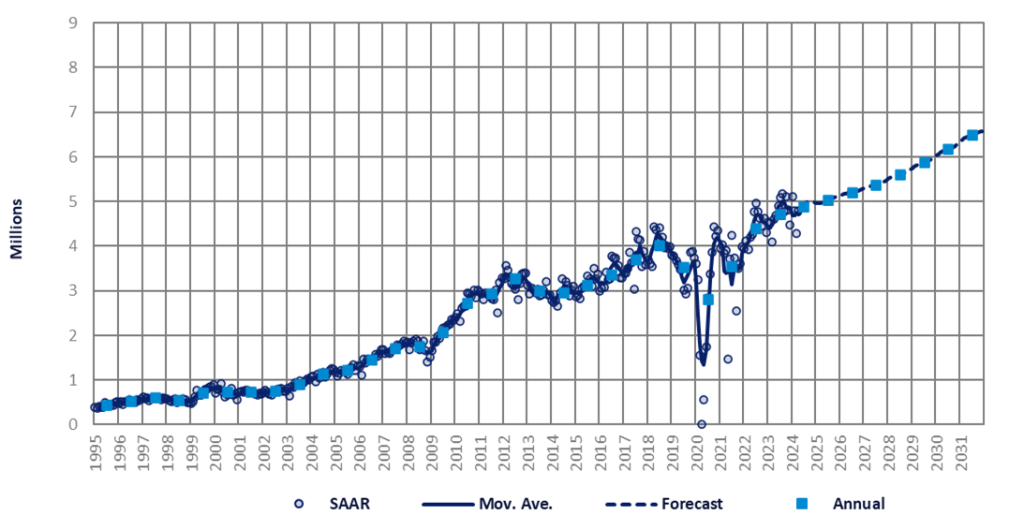

The Indian market experienced a resurgence in April, having decelerated in March, with the April selling rate reaching a strong 4.78 million units/year compared to 4.28 million units/year in the previous month.

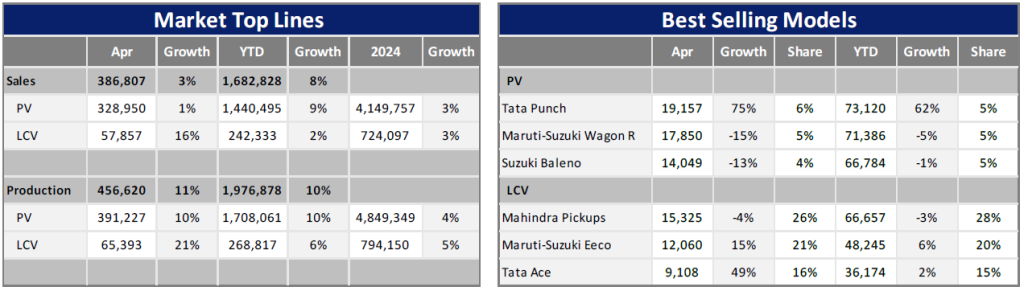

In absolute terms, Light Vehicle (LV) wholesales reached around 387k units in April – the highest sales ever recorded for the month. Although this figure represented a month-on-month (MoM) decrease of 9%, it marked a year-on-year (YoY) increase of 3%.

Sales of Passenger Vehicles (PVs) decreased by 9% MoM with a total of 329k units and exhibited a marginal 1% YoY increase due to a high base in April 2023. Deliveries of Light Commercial Vehicles (LCVs) with gross vehicle weight (GVW) of up to 6T reached 58k units, reflecting a 6% MoM decline but a 16% YoY uptick.

Many consumers adopted a wait-and-see approach as the six-week long general elections began. On the supply side, automakers remained cautious about increasing deliveries due to a high level of PV inventory at dealerships. It is reported that PV inventory stood at an estimated 360k units at the end of April, equivalent to approximately one month of PV wholesales in the country.

Meanwhile, retail sales of PVs and LCVs in April improved to 382k units compared to 372k units in March and 379k units in February, according to data from the Federation of Automobile Dealers Associations (FADA).

“The PV category experienced double-digit YoY growth, supported by enhanced model availability and favorable market sentiments, particularly around festive events like Navratri and Gudi Padwa. Despite strong bookings and customer flow, high competition, excess supply and discounting presented challenges for sustained growth. Additionally, the lack of new models in some portfolios impacted market traction,” said FADA President Manish Raj Singhania.

Overall, LV sales between January and April climbed by 8% YoY to 1.7 million units. This total consisted of 1.4 million PVs (+9% YoY) and 242k LCVs (+2% YoY). Consequently, the year-to-date (YTD) selling rate averaged 4.74 million units/year, a touch above last year’s record sales of 4.71 million units.

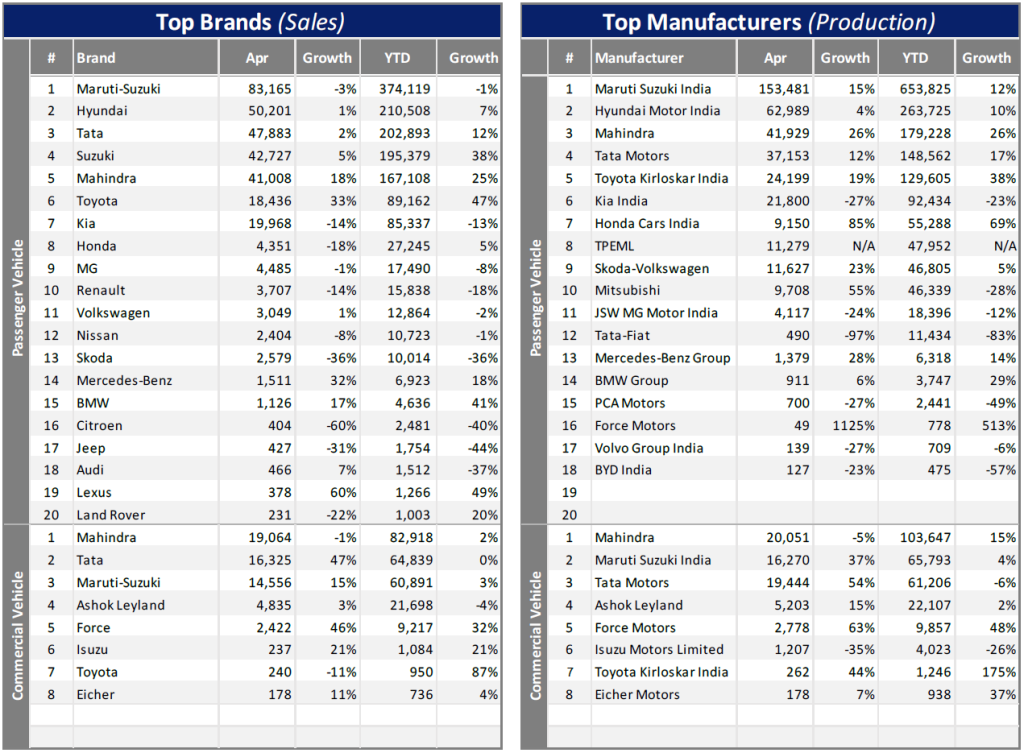

Additionally, preliminary data for May suggest that PV sales slowed due to uncertainties relating to the elections, while the growth rate was also influenced by the high base in May 2023. PV wholesales for Suzuki Group improved by a mere 2% YoY, while Hyundai’s sales inched up by 1% YoY. Similarly, Tata Motors’ PV dispatches rose by 2% YoY.

Notably, we decided to increase our forecasts for Suzuki Group by an average of 143k units (+8%) per annum in the long term. These increases were offset by lowering our projections for other automakers, with the largest cuts made to Tata, Hyundai, Mahindra, Kia, and Toyota.

Therefore, our overall sales forecasts for India remain unchanged, with sales forecasted to reach yet another record high of 4.9 million units (+3%) this year.

We expect that sales will improve after the conclusion of the general elections. Several new model and new model generation introductions planned for this year should also drive volumes. Plus, SUV sales are showing no signs of slowing down, which presents an upside risk to our forecast.

On the other hand, the downside risks to the 2024 forecast arise from persistent inflation and high interest rates. Inflation continues to exceed the central bank’s 4% target, and along with a record-low rupee, it makes interest rate cuts challenging. The ongoing severe heatwaves across India present a risk to agricultural output and rural incomes.

Other concerns include the continued impact of global warming on rural India, an uncertain global outlook, and rising oil prices (India is a major importer of oil). As such we remain cautiously optimistic about India’s sales outlook.

This article was first published on GlobalData’s dedicated research platform, the Automotive Intelligence Center. For more details on GlobalData’s designated Global Light Vehicle Sales Forecast module, click here