Denso, a key supplier to Toyota, has reported that the consolidated operating profit fell by 11.1% to Y107.2bn ($0.7bn) for the first quarter (Q1) ending 30 June 2025.

Profit attributable to parent company’s owners saw a 16.1% down to Y79.3bn ($0.5bn). The company's consolidated revenue stood at Y1,754.1bn ($11.7bn), in line with the last year.

These figures come against the backdrop of a global automotive industry grappling with supply chain issues, and the recent profit decline has significant implications for the Japanese automaker's supply chain.

In July, the US agreed to lower tariffs on Japanese car imports to 15%, a substantial reduction from the proposed 25%. This tariff reduction is expected to alleviate some pressure on Japanese auto manufacturers, including Toyota, which has been facing production bottlenecks partly due to Denso's challenges.

Denso executive vice president and CFO Yasushi Matsui commented: "Revenue in the first quarter remained consistent with the previous year, driven by a strong increase in vehicle sales in Japan, despite a decline in revenue due to the impact of the strong yen."

He also noted that the company forecasts Y7,200.0bn ($48.2bn) in revenue and Y675.0bn ($4.5bn) in operating profit for the fiscal year, taking into account the first quarter's results and the anticipated tariff cost reflections from the second quarter onwards.

Matsui added: “Operating profit forecast remains unchanged supported by efforts to minimise the impact of tariff costs and to steadily reflect incurred costs in pricing. Furthermore, as part of measures to enhance corporate value, it was resolved to sell Denso’s own shares in Toyota Industries Corporation (“Toyota Industries”) and to provide advance notice of a tender offer for its own shares held by Toyota Industries.”

Regionally, Denso saw a revenue rise in Japan by 2.9% to Y1,013.3bn ($6.8bn), while operating profit plummeted by 70.4% to Y13.3bn ($89.3m).

North America experienced a revenue decrease of 5.4% to Y473.2bn ($3.2bn), with a 3% drop in operating profit.

Europe's revenue fell by 6.4% to Y186.9bn ($1.3bn), but operating profit rose by 4.4%. Asia's revenue dipped slightly by 0.5% to Y459.0bn ($3.1bn), with a 33.3% increase in operating profit. Other areas saw a 4% revenue increase and a 7.3% decrease in operating profit.

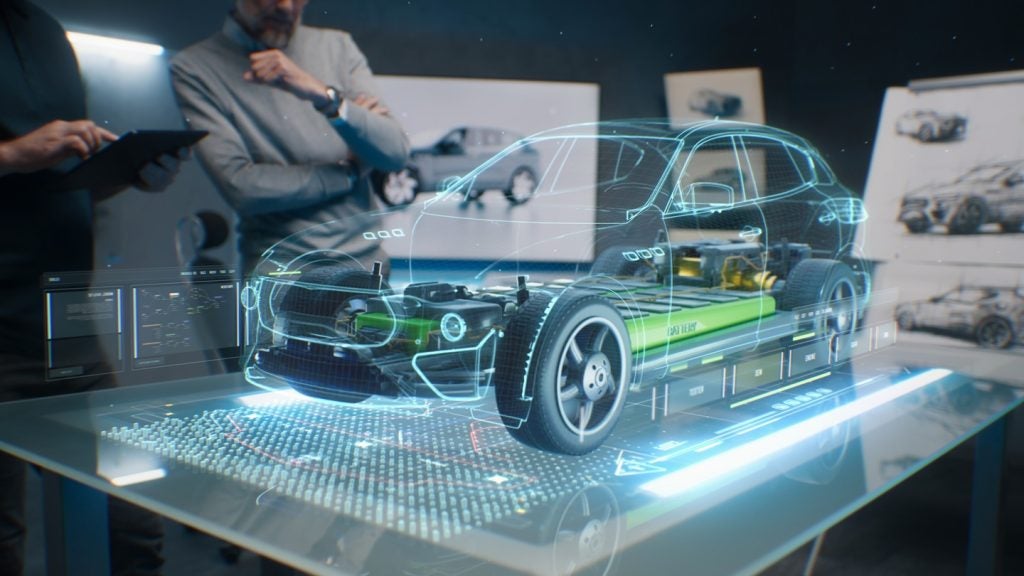

The interdependence between Toyota and Denso is highlighted by Ainvest, noting that Denso supplies more than 1,000 components per vehicle to Toyota. This has traditionally streamlined Toyota's production process but has also created vulnerabilities.

Toyota is now facing extended wait times for hybrid models, prompting efforts to localise production, such as the $14bn battery plant in North Carolina in the US and a $7bn joint venture with Mazda in Alabama.