UK car output rose 14.8% in November 2023 over the previous year, but UK automotive industry performance is on track for another dismal result, according to analysis by GlobalData.

The latest figures published by the Society of Motor Manufacturers and Traders (SMMT) showed that 91,923 cars rolled out of factory gates, an increase of 11,832 on November 2022 - the best performance for the month since 2020 as supply chain challenges eased.

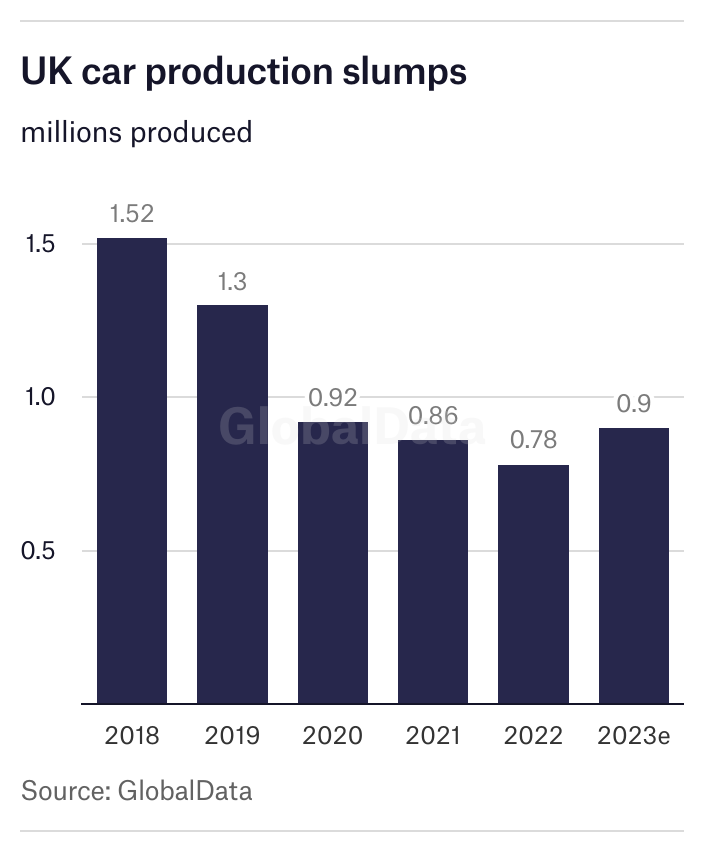

However, the result leaves the industry on track for a 2023 annual production result of just 0.9 million units – which compares with over 1.5 million units as recently as 2018. Total UK car output in the first eleven months of 2023 was 843,345 units – 16.5% ahead of the same period in 2022.

Besides the impact of the pandemic and subsequent supply shortages caused by the chips shortage, overall UK passenger car production has been hard hit by structural issues such as the closure of Honda’s Swindon plant and the loss of Vauxhall (Stellantis) Astra production from the Ellesmere Port plant in northwest England. In 2018, the Honda Swindon plant built some 160,000 cars (mainly Civic, but some CR-Vs) and Vauxhall (Stellantis) turned out over 77,000 Astras.

Also, Tata JLR output in Britain is some 200k lower when comparing 2023 with 2018 (an estimated 237k versus 449k). Land Rover has moved Discovery and Defender manufacturing from the UK to its plant in Slovakia.

Mike Hawes, SMMT Chief Executive, put a positive spin on the November numbers. He said: “UK car production is firmly back on track following the tough Covid years and resulting supply chain challenges. With significant investment committed to UK automotive manufacturing, production volumes increasing and the imminent threat of tariffs on EVs traded with the EU now removed by the extension of current rules of origin until 2027, there is renewed confidence in the sector.

“We now need to see the Anglo-European battery industry build capacity at pace to meet forecast demand.”