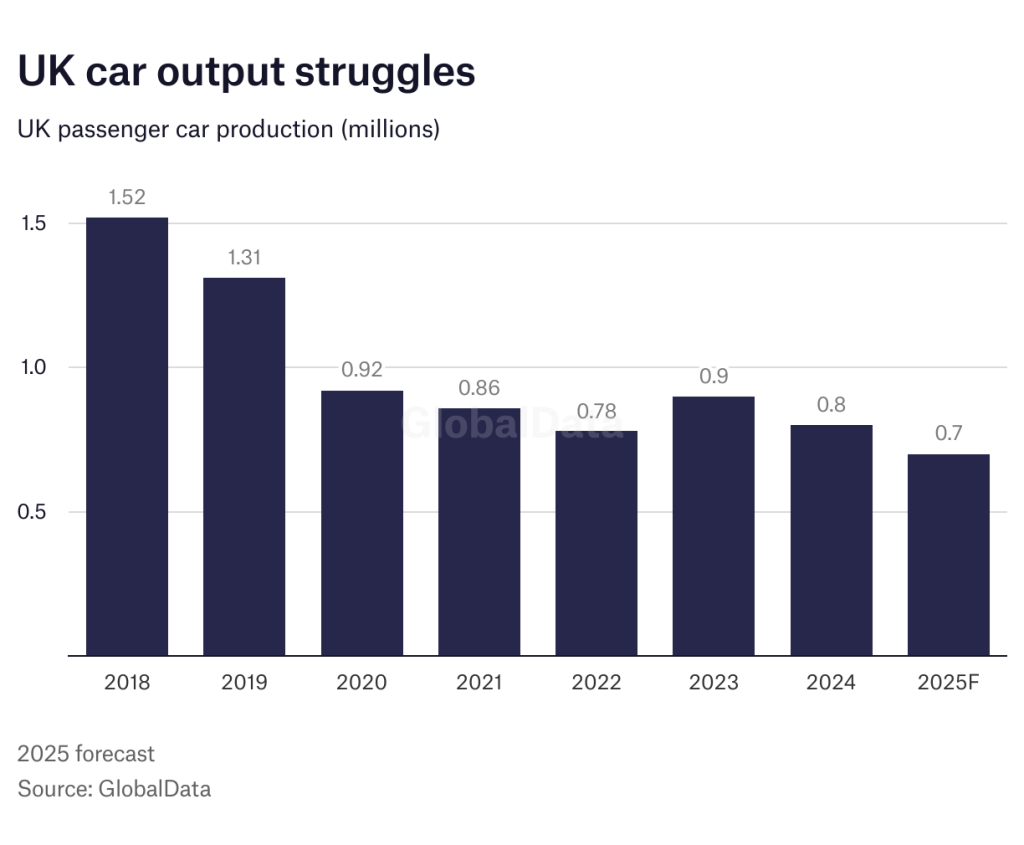

The UK automotive industry has urged the Chancellor (Rachel Reeves, Britain’s government minister responsible for fiscal policy) to get behind the government’s Modern Industrial Strategy, and create the conditions needed to restore the sector to a 1.3 million vehicle manufacturing hub by 2035.

According to GlobalData, UK passenger car output this year is forecast at around 700,000 units and has declined from an annual 1.5 million units as recently as 2018.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

The Society of Motor Manufacturers and Traders (SMMT) is also warning that the raft of industrial measures and funding pledged in support of the sector’s growth would be ‘completely undermined by fiscal policies that threaten the UK’s new car market – a critical economic contributor and central to the country’s appeal as an automotive investment destination’.

The sector has welcomed recent government commitments, notably the Industrial Strategy and the £2.5 billion fund designed to boost innovation, productivity and inward investment. This, it says, combined with preferential treatment for automotive products negotiated in landmark trade deals with the US and India; a new regulatory framework enabling automated ride hailing services from next year; changes to the ZEV mandate; and the Electric Car Grant, is evidence of government’s recognition of the importance of the sector to both economic prosperity and decarbonisation.

However, the SMMT says measures trailed ahead of the Autumn Budget (which will be announced today – 26 November 2025) risk negating this support, inflicting ‘severe damage’.

The SMMT also maintains thar singling out electric cars for a new pay per mile tax (to fill the tax raising gap caused by rising electrification and lower fuel duty revenues) would ‘suppress demand, discouraging consumers and making ever-tougher sales targets even more costly and challenging to achieve’.

The share of BEVs in UK new car sales has risen to 25% but the UK government target for 2025 is set at 28% or penalty fines could be faced by companies on their volume shortfalls.

Given the industry has already had to spend £8.5 billion on EV discounts in pursuit of targets, measures that further weaken demand will only shrink the market and deter investors, the SMMT says.

Proposals set out in the last UK Budget are already threatening investment, the SMMT says. Plans to end Employee Car Ownership Schemes and force automotive workers to pay company car tax on the very vehicles they make and purchase would cost the industry – and government – a combined £1.5 billion per year, the SMMT claims, with 5,000 manufacturing jobs at risk.

Added to ongoing crippling energy costs and employment taxation, attracting much needed investment will be ever more difficult, the trade association maintains.

The SMMT also points out that the UK industry faces fierce global competition in an increasingly complex geopolitical landscape where every major market, including the US, China, and EU, is intent on bolstering its own competitiveness.

Mike Hawes, SMMT Chief Executive, said: “Government has said it will back automotive to the hilt and, for the most part, deeds have matched words with trade agreements, regulatory flexibilities and an Industrial Strategy supplemented by a £2.5 billion fund that is designed to support automotive as a growth sector. But with the good also came the bad and the downright ugly, with the proposed ending of Employee Car Ownership schemes.

“The Budget this week is a chance to align fiscal measures to growth and the future success of the sector. Rather than road pricing for EVs, we need to see measures that stimulate consumer demand, so we can deliver the tax revenues, jobs, investment, productivity and growth that is in everyone’s interests.”

Mick Flanagan, SMMT President, added: “I believe 2025 will be seen as an inflection point for our industry. The years of globalisation seem to be at an end, and as political sands shift, trade barriers go up and global competitors seek new footholds, we need a partnership with government to create the right conditions to help us succeed. Every vehicle maker and supplier has invested heavily to create a pipeline full of EV programmes, however, the demand is still not there, the charging infrastructure is not there – and yet the ZEV mandate still demands we sell these vehicles. We are at a tipping point in our electrification journey – what we choose to do now will shape our future radically.”