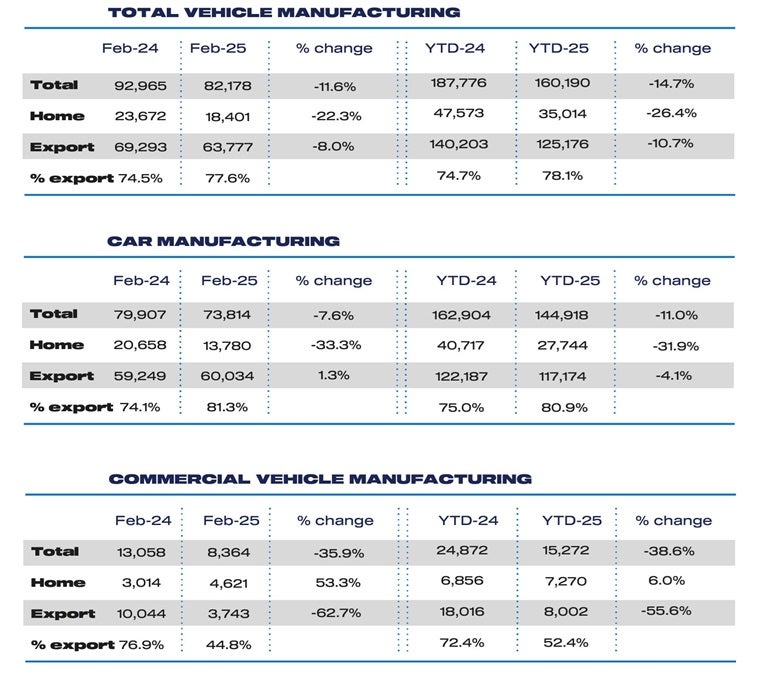

UK car and commercial vehicle production declined by 11.6% in February, to 82,178 units, according to the latest figures released by the Society of Motor Manufacturers and Traders (SMMT).

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

The SMMT said multiple factors were at play in the month’s decline over last year, notably soft markets at home and overseas, model changeovers and plant restructuring.

February marked the 12th consecutive month of decline for car manufacturing down 7.6% to 73,814 units. Export volumes were up 1.3% to 60,034 units. Car production for the UK market, meanwhile, fell 33.3% to 13,780 units.

UK production of battery electric, plug-in hybrid and hybrid cars fell 5.6% to 27,398 units in the month, but still boosted their share marginally to 37.1%, from 36.3% last February. In the year-to-date these electrified cars have taken a 39.6% share of production, up from 36.0% a year ago, with a more modest -2.1% fall in volumes compared with overall output down -11.0%.

Commercial vehicle (CV) output fell 35.9% to 8,364 units, driven primarily by less van production and following last year’s February performance, which was the best since 2008 when output almost doubled. CV columes were driven by domestic demand, accounting for 55.2% of output with volumes up by more than half to 4,621 units. CV exports, however, fell 62.7% to 3,743 units (with 93.8% heading to the EU, reflecting a drop of 5,956 units shipped to the bloc).

The SMMT said overall performance reflects the challenges the sector faces globally. It said measures are needed ‘urgently’ to bolster the UK’s competitiveness and drive consumer demand.

The SMMT noted that yesterday’s Spring Statement by the UK Chancellor, offered no support for the industry or consumers, and said it ‘represented a missed opportunity and will delay further the sector’s ability to deliver growth for the UK economy’. It said the forthcoming Industrial and Trade strategies must, therefore, be ‘fast-tracked to signal the UK is open for business, and the £2 billion promised by government via the Automotive Transformation Fund rolled out immediately’.

The trade body also called for a cancelling of the VED Expensive Car Supplement for EVs, as well as cutting VAT on public charging and new BEV sales, extending the Plug-in Truck Grant and introducing mandatory targets for infrastructure rollout. This, it said, would back the industry’s billions of pounds of investment in new factories, models and discounts, and embolden consumers and operators to make the switch.

Mike Hawes, SMMT Chief Executive, said: “These are worrying times for UK vehicle makers with car production falling for 12 months in a row, rising trade tensions and weak demand. The market transition is not keeping pace with ambition and, while the industry can deliver growth – and green growth at that – it needs policies to deliver that reality.

“It was disappointing, therefore, to hear a Spring Statement that did nothing to alleviate the pressure on manufacturers and, moreover, confirms the introduction next month of additional fiscal measures which will actually dissuade consumers from investing. Without substantive regulatory easements our manufacturing viability remains at risk and the UK’s transition to zero emission mobility under threat.”