New vehicle sales in Indonesia fell 14% to 72,936 units in June 2024 from 82,097 units a year earlier, according to wholesale data compiled by automotive industry association Gaikindo.

The market had been in decline for almost a year after rebounding strongly in the previous two years from pandemic lows. Consumer sentiment continued to weaken last month after Bank Indonesia hiked its benchmark interest rate again in April, by 25 basis points to 6.25%, up from 3.5% two years ago, to help support the weakening rupiah.

The vehicle market declined 19% to 408,012 units in the first half of 2024 from 505,985 in the same period of 2023, with sales of passenger vehicles falling 17% to 317,580 units while commercial vehicle sales plunged 26% to 90,432 units.

Toyota sales fell 19% to 129,802 units year to date (YTD) while deliveries by its subsidiary Daihatsu were down 14% at 85,434 units; Honda 47,589 units (-36%); Mitsubishi 36,560 (-7%) and Suzuki 33,133 units (-20%).

Vehicle production in the country fell 19% to 561,772 units YTD while exports of assembled vehicles dropped 12% to 218,333 units.

In May the government said it was targeting 50,000 battery electric vehicle (BEV) sales in 2024, after it extended the sales tax discount (from 11% to 1%) on BEVs with a minimum 40% local content until the end of 2024 to stimulate demand and help attract inward investment. It has also suspended the import duty on BEVs until the end of 2025 for companies investing in local production.

BEV sales amounted to just 11,930 units in the first half of the year, however, mostly low cost Chinese models. The best seller was the 38kWh Wuling Binguo small car priced from IDR317m (US$19,950), with 3,615 deliveries YTD. Other key players include Chery with the Omoda E5, Hyundai with the Ioniq 5 and SAIC Motor with the MG ZS EV.

China’s BYD and Vietnam’s VinFast launched local sales operations in the country this year and have pledged to invest in local production.

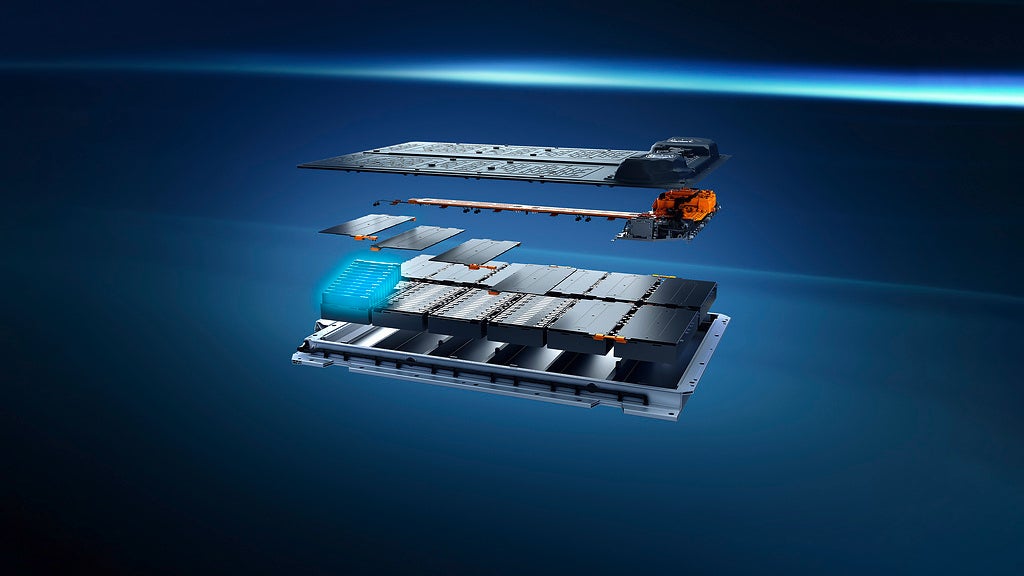

Local distributor Indomobil launched the GAC Aion Y Plus this month while Hyundai began production of the Kona Electric small SUV powered by batteries produced at its local joint venture plant with LG Energy Solution. It aimed to price the vehicle in the region of IDR500m (US$31,000).

China’s Hozon Auto began local assembly of its Neta V-II BEV in June after its Neta V predecessor went on sale in the country in the fourth quarter of 2023. Hozon said it was targeting local content of 60% and planned to launch exports to other right hand drive markets in the region.