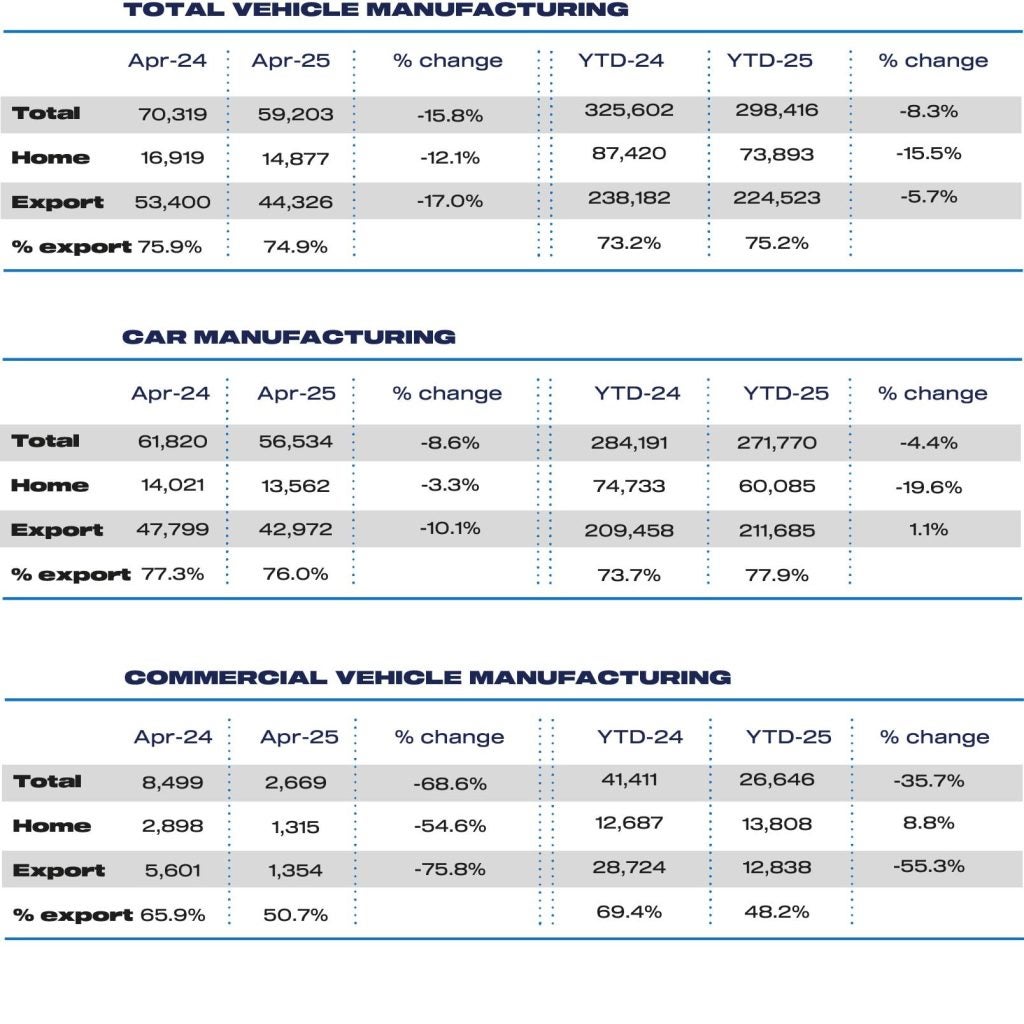

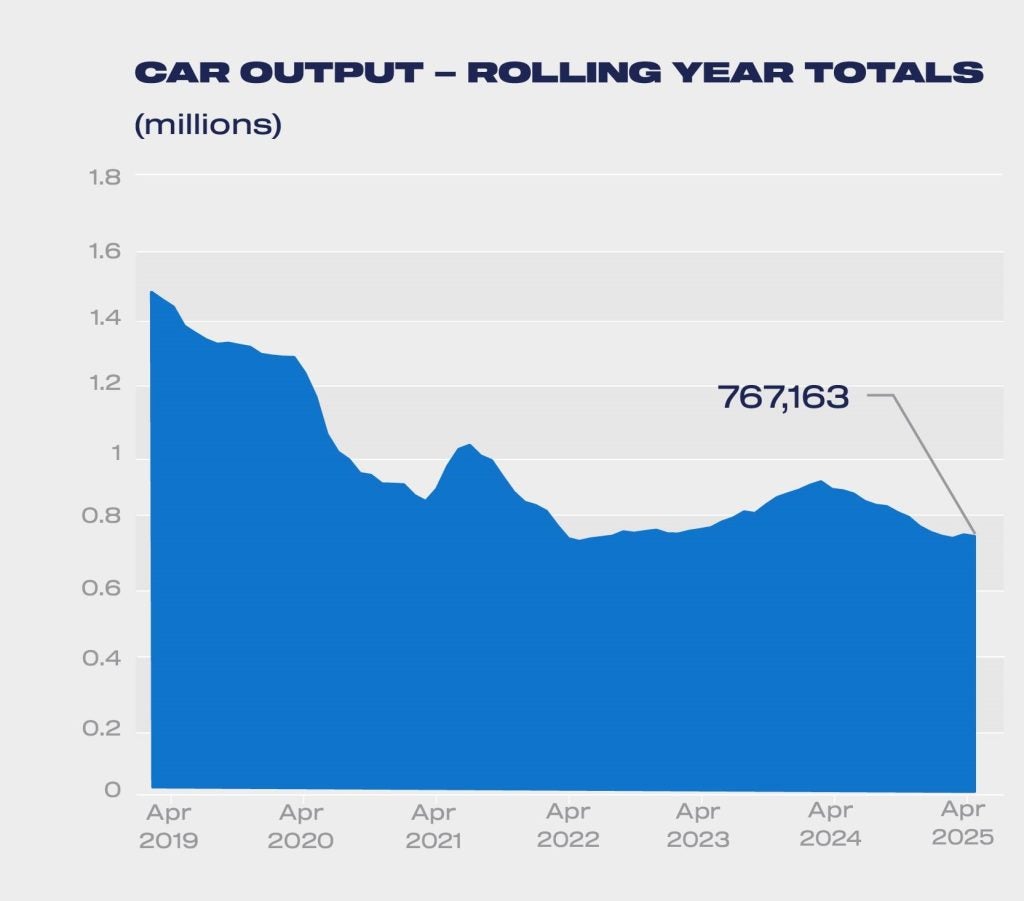

UK car and commercial vehicle production fell by 15.8% to 59,203 units in April, according to the latest figures published by the Society of Motor Manufacturers and Traders (SMMT). Vehicle output fell to the lowest level for the month since 1952, excluding 2020 when the first Covid lockdown effectively saw manufacturing cease.

The result caps off the sector’s lowest start to the year since 2009.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

The SMMT said April’s decline in car output was driven by a combination of factors, notably the later timing of Easter – which saw fewer production days in the month (and hence a factor behind the comparative rise in output in March) – as well as model changeovers and lower demand in key export markets. As a result, car production fell 8.6% to 56,534 units. Commercial vehicle output also declined, by 68.6% to 2,669 units, driven primarily by a plant closure and normalising demand for new heavy goods vehicles (HGVs) following robust post-pandemic growth.

Car production for export fell 10.1%, while production for the domestic market – always a smaller proportion of volumes – also decreased, by 3.3%. Shipments to the UK’s two largest global markets, the EU and US, fell by 19.1% and 2.7% respectively, although the EU still took more than half of all exports while the US received 16.5%. Conversely, exports to China and Turkey rose by 44.0% and 31.2% respectively.

Commercial vehicle export volumes, meanwhile, fell sharply by 75.8% with just over half (50.7%) of output heading overseas. The decline was driven by a 78.9% drop in shipments to the EU, but the bloc retained the lion’s share of exports at 84.9%. CV output for the domestic market also softened, down by 54.6%.

The SMMT noted that production is being ‘constrained by economic uncertainty and rapidly changing global trading conditions’ and said the UK industry ‘awaits publication of government’s industrial strategy, which must contain measures that boost the competitiveness of Britain’s most valuable export sector’. It said a strategy with automotive and advanced manufacturing at its heart will enable the sector to take advantage of the UK’s new trading arrangements, including those agreed with the EU and US – while exploring possibilities for growth in other markets, notably India, delivering economic benefits across the UK.

Mike Hawes, SMMT Chief Executive, said: “With automotive manufacturing experiencing its toughest start to the year since 2009, urgent action is needed to boost domestic demand and our international competitiveness. Government has recognised automotive manufacturing’s critical role in driving the UK economy, having successfully negotiated improved trading conditions for the sector with the US, EU and India in the space of a month.

“To take advantage of these trading opportunities we must secure additional investment which will depend on the competitiveness and confidence that can be provided by a comprehensive and innovative long-term industrial strategy. Get this right and the jobs, economic growth and decarbonisation will flow across the UK.”