Washington politics got October US light vehicle sales off to a slow start but the end of the shutdown had Americans flocking back to dealer showrooms.

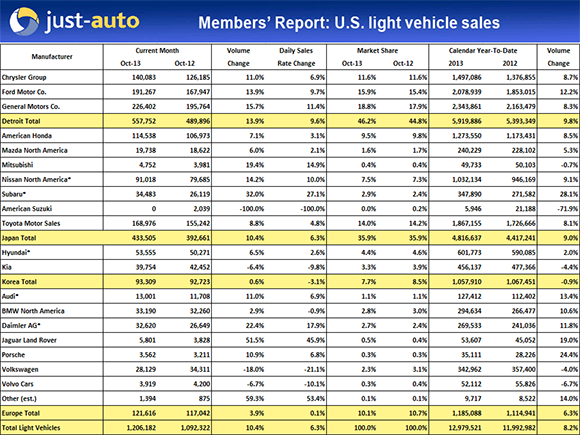

Automakers sold 1.2m cars and trucks last month, up 10.4% from October 2012. The seasonally adjusted annualised sales rate (SAAR) was 15.23m units, down slightly from September’s pace but well ahead of last October’s 14.40m.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Only three brands – Kia, Volkswagen and Volvo – missed their numbers from a year ago while several automakers, including Audi, Hyundai, Mercedes-Benz, Nissan and Subaru, celebrated new monthly records. Mazda noted its October results were the best in six years. Even Mitsubishi ended the month with a solid 19.4% jump and is now almost at break even compared with its year ago results.

The Detroit automakers posted improvements ranging from Chrysler Group’s 11% gain to General Motors’ 15.7% jump. The Detroit Three added 1.4 points of market share to their take for the month as strong demand for full size pickups played to their advantage. October’s top three best selling vehicles were American brand pickups.

Ford ended the month 13.9% ahead of October 2012 as Lincoln sales rocketed up 38.4%, driven by a 64% increase in passenger car sales.

Though GM enjoyed the largest gain, all was not sunny at the Renaissance Centre: the new GM full size pickups continued to lag the segment’s growth rate. Pickups account for roughly a quarter of GM’s total sales and the GMC Sierra is just keeping pace while the higher volume Chevy Silverado is behind the curve.

Jaguar Land Rover set the growth pace for the month with sales up 51.5% thanks in large part to a record month for Land Rover and a 39% jump for the Jaguar XF. Subaru set another sales record with a 32% improvement with triple digit advances by the Forester and XV Crosstrek. The Volkswagen brand was the biggest loser in October with weakness in all lines.

Increased sales of the Frontier pickup and Pathfinder and Rogue utilities propelled Nissan to a new October sales record. Car sales were essentially flat but light truck volume rose 42.8%.

Maserati announced an all time North American monthly sales record based on brisk sales of the new Quattroporte. Dealers are likely champing at the bit to get the new, and slightly cheaper Ghibli to add to their offerings.

Mercedes may have found the torpedo to sink BMW’s hopes of repeating as the luxury segment leader for the year. The new CLA has struck a chord with Americans who have scooped up 7,205 of the small sedans in just two months, making the CLA one of the hottest new products of 2013 and padding Mercedes’ lead in the segment to nearly 5,000 units.

The market share gained by Detroit came mostly at the expense of the Koreans. While Hyundai celebrated a new October sales record, Kia continued to languish with weak sales of the Forte and volume leading Optima. Year to date (YTD) Kia sales were now 4.4% behind the first 10 months of 2012.

With petrol prices remaining moderate, pickups and crossovers were the hot segments in October. Light trucks accounted for 52% of the total volume, up from 49.7% in October 2012. In YTD sales, trucks have claimed 49.5% of the market, compared to 47.9% for the first 10 months of 2012.

While September’s dive created a sales spike the likes of which haven’t been seen since 2009, October’s recovery looks to have things back on track for a year end tally in the 15.6m sales range.