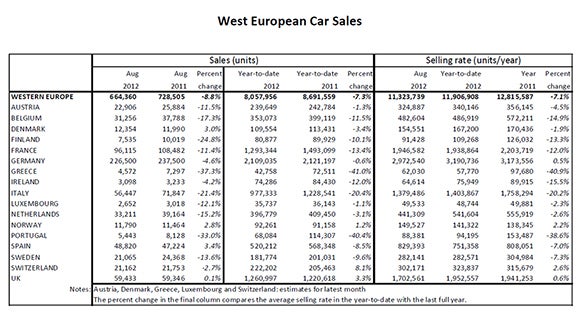

This year’s slide in West European car sales continued in August with sales down by 8.8% on last year according to data issued by LMC Automotive.

LMC said that the decline, for the eleventh month in a row, left the Seasonally Adjusted Annualised Rate (SAAR) of sales at just 11.3m units. The company also suggested that even that depleted market level was inflated by the widely reported self-registering and heavy discounting currently taking place in the market.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

The market decline in Germany last month was 4.6% with the second half of the year proving something of a contrast from the first half, with the selling rate slipping below 3.0m units a year.

LMC said that other markets in Europe continue to reflect the economic gloom in the region. The Italian market’s selling rate remains desperately weak, LMC said, with no sign of any significant improvement around the corner. Italian sales continue to slip back and it looks as though a full year market fall of at least 20% is in order, LMC said. The French market is also struggling (a double-digit drop in August) and is forecast to fall below 2m units for the full year, the first time this will have happened since 1998.

The UK car market’s selling rate also fell back, despite the 0.1% increase in August, but the UK market is seasonally subdued ahead of a registration plate change in September.

In contrast, there was a slight improvement in the Spanish market through a pull forward in sales before the VAT rise on September 1st.

LMC forecasts a car market in Western Europe of 11.84m units this year, some 7.6% down on 2011.