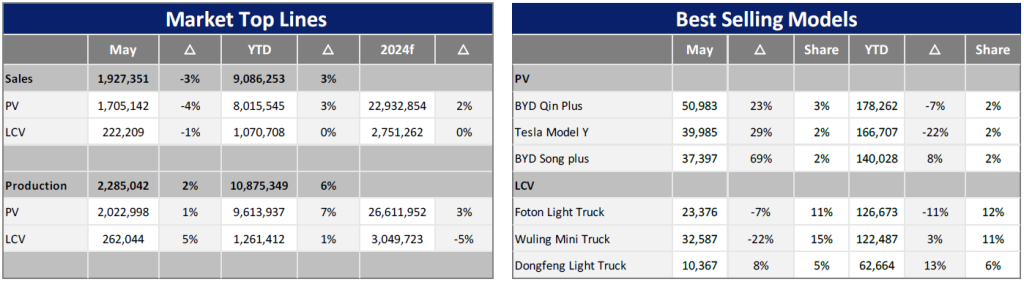

In May, the Chinese Light Vehicle (LV) market exhibited a steady uptick and continuous structural optimisation, reflecting a positive recovery trend. Domestic LV sales, excluding exports, reached 1.9 mn units, marking a 3.2% year-on-year (YoY) decrease but a commendable 5.0% month-on-month (MoM) increase.

Within the segment, Passenger Vehicle (PV) sales, influenced by the high base of the same period last year, declined by 3.5% YoY, yet still accounted for 1.7 mn units. Meanwhile, Light Commercial Vehicle (LCV) sales totalled 222k units, with a minor YoY decline of 0.6%. Cumulatively for the first five months of this year, LV sales amounted to 9.1 mn units, a 3.0% YoY increase. Within this, PV sales contributed significantly to the growth, reaching a total volume of 8.0 mn units, a 3.4% YoY increase. In contrast, LCV sales remain a substantial part of the market, though slightly down by 0.1% YoY at 1.1 mn units.

The implementation of the “old for new” policy’s cash subsidy details, the Beijing Auto Show’s stimulation of consumer enthusiasm, and the temporary cooling of the new product price war in the auto market have slightly eased the market’s wait-and-see sentiment. Consequently, MoM, PV sales rose by 6.5% compared to the previous month. However, the LCV sector’s recovery appears to require more time, as it still experienced a 4.8% MoM decrease in May.

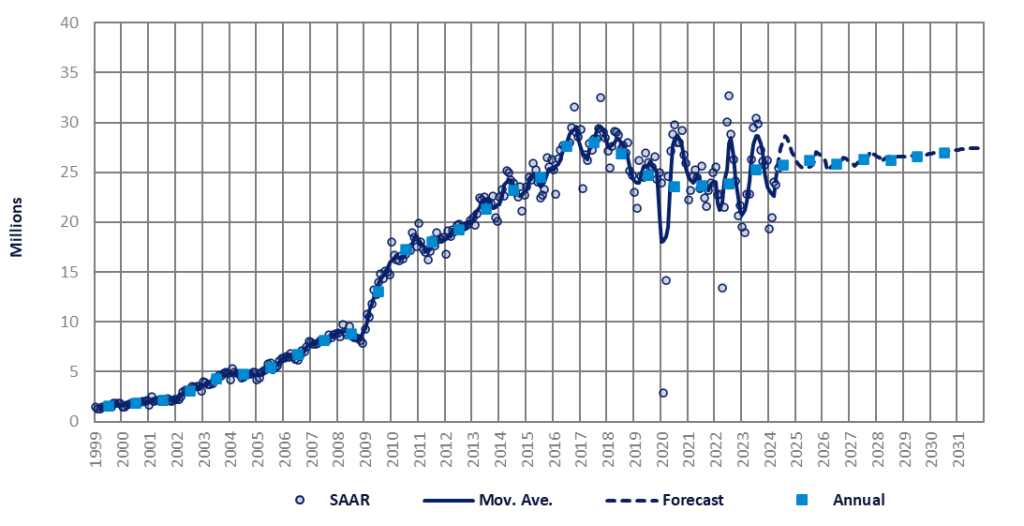

The selling rate for May stood at an annualised 25.4 mn units/year, reflecting a robust 7% increase from the previous month of April. Despite this uptick, the year-to-date (YTD) average selling rate remains moderate at 22.6 mn units/year. In YoY comparisons, May’s sales, at a wholesale volume level, experienced a slight decline of 3.3%. However, when considering the cumulative total for the year, there has been a modest overall increase of 3%.

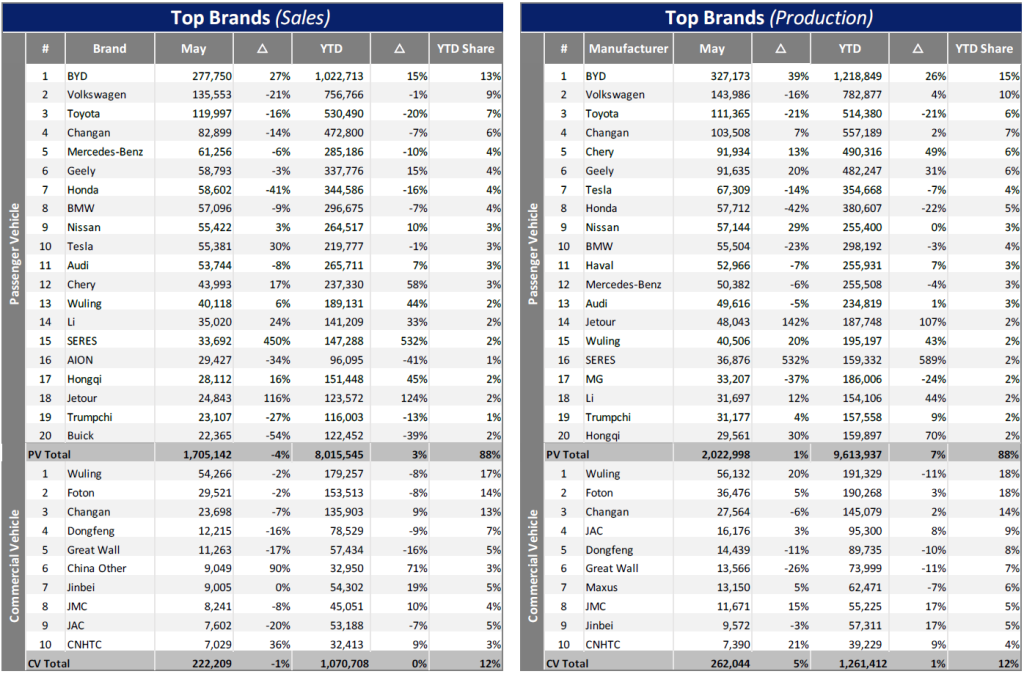

In the realm of production, the LV output for May was recorded at 2.3 mn units. This represents a modest YoY increase of 1.6%, notwithstanding a minor MoM decline of 1.0%. When considering the cumulative output for the year to date, volume has reached an impressive 10.9 mn units, demonstrating commendable growth of 6.5%. Breaking down the figures further, PV production, which accounts for 90% of the overall LV production, remained stable in May at 2.0 mn units, virtually unchanged from the previous month, with YoY growth of 1.2%. The production figures for Chinese OEMs showed a significant increase of 16.6% YoY, contrasting with a substantial decrease of 18.9% YoY in production for joint venture (JV) brands. Conversely, the LCV segment reported a more dynamic performance, with volumes for May reaching 262k units, reflecting a healthy YoY increase of 5.1%.

In May of this year, the export momentum in the Chinese automotive industry showed a slight deceleration, yet it remained robust, with shipments reaching 390k units. This represents a significant YoY increase of 26%, with exports making up 19% of the total PV production, underscoring their contribution to the overall growth of output. The ranking of OEMs by export volume continues to be led by Chery, SAIC, and Geely, which together account for 46% of the total export volume. Despite recent disruptions from external factors, particularly the EU announcement of increased tariffs on Chinese electric vehicles, the export figures may experience short-term volatility. However, the long-term outlook for the new energy export market remains optimistic and promising. On a counterbalancing note, these challenges are also expected to accelerate the expansion of Chinese automotive companies establishing manufacturing facilities overseas, thus potentially mitigating the impact of tariffs and solidifying their global presence.

In May, China’s NEV output surged to 886k units, a substantial YoY increase of 30% and a modest MoM growth of 9%. This impressive output has driven the NEV market penetration rate to 42.6%, highlighting a significant shift in market dynamics and a strategic realignment by domestic manufacturers. The Battery Electric Vehicle (BEV) segment contributed 461k units to the total NEV output, with a more moderate YoY increase of 10.6%. Despite this steady growth, the MoM increase was notably higher at 19.1%. However, BEV share of NEV sales has declined to below 60%, deviating from the original forecast that anticipated a 65% share for an extended period. This shift may be attributed to the development of hybrid technology, especially in the interim period before the widespread adoption of solid-state batteries. The Plug-in Hybrid Electric Vehicle (PHEV) segment has excelled, with a YoY increase of 76.1%, producing 273k units. The PHEV segment also demonstrated robust MoM growth of 7.9%. This sustained high growth rate reflects a burgeoning consumer preference for PHEVs, which offer the combined benefits of electric propulsion and traditional ICE, catering to a diverse range of driving needs and preferences.

In this month’s revision of our short-term forecast, despite May’s sales meeting our expectations, we have decided to increase our 2024 PV sales forecast by 208k units. This upward revision is prompted by the government’s recent policy announcements, which are expected to significantly boost sales in the latter half of 2024. The forecast for LCV remains mostly stable, with only a slight adjustment in 2024. As a result, our 2024 LV sales have been raised by 1.8% (higher than the initial 1% estimate), targeting a total of 25.7 mn units. It should be emphasised that this forecast adjustment pertains solely to 2024; the forecast for 2025 and beyond remains unaffected by this update.

This article was first published on GlobalData’s dedicated research platform, the Automotive Intelligence Center.