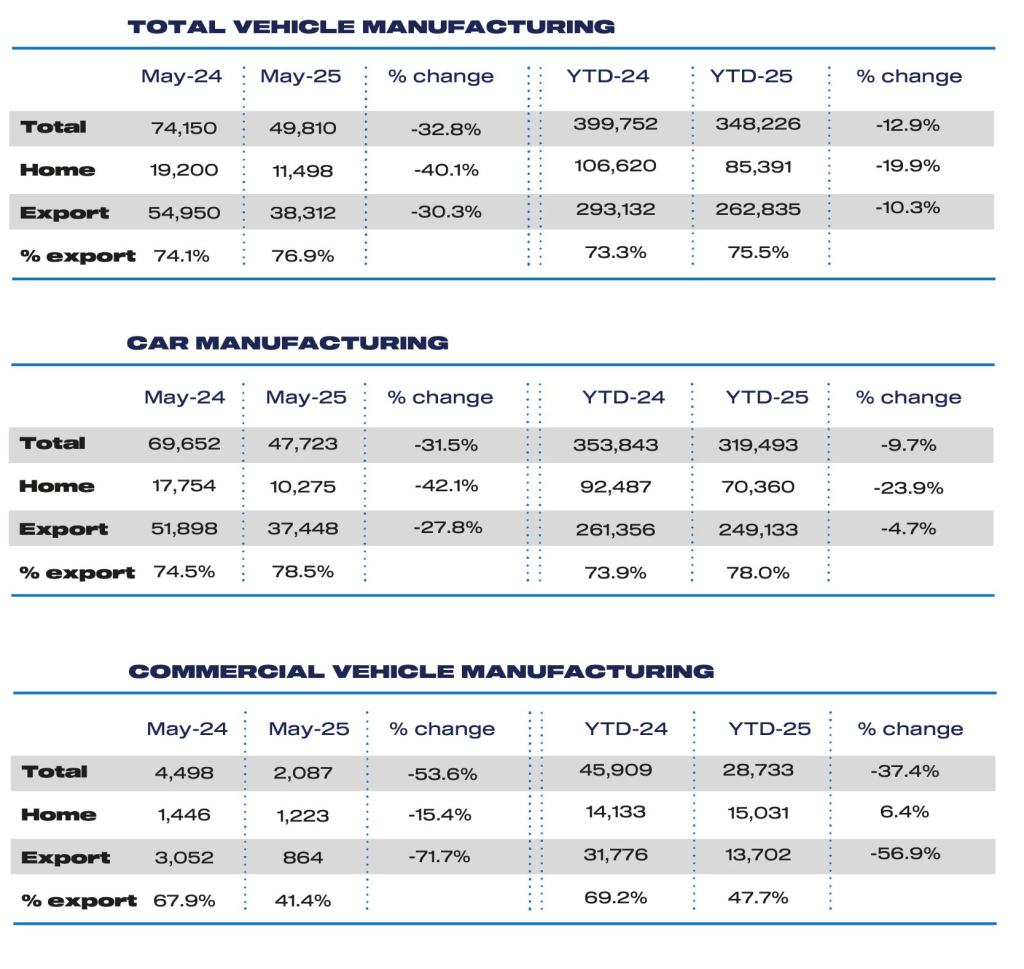

UK car and commercial vehicle production fell for the fifth consecutive month in May, down 32.8% to 49,810 units, according to the latest figures published by the Society of Motor Manufacturers and Traders (SMMT).

Excluding 2020, when Covid lockdowns saw factories shuttered or running at greatly reduced capacity, it was the lowest performance for the month since 1949. Year to date, total output is down 12.9% on 2024, to 348,226, the lowest since 1953.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Car production declined by 31.5% in the month. The SMMT said the result was ‘due primarily to ongoing model changeovers, restructuring and the impact of US tariffs’.

Commercial vehicle output was also down sharply, by 53.6% to 2,087 units, as the closure of one of the UK’s CV plants continues to impact comparisons with last year.

Car production for export fell by 27.8%, although a 42.1% fall in output for the smaller domestic market meant exports comprised a larger share of production, up to 78.5%. Shipments to the EU and US, the UK’s two largest markets, fell by 22.5% and 55.4% respectively with the US share of exports declining from 18.2% to 11.3%. This was in large part due to the imposition by the US administration of supplementary 25% Section 232 tariffs on cars from March which depressed demand instantly, forcing many manufacturers to stop shipments.

However, with the trade agreement negotiated by government due to come into effect before the end of June, this should ‘hopefully be a short-lived constraint’, the SMMT said. Declines were also recorded in exports to China and Turkey, down 11.5% and 51.0% respectively.

Export volumes of vans, buses, coaches, taxis and trucks also declined in May, down by 71.7% year on year. The EU remained overwhelmingly the sector’s biggest customer, accounting for 94.7% of exports, although volumes fell -72.1%. As a result, the export share of overall commercial vehicle production fell from 67.9% to 41.4%, with the domestic market now the primary destination for UK commercial vehicle output.3

Mike Hawes, SMMT Chief Executive, said: “While 2025 has proved to be an incredibly challenging year for UK automotive production, there is the beginning of some optimism for the future.

“Confirmed trade deals with crucial markets, especially the US and a more positive relationship with the EU, as well as government strategies on industry and trade that recognise the critical role the sector plays in driving economic growth, should help recovery. With rapid implementation, particularly on the energy costs constraining our competitiveness, the UK can deliver the jobs, growth and decarbonisation that is desperately needed.”