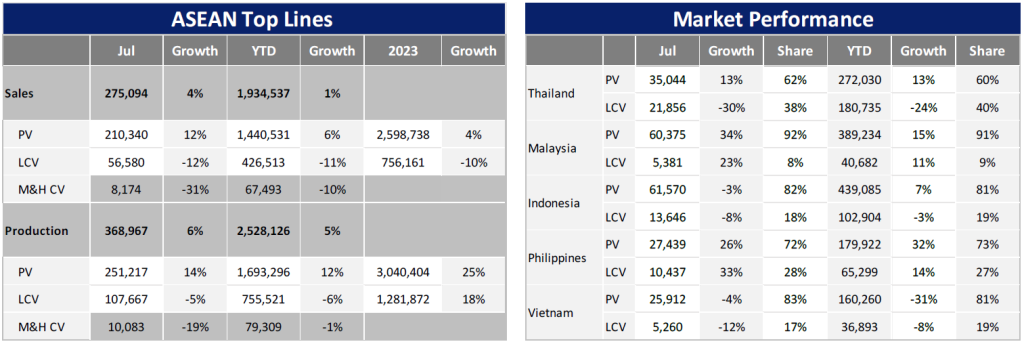

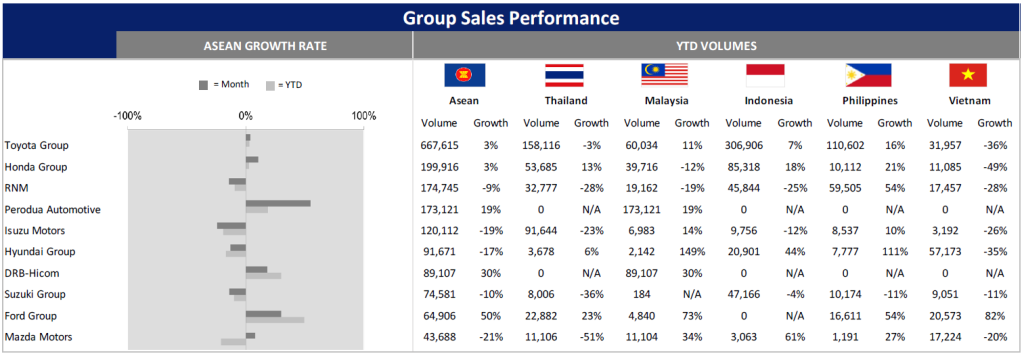

After ASEAN Light Vehicle (LV) sales slightly increased by 1% YoY in H1 2023, the market jumped by 6% YoY in July 2023 thanks to the increasing sales performance in Malaysia and Philippines.

Malaysia LV sales jumped by 33% YoY and 8% MoM in July. Behind the outstanding performance, it was the result that carmakers were offering competitive prices, aggressive promotions, and value-added services in order to at least partially offset the end of the tax cut. Also, demand was boosted by the introduction of new models (such as the newly launched Proton X90, new-generation Perodua Axia, and Toyota Vios), improved supplies, and resilient consumer spending.

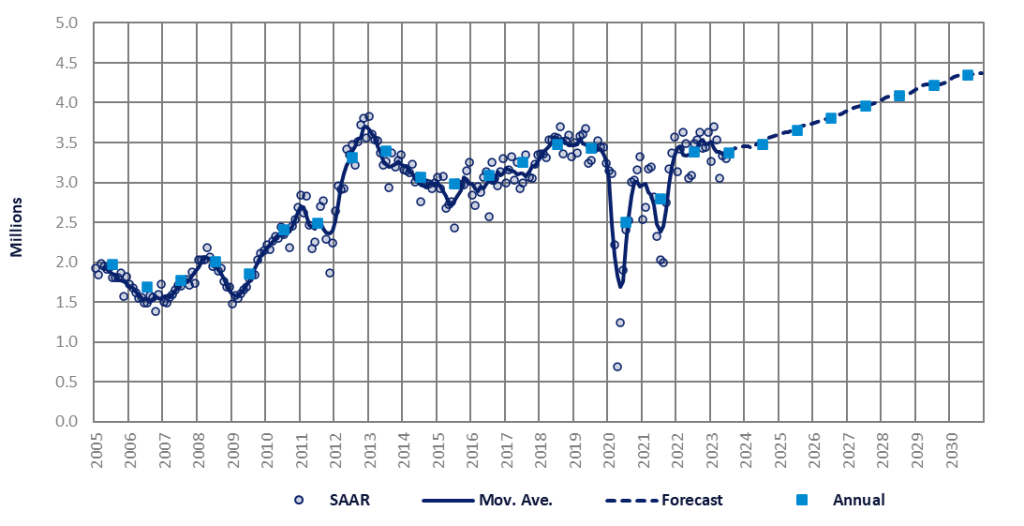

As PV sales continued to exceed our expectation, we made minor upward adjustments in the Passenger Vehicle (PV) forecast for 2023-2026. On the other hand, we cut the Light Commercial Vehicle (LCV) forecast by an average of 4k units a year through the long term, as the industry is facing challenges from the global slowdown. The net impact of the revisions on total LV sales forecast is small increases in 2023-2026 and marginal cuts in 2027 and onward. Thus, the latest 2023 sales were now projected at 753k units in 2023.

Philippines LV demand has continued to increase. July sales flew by 28% YoY as the seventeenth consecutive month of double digits growth. The LV market surged strongly by 27% YoY in January – July. The strong sales performance was supported by both supply and demand side. The Philippine market is vulnerable to any supply disruptions overseas as the imported CBU accounted for around 80% of new vehicle sales. So the improvement of global supply means the removal of sales constraints. Moreover, the imports from China increased strongly, perhaps partially because sluggish demand in China is forcing automakers in China to increase exports. The Philippines is one of the main export markets for China-built vehicles. For example, all VW models sold in the Philippines are imported CBUs from China.

The LV demand was also boosted by an economic recovery and the continuing solid inflows of remittances from Filipino workers overseas. A weak peso has increased the peso-value of US-dollar remittances significantly and boosted consumers’ purchasing power. As such, Philippines 2023 sales outlook were raised from 419k units in our previous report to 426k units.

In contrast, Indonesia, Thailand and Vietnam market saw a declining sales result in the month. Indonesia’s LV sales dropped by 4% YoY in July since buyers held purchasing in July and waited to see the new model launches and sales campaign at the GAIKINDO Indonesia International Auto Show (GIIAS) in mid-August. Based on the media report, however, August sales continued to decline by 6% YoY. This could be the result that a) the most awaited model, Mitsubishi XForce, was launched at the event but the delivery will begin in October and b) Toyota Avanza/Veloz Hybrid powertrain previously was expected to be debut at the event, but the new schedule is expected to be around November.

Due to the high booking orders at the GAIIS event and the delivery timing of Mitsubishi XForce and Toyota Avanza/Veloz Hybrid in Q4 2023, Indonesia 2023 sales projections were marginally raised from 970k units in last month’s report to 971k units.

Thailand July sales continued to decline by 8% YoY on weak demand for LCV (-30% YoY). This is due to the cloudy economic environment and tightened auto loan approval for LCV. Meanwhile, PV sales increased 13% YoY, driven by the government’s cash subsidy for purchasing BEV and the strong sales of new generation Toyota Yaris Ativ. Based on our advance data, August sales dropped by 6% YoY which were weaker than projected. So, we slight lowered Thailand’s 2023 sales to 776k units or a 6% YoY decline.

The Vietnam government re-introduced the 50% registration fee cut for locally manufactured and assembled vehicles from 1 July to the end of 2023, aiming to stimulate consumer demand and support local manufacturers. Yet, the Vietnamese market remained sluggish in July (-6% YoY). The impact of the scheme on sales is expected to be modest, as most consumers who wanted to buy new vehicles probably already did so last year. Moreover, the higher financing costs and tightened credit conditions caused a significant slowdown in sales. Consumers are wary about the economic outlook. Thus, we lowered Vietnam 2023 sales outlook to 434k units.

In conclusion, ASEAN 2023 sales were adjusted from 3.34 million units to 3.35 million units, which is largely from the upward Malaysia sales outlook.