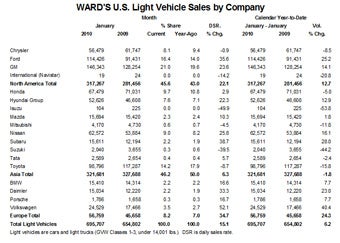

Ever mindful that year on year comparisons are now firmly with the post-credit crunch era, US light vehicle sales, adjusted for selling days, were up a healthy 15.1% to 695,707 units last month. In Detroit, Ford added to the we-didn’t-need-a-bailout glow by trouncing its rivals with a 35.6% gain to 114,626. GM topped the domestic maker unit count at 146,343, up 23.6%, and Chrysler was off 0.9% to 56,479.

Ford grew market share 2.4 points to 17.3% and said its 24% sales gain was due more to strong products than Toyota’s recall problems.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

While Ford joined other automakers in offering Toyota customers incentives to trade-in their vehicles, it had not yet seen a material impact on ‘conquest’ sales.

“My view looking over this five day wheel base is that there was not a significant movement because people were not going to overreact to that uncertainty,” sales and marketing chief Ken Czubay said on a conference call.

He was disappointed in Ford’s retail sales in January and noted that a large portion of January’s growth to 112,406 vehicles was due to a sharp increase in sales to government, commercial and retail fleets.

But he forecast better months ahead, telling AFP that “the elements of our product vision are really starting to gain momentum and we look forward to a very robust year with new products throughout 2010.”

General Motors also said its gain was largely with help from fleet sales amid an overall weak industry performance.

Market share grew 1.5 points to 20.9% but executives also said they did not think the Toyota recall had a significant impact.

“With one week we don’t think there was a heck of a lot of diversion,” said Mike DiGiovanni, executive director, global market and industry analysis.

Selling days-adjusted data showed Toyota off 8.7% to 98,796 units though the automaker itself said sales were 23% lower than internal targets made before the recall was announced on 21 January and sales and production of the eight affected models were suspended on the 26th.

“There is no doubt that the stop sale which was put in place last week impacted our sales,” said Bob Carter, general manager for the Toyota division.

Toyota’s market share fell 3.8 points to 14.1% of the US market in January, according to Autodata.

That was the first time Toyota’s US sales have fallen below 100,000 vehicles a month since January 1999.

But Carter said it’s not yet clear whether the stigma from the recall of millions of vehicles due to faulty accelerator pedals has turned consumers off Toyota products.

“I don’t want to relate that to demand because I’m being pragmatic: 60% of our dealer inventory for the last 10 days of the month was really not available for sale,” Carter said in a conference call.

Sales of vehicles not affected by the recall were “very close and in some cases actually exceeded” internal targets, Carter said.

And Toyota dealers are reporting that incentives offered by competitors in the wake of the recall to lure Toyota customers had “minimal to no effect on our business”.

“We are fortunate to have a very strong brand,” Carter said.

“Most of our consumers are confident in the brand. And many are delaying their purchase to see the outcome” of the fix Toyota has already begun to implement, he added.

Honda volume was up 2.9% to 67,479, adjusted.

“We’re off to a steady start for 2010 and we’re optimistic that we can build momentum,” said John Mendel, executive vice president of sales for American Honda.

Nissan booked a 25.8% rise to 62,572 and Hyundai Group volume was up 22.3% to 52,626. Subaru booked a 38.7% surge to 15,611 and Mazda was up 10.4% to 15,694.

“While we were surprised and disappointed in the overall weakness of the industry in January, we are encouraged by our strong performance at both ends of the market spectrum,” said Dave Zuchowski, Hyundai Motor America’s vice president of national sales.

All major European brands saw rises. VW led with a 52.1% surge to 24,529; Daimler was up 33.3% to 15,034; Porsche was up 16.7% to 1,786 and BMW was up 16.6% to 15,410.

There was a slight change in the top model pecking order. The perennial Ford F series truck topped it (27,630) followed by the rival Chevy Silverado (22,722) but the Toyota Camry – top last year – was relegated to fifth behind the Honda Accord, Nissan Altima, Toyota Corolla/Matrix and Chevy Malibu.