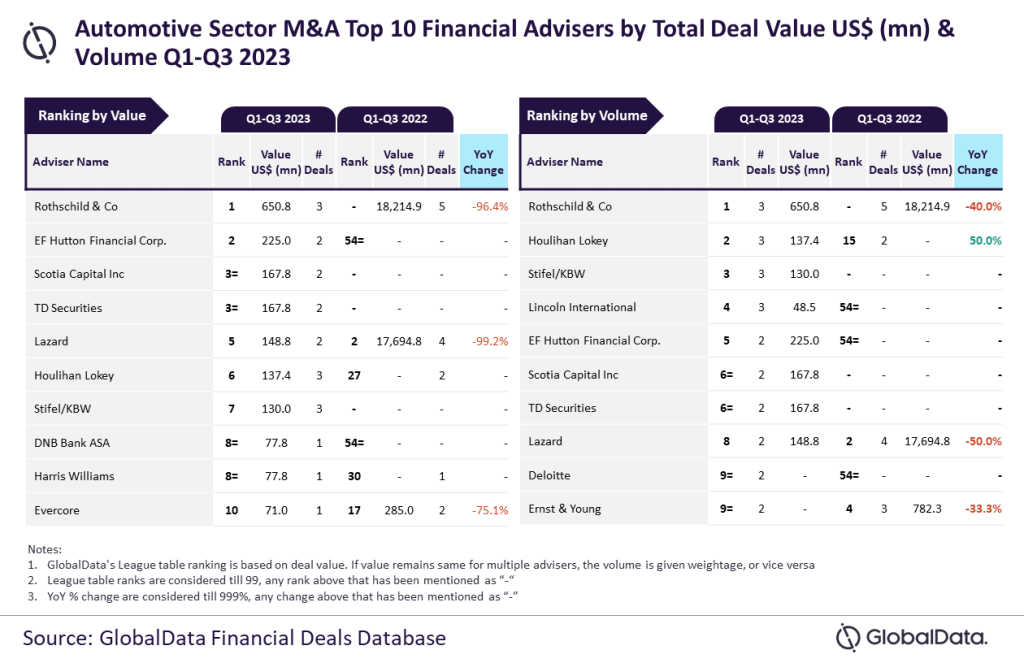

Rothschild & Co was the top mergers and acquisitions (M&A) financial adviser in the automotive sector during the first three quarters (Q1-Q3) of 2023 by value as well as volume, according to the latest financial advisers league table by GlobalData, which ranks financial advisers by the value and volume of M&A deals on which they advised.

Based on its Financial Deals Database, the leading data and analytics company reveals that Rothschild & Co achieved the leading position by advising on three deals worth $650.8 million.

Aurojyoti Bose, Lead Analyst at GlobalData, comments: “Rothschild & Co witnessed a decline in both deals volume and value during Q1-Q3 2023 compared to Q1-Q3 2022, but the decline was more pronounced in the latter. Nevertheless, it registered the highest average deal value among all the top 10 advisers by value and volume.”

An analysis of GlobalData’s Financial Deals Database reveals that EF Hutton Financial Corp. occupied the second position in terms of value, by advising on $225 million worth of deals, followed by Scotia Capital Inc and TD Securities jointly occupying the third position by value, with each of them advising on $167.8 million worth of deals.

Meanwhile, Houlihan Lokey occupied the second position in terms of volume with three deals, followed by Stifel/KBW with three deals, Lincoln International with three deals, and EF Hutton Financial Corp. with two deals.

Our signals coverage is powered by GlobalData’s Thematic Engine, which tags millions of data items across six alternative datasets — patents, jobs, deals, company filings, social media mentions and news — to themes, sectors and companies. These signals enhance our predictive capabilities, helping us to identify the most disruptive threats across each of the sectors we cover and the companies best placed to succeed.