In the first half (H1) of 2025, Porsche's operating profit plummeted by 67% to €1.01bn ($1.16bn), compared to €3.06bn in the same period last year.

Sales revenue also saw a decline of 6.7% to €18.16bn, with the operating return on sales dropping to 5.5%.

The company's performance was affected by macroeconomic and geopolitical challenges.

During H1 2025, Porsche incurred special expenses of around €200m for its realignment and approximately €500m for battery activities.

The US tariffs added an extra €400m load, as Porsche offered price protection to its customers and absorbed extra import tax costs rather than passing them on.

The automotive net cashflow stood at €394m, a significant decrease from the previous year's €1.12bn. The margin also fell to 2.4%.

However, vehicle deliveries remained robust, with 146,391 units worldwide, 36.1% of which were electrified.

Porsche has revised its financial forecast for 2025, taking into account the recent EU Commission's agreement with the US on import tariffs.

The updated forecast includes an anticipated 15% US import tariff from 1 August and potential price adjustments to offset the financial impact.

Porsche maintains its expected group sales revenue of €37 to €38bn, consistent with its previous projections.

The carmaker is navigating a challenging period marked by a significant restructuring process, a slow transition to electric vehicles, and market difficulties in China.

Also, it is reportedly set to intensify its cost-cutting efforts as it faces headwinds from declining sales in China and the impact of US import tariffs.

Porsche said that its management is “resolutely pushing ahead with extensive measures to rescale and recalibrate the company”.

Despite these challenges, Porsche's revised outlook remains optimistic, with a group return on sales of 5% to 7% and an automotive net cashflow margin of 3% to 5%.

Special effects associated with strategic realignment are expected to incur costs of approximately €1.3bn.

Porsche executive board chairman Oliver Blume said: “We continue to face significant challenges around the world. And this is not a storm that will pass. The world is changing dramatically – and, above all, differently to what was expected just a few years ago. Some of the strategic decisions made back then appear in a different light today. That is why we are fundamentally developing Porsche further.

“Our completely revamped product range is very well received by our customers. We expect that we will begin to see positive economic momentum again from 2026 onwards.”

The Macan was the “best-selling model”, and Porsche achieved new delivery records in North America and other markets.

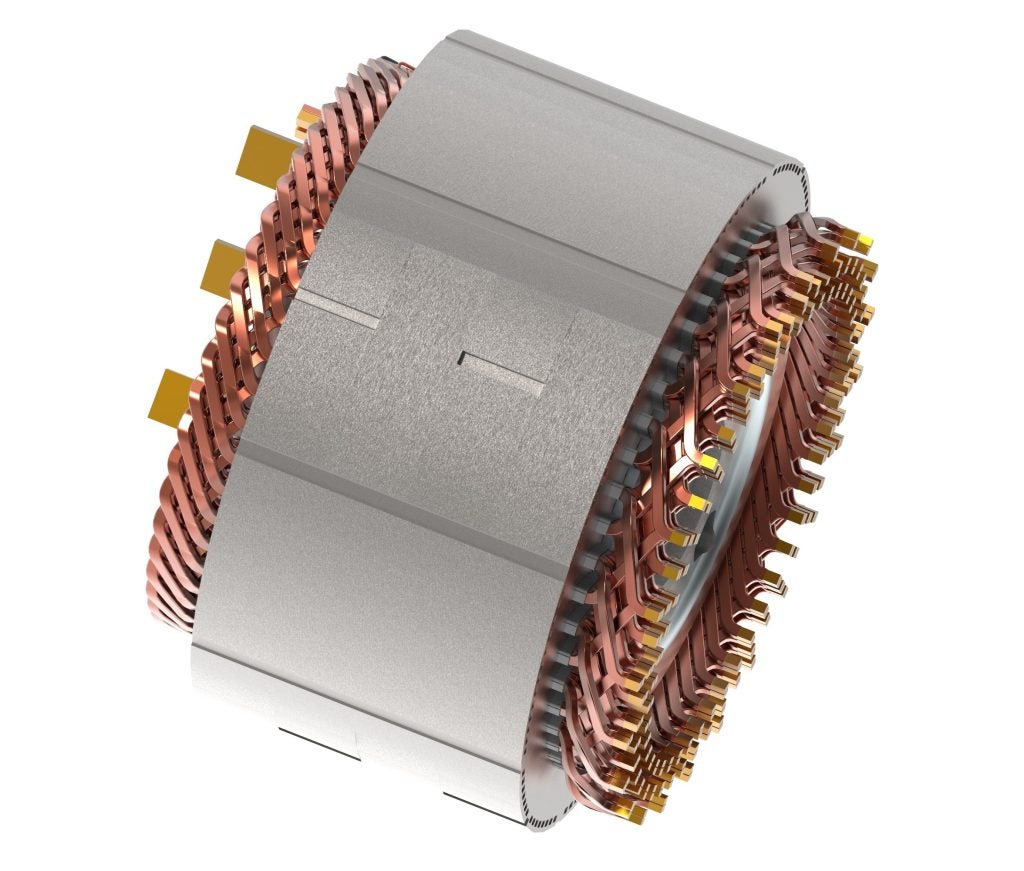

Porsche subsidiary V4Smart has also celebrated a milestone, with its second production line in Nördlingen, Bavaria, ramping up as planned.

This line, along with the one in Ellwangen, represents Europe's only production facilities for high-performance lithium-ion round cells.