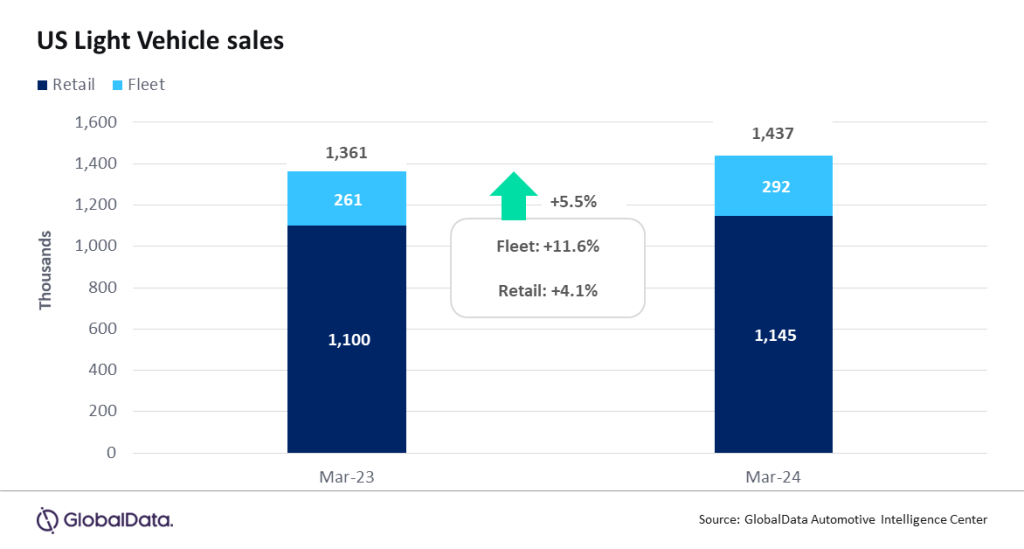

According to preliminary estimates, US Light Vehicle (LV) sales grew by 5.5% year-on-year (YoY) in March, to 1.44 million units. The market delivered another month of YoY growth – a streak which now extends to 20 consecutive months – but year-ago sales were still relatively low, making the gain easier to achieve. For Q1 as a whole, sales were up by 5.1% YoY, reaching 3.75 million units.

US LV sales totaled 1.44 million units in March, according to GlobalData. The annualized selling rate for the month was 15.5 million units/year, down from 15.8 million units/year in February. The daily selling rate was estimated at 53.2k units/day in March, compared to 49.9k units/day in February. March is typically a strong month for auto sales, helped by calendar effects and end-of-quarter targets. In addition, March is the end of the financial year for some OEMs. Last month did not see a return to pre-pandemic levels, or even the unusually strong result that was seen in March 2021, but volumes comfortably beat those for the same month in 2022 and 2023. According to initial estimates, retail sales totaled 1.15 million units in March, while fleet sales accounted for approximately 292k units, representing around 20.3% of total sales.

General Motors (GM) topped the sales rankings in March, beating Toyota Group by around 11k units. While these two OEMs have alternately held the top spot for the past few months, this was the first time that GM had led the market for two consecutive months since August and September 2023. Having slipped just behind Ford in February by a slim margin, Toyota was the best-selling brand in March with 184k units, compared to 165k units for Ford, while Chevrolet was the third most popular brand with 145k units. The Toyota RAV4 was once again the number one model in March, a position it has now occupied for six straight months, with the SUV selling 45k units. The Tesla Model Y is thought to have claimed second place on 41k units. Perhaps most surprisingly of all, the Ford F-150 did not even feature in the top five models. The Compact Non-Premium SUV segment continued its strong run of results in March with a 22.8% market share, matching the February outturn. The Midsize Non-Premium SUV segment also saw a steady market share at 16.0%, while Large Pickups had another disappointing month as its share fell to 11.9%, the lowest since May 2016.

David Oakley, Manager, Americas Sales Forecasts, GlobalData, said: “March had a number of potential curveballs, including several OEMs looking to hit targets at the end of their financial year, steep discounting on certain models – particularly Electric Vehicles (EVs) – and pent-up demand from the fleet segment. In the end, sales were decent, but could have been even better. We are continuing to see signs that the segments that are performing well are generally those at the more affordable end of the spectrum, while costlier models are starting to see an easing in demand. Results are mixed across manufacturers, and brands that have an aging lineup and/or have not moved to increase incentives sufficiently, are being left behind. April will be an intriguing month because sales a year ago were relatively strong – a situation we have not been accustomed to seeing recently”.

US inventory climbed to 2.5 million units in February 2024, up by 4% from January and 44% from February 2023. The recovery in production continues to drive wider vehicle availability across segments and price points. Inventory at the end of Q1 is expected to show a further increase and should provide ample choice for consumers as the industry heads into the Spring selling season.

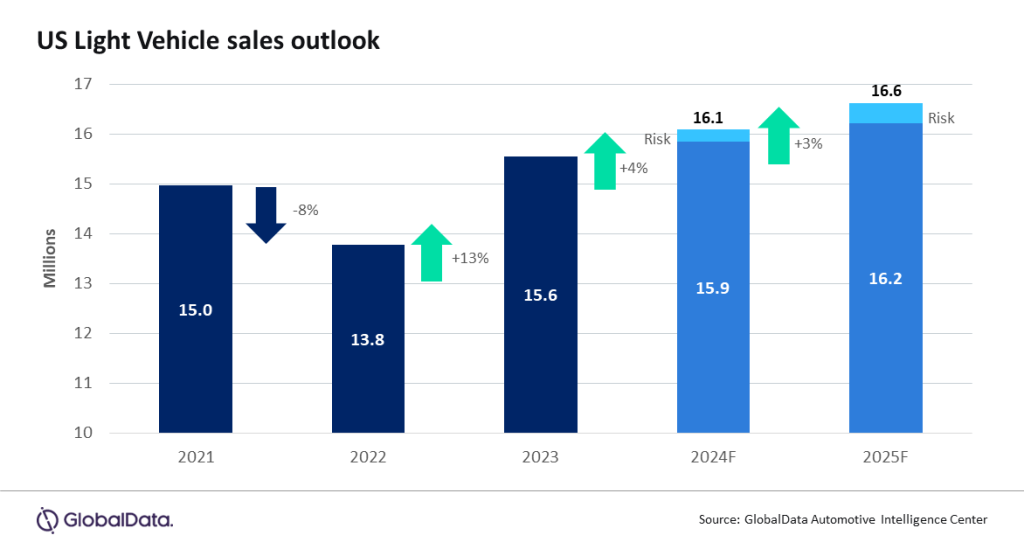

The topline outlook for US auto sales remains at 16.1 million units for 2024, as pent-up demand is met, and growth begins to ease. For 2025, sales are forecast at 16.6 million units – a 3% increase from 2024 and unchanged from last month. The recent EPA ruling that relaxes the emission targets from 2027-2032 is expected to have a marginally positive impact on the topline in the medium term, by easing some of the pressure on pricing. We now expect sales to cross the 17 million-unit mark by 2029, though this falls short of the previous peak of 17.5 million units achieved in 2016.

Jeff Schuster, Vice President Research and Analysis, Automotive, said: “The outlook for 2024 is on track with the forecast at the beginning of the year, and signals from the marketplace are broadly positive. Availability of smaller, more affordable vehicles is expected to bring back some consumers that exited the new vehicle market during the pandemic, helping to return sales to a more normal distribution and recovery. Better financial conditions, strength in the labor market, and easing of inventory and inflationary pressure should all be supportive of a stronger automotive market in 2024 and beyond.”

Global outlook: The global LV selling rate increased to 84.7 million units in February, up from 81.5 million units in January. However, sales volume declined by 2.7% on a YoY basis, dropping to 6.1 million units. The pullback was heavily influenced by a 27.0% YoY decline in China, which can be largely attributed to the timing of Lunar New Year celebrations. Western Europe rebounded and enjoyed growth of 10.8% on the back of improved vehicle availability. The forecast for 2024 expects total LV sales to reach 89.2 million units (adjusted for China exports), representing a 3.1% increase and a slight upward revision from our forecast last month. A large proportion of the easy gains have now been achieved due to improved inventory levels, enabling pent-up demand to be met.

This article was first published on GlobalData’s dedicated research platform, the Automotive Intelligence Center