Under conditions of softening demand and pressure on prices, Bain & Company says OEM margins are continuing to drop. The consulting firm says that its analysis reports that OEM margins continued to decline in the first quarter of 2025, falling to 5.4%. That is more a more than 40% drop from their 2021 peak, according to Bain.

The Q1 OEMs margin result also marks the third consecutive quarter in which supplier margins outperformed those of OEMs (supplier margins estimated at 6%), a significant reversal of the 17-quarter trend that began during the pandemic, according to Bain’s research.

The automotive OEMs’ falling margins reflect softening customer demand and intensifying pressure on prices, Bain says.

The firm also warns that OEM margins may get squeezed further in 2025 and beyond by persistent inflation and high interest rates causing subdued demand, rising costs, and falling prices.

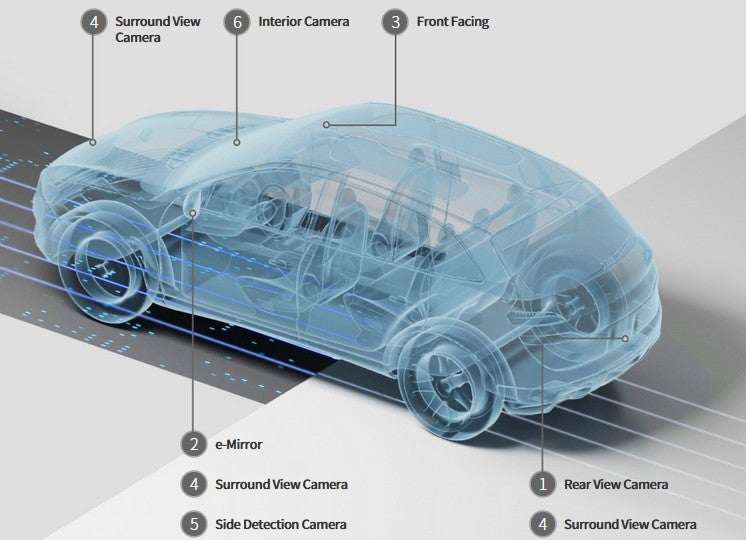

In addition, Bain warns that growing uncertainty around the pace of electric vehicle (EV) adoption will likely force OEMs to shoulder the dual burden of producing both combustion engine vehicles and EVs for an extended period, further pressuring margins. Many OEMs have already announced efficiency and performance improvement programs, including a reduction of material costs, that put additional pressure on suppliers.

Bain says that after supplier margins had stabilised at around 6.5% post-pandemic, they dropped to 6% in the first quarter of 2025. It says suppliers are still suffering from higher input costs (even though material costs have receded from all-time highs) while OEMs increase cost pressure even further.

Bain also notes that a growing number of suppliers face liquidity challenges that will likely require special support, including from OEMs, to prevent insolvency.

Bain concludes that amid this ‘hurricane of external pressures on margins’, both OEMs and suppliers ‘have no time to lose to increase the resilience of their business models, enacting more fundamental cost-reduction measures while staying disciplined to maintain price levels’.

Looking ahead, Bain also cautions that escalating trade tariffs could add a new layer of pressure on margins, particularly for globally exposed supply chains.