Light and heavy vehicle sales in Brazil topped 197,900 units last month despite September having two less working days than August.

Nine month sales reached 1.63 m, an 8.3% increase on YTD 2022.

A sales slump had been feared after government subsidy discounts in July ended.

Since that did not happen, auto manufacturers association Anfavea raised its full year registrations growth forecast versus 2022 to 6% from 3%.

Expectations by various analysts point to 2.23 m registrations by year end.

The light vehicle sales forecast has been revised up to 7.2% from 4.1% estimated in January.

Anfavea president Marcio Leite said: “Two thirds of this strong demand for local market’s cars has been filled by imports. The scenario is still far from worrying due to most of them coming from [neighbouring] Argentina, but caution is needed.”

BEV sales reached 1% of the total in September with the BYD Dolphin's good performance due to its surpisingly low price.

However, year to date BEV share slipped to 0.5% from 0.6%, an indication the new Chinese hatchback took sales from other models while the EV sector shrank.

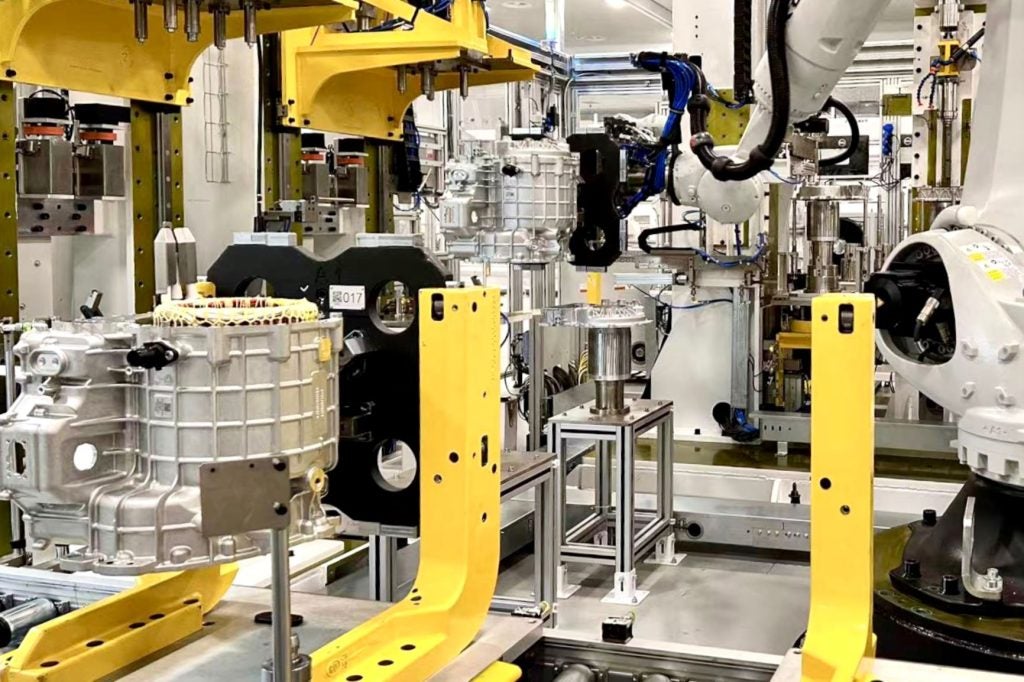

Early this month BYD confirmed investment of US$600m to build light and heavy vehicles in the northeastern state of Bahia at a former Ford factory which produced the EcoSport SUV and Ka hatchback until January 2021.

The 11.1% predicted drop in heavy truck sales proved correct in view of the costly new technology required to meet the new phase of Euro 6-equivalent diesel engine emissions standards.

Buses have been performing beyond expectations despite representing accounting for just 1% of the market versus lorries’ 5%.

For overall production, the prediction is now 2,732,000 vehicles for the full year, up just 0.1% over 2022 and down on the 2.2% rise predicted in January.

The lower output was attributed to poor export results in the first nine months. September was the worst month so far with 27,000 units.

The economic crisis in Argentina, previously Brazil’s largest market, has seen Mexico become the key destination for exports.

Chilean and Colombian markets have retracted 11.2% year on year.

Eastern brands, especially the Chinese, also made big advances into markets in South and Central America. Brazilian products remain competitive, especially lorries, in Mexico.

With that worsening external scenario, the previous 2.9% fully year export fall forecast made at the beginning of 2023 has been revised down to a worrying 12.7% lower.