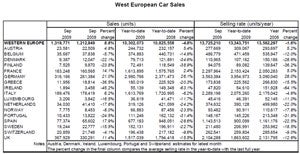

Figures released by JD Power show that Western Europe’s car market grew by 8.8% year-on-year to 1.32m units in September, though the market analyst and forecasting company warned that there are signs of slowdown.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

September’s seasonally adjusted annualised rate (SAAR) of sales topped 13.7m units as incentives continued to support the market. The 13.7m annual selling rate, while down on some of the second quarter highs earlier this year, is still stronger than the full-year 2008 result.

In the first nine months, West Europe’s car sales totalled 10.3m units, a decline of 4.8% on the same period last year.

In Germany sales were up by 21% in September and the SAAR, while strong at 3.6m units as scrappage orders continued to flow through, showed some moderation from the highs earlier this year, JD power said.

JD Power also warned that the car market in Germany is about to fall sharply in the post-scrappage-incentive environment and said it is likely that sales will continue to weaken in the months ahead.

The French market was strong in September, even by comparison with a pre-crisis level of sales — a selling rate of 2.3m units compares favourably with annual sales levels of the past decade, JD Power said.

Italian demand is also holding up well, through incentive scheme support.

JD Power said that the UK market, in one of its more important seasonal months, grew by 11%, but noted that the market is still below trend level. The Spanish market is also doing better as a result of government support, but remains in historically weak territory.

JD Power warned that a major market reduction will follow the ending of incentive schemes and is forecasting that the West European car market will fall 9.3% in 2010 to 11.96m units following a drop of 2.7% to 13.19m units this year..

The fall in German sales due to the end of the scrappage scheme is the major factor in the decline projection for next year. JD Power said that other countries may extend their schemes into 2010, and it now expects extensions of some sort in France and Italy — this does not imply growth in those countries for 2010 but, rather it says, relative stability on the 2009 level.

JD Power said it sees a second incentive renewal as being unlikely in the UK, after the recent top-up of the scrappage incentive fund, while a top-up is also assumed for Spain but, again, this offers only the likelihood of stability, not growth.

Furthermore, in the absence of a substantive economic recovery in Western Europe in 2010, the chances of any markets “coming to the rescue” to offset the likely 2010 decline in Germany are relatively small, JD Power says.