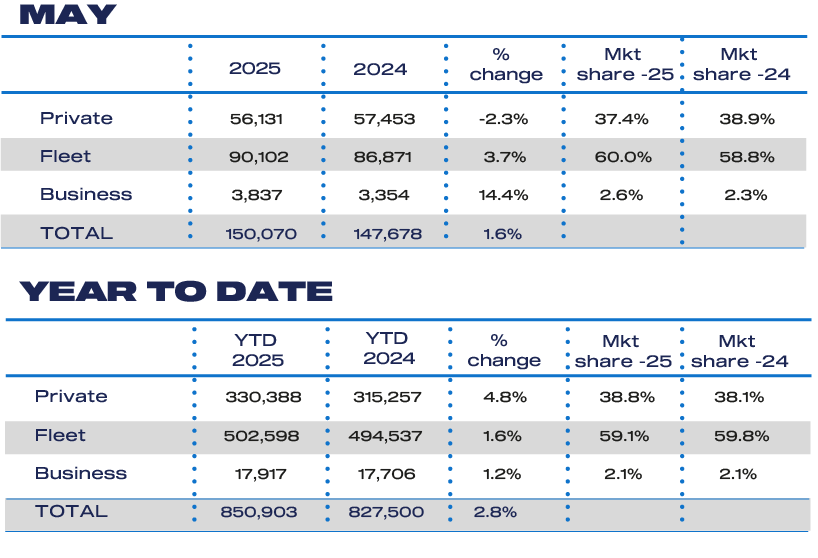

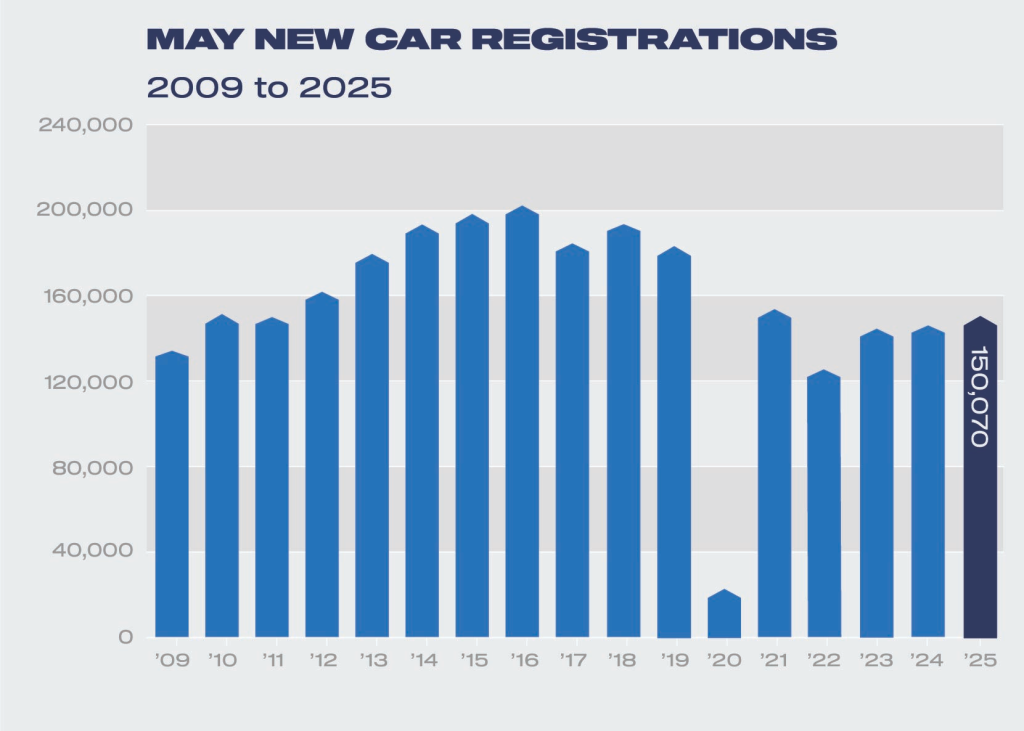

The UK’s new car market returned to growth in May, as registrations rose 1.6% to 150,070 units, according to data from the Society of Motor Manufacturers and Traders (SMMT).

It was the best May performance since 2021, but still 18.3% lower than in pre-pandemic 2019 and only the second month of growth this year, reflecting low levels of consumer confidence and a weak UK economy.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

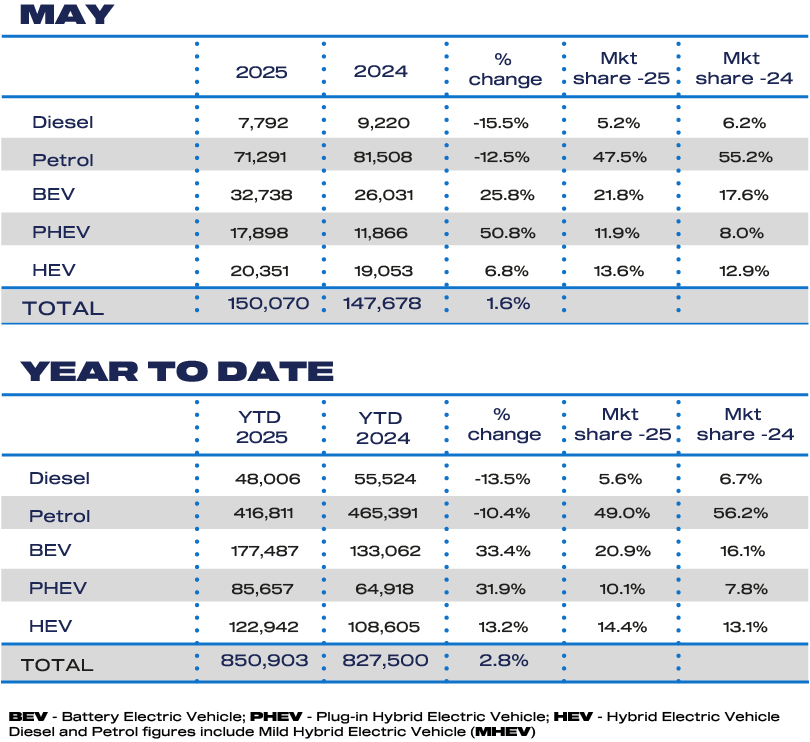

Fleets and businesses drove the month’s growth, up 3.7% and 14.4% respectively and responsible for 62.6% of registrations, while sales to private buyers fell for the second consecutive month, down 2.3%. There were double digit declines in deliveries of both petrol and diesel cars – down 12.5% and 15.5% – while demand for the latest electrified models increased strongly to take a combined 47.3% market share.

Uptake of hybrid electric vehicles (HEVs) grew by 6.8% to 20,351 units, while plug-in hybrid electric vehicles (PHEVs) were up more than half (50.8%) to 17,898 units. Registrations of battery electric vehicles (BEVs), meanwhile, rose by 25.8%, accounting for 21.8% of the market as manufacturers continued to support sales with attractive incentives.

Despite this, BEV registrations year-to-date have only reached 20.9% car market share – still seven percentage points off the 28% mandated by UK regulations. Moreover, The SMMT noted that significant discounting is ‘still ongoing despite new model introductions and increasingly affordable offerings’.

The SMMT said that while recent adjustments to the ZEV Mandate were welcome, the current market situation is ‘unsustainable for a sector already facing multiple cost pressures’.

The SMMT again called for more fiscal incentives to boost BEV sales. It said halving VAT on new EV purchases would put 267,000 additional new EVs – rather than fossil fuel vehicles – on the road in the next three years and drive down CO2 emissions by six million tonnes a year. Removing EVs from the VED Expensive Car Supplement, meanwhile, and equalising VAT paid on public charging to that levied at home would also ‘send a signal that now is the time to switch’.

Mike Hawes, SMMT Chief Executive, said: “A return to growth for new car registrations in May is welcome but manufacturer discounting on new products continues to underpin the market, notably for electric vehicles. This cannot be sustained indefinitely as it undermines the ability of companies to invest in new product development – investments which are integral to the decarbonisation of all road transport. Next week’s Spending Review is the opportunity for government to double down on its commitments to Net Zero by driving demand through fiscal measures that boost the market and shore up our competitiveness.”