unsurprisingly given the nature of the top-selling models, the Compact Non-Premium SUV segment set another new record-high market share, at 22.8%. This comfortably beat the 21.4% that the segment achieved in January. The Midsize Non-Premium SUV segment was second with a 16.0% share, followed by Large Pickups on 12.4%. This was the lowest share for Large Pickups since August 2016.

Inventory levels remained unchanged from January at 2.4 million units, but the stronger selling rate lowered days’ supply to an estimated 49 days, from 56 days in January. We would expect to see some building of inventory over the next couple of months, ahead of the Spring selling season.

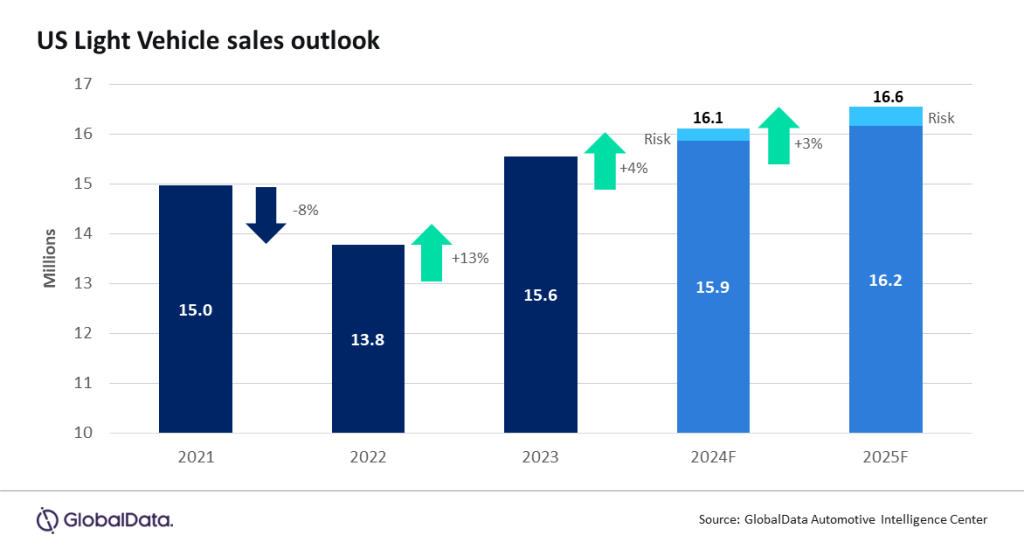

As February picked up some of the lost volume from the weakness in January, the outlook for 2024 is holding at 16.1 million units, with demand slowly improving to sustainable levels. The forecast for 2025 remains at 16.6 million units, a 3% increase from 2024. However, looking at the longer-term forecast, we do not expect the US to return to the 17 million unit level, unless a viable way is achieved to lower prices, and to encourage consumers to return to the new vehicle market ahead of the used vehicle market.

Jeff Schuster, Vice President Research and Analysis, Automotive, said: “The outlook for 2024 carries a conservative bias, as the Fed’s battle with inflation is going better than initially thought and a healthier mix of lower priced models is potentially becoming more widely available. As a result, we could see a slightly stronger sales pace this year, if the economy and job market hold steady. However, the presidential election is a wildcard and may have an impact on consumers’ purchase decisions as the year progresses. A plausible range for the year is 16-16.5 million units, creating a relatively healthy environment”.

Global outlook: Global LV sales volumes in January were up by 16% YoY, which is a strong start to the year; however, the month usually encompasses several distortions. Once again, China’s domestic sales have outperformed most markets, but the 47% increase seen in January results from abnormal weaknesses experienced last year, owing to the expiry of tax incentives and timing of the Lunar New Year. As expected, the global LV selling rate cooled in January, following the strong finish to 2023, dropping to 81.7 million units from 90 million units in December. LV sales in 2024 are projected to reach 89.1 million units (adjusted for the removal of China exports), an increase of 3% from 2023. This maintains our view that growth will slow as natural demand—at current pricing—is now being met. Global inventory is expected to build slightly in 2024 as production returns to predictable levels and outpaces demand.

This article was first published on GlobalData’s dedicated research platform, the Automotive Intelligence Center