Nissan Motor has agreed to source engines, gearboxes and other drivetrain parts from Renault’s new joint venture with China’s Zhejiang Geely Holding, the companies said this week.

Earlier this year Renault and Geely agreed to establish a 50:50 joint venture, codenamed Horse, to pool together 17 engine and transmission plants and five R&D centres on three continents, employing 19,000 people and generating annual revenue of EUR15bn.

The aim was to established a competitive company focused on the production of internal combustion engine (ICE) and hybrid powertrain systems with a diversified customer base to maximise economies of scale.

Nissan said it had agreed to source drivetrain modules and parts from the joint venture for 12 plants as the three-way strategic Alliance between Renault, Nissan and Mitsubishi appears to be expanding to also include Geely.

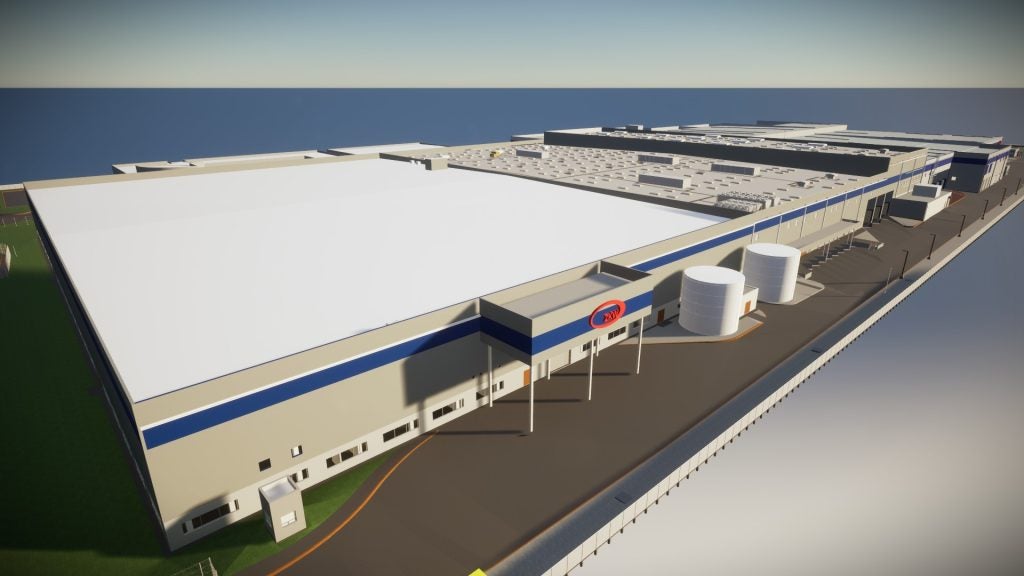

The Horse joint venture, to be based in London, will have an estimated production capacity of 5m ICE, hybrid and plug in hybrid drivetrains per year once established. It will include eight Geely plants in China and one in Sweden plus eight Renault plants located in Europe, Turkey and Latin America.

This joint venture is separate from the Ampere electric vehicle company being established by Renault, in which Nissan and Mitsubishi Motors have committed to investing. Nissan has also agreed to collaborate with Ampere to co-develop a battery version of its Micra compact car for Europe which is expected to significantly cut development costs and improve economies of scale. Mitsubishi is also expected to work with Ampere to develop and make an EV compact SUV.

Renault CEO Luca de Meo, said: “What we are doing now is, from size and impact, much bigger than what we have done in the Alliance in the last 10 years. The most important thing is to show that this alliance can create business value.”