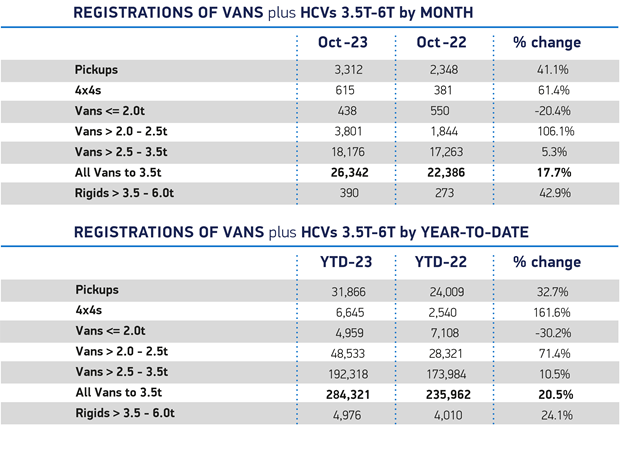

Britain’s new light commercial vehicle (LCV) registrations increased 17.7% year on year in October to 26,342 units, according to the Society of Motor Manufacturers and Traders (SMMT).

The growth was 3.8% above pre-pandemic 2019 levels and rounded off 10 consecutive months of rising demand this year, up 20.5% year on year to 284,321 units.

This was the highest volume for two years due to easing of supply chain disruptions.

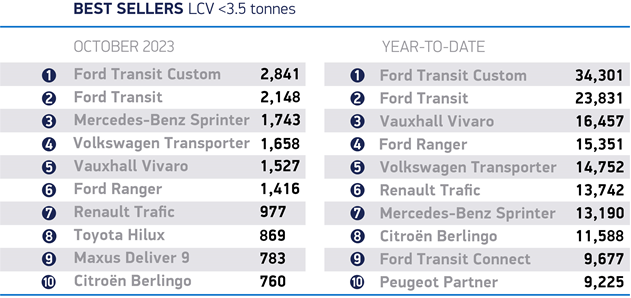

New van buyers continue to opt for payload and fuel efficiencies, with large vans weighing greater than 2.5 tonnes to 3.5 tonnes up 5.3% to 18,176 units last month, accounting for 69% of sales.

Demand for medium-sized vans drove growth, however, with deliveries up 106.1% to 3,801 units. There was also a jump in demand for 4x4s and pickups, up 61.4% and 41.1% respectively, but registrations of the smallest vans continued to fall, off 20.4% at 438 units.

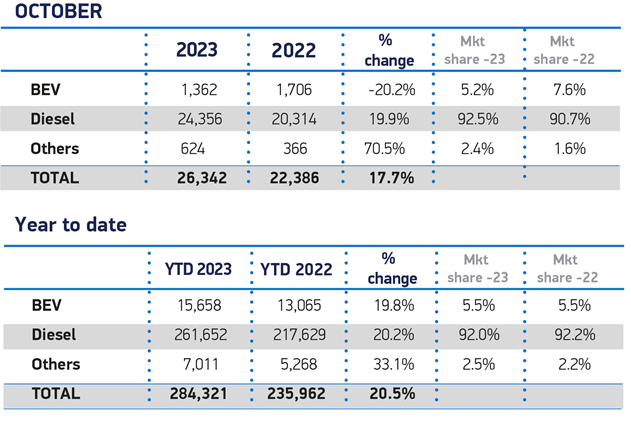

Following a glut of new battery electric van (BEV) registrations in 'plate change month' September, uptake was slower in October, down a fifth (20.2%) to 1,362 units though there was a large fleet order in October 2022.

Year to date 2023, BEV demand has risen 19.8% with 15,658 units registered since January.

With the van market enjoying 10 consecutive months of growth, the outlook for the year has been revised upwards to 332,000 units, a 1.4% rise on July’s outlook.

However, anticipated BEV registrations have been cut by 9% to 21,000 units – 26.8% above 2023 – to a 6.3% market share.

Looking further ahead, 2024 is expected to see 334,000 new van registrations with 34,000 BEVs exceeding 10% of sales.