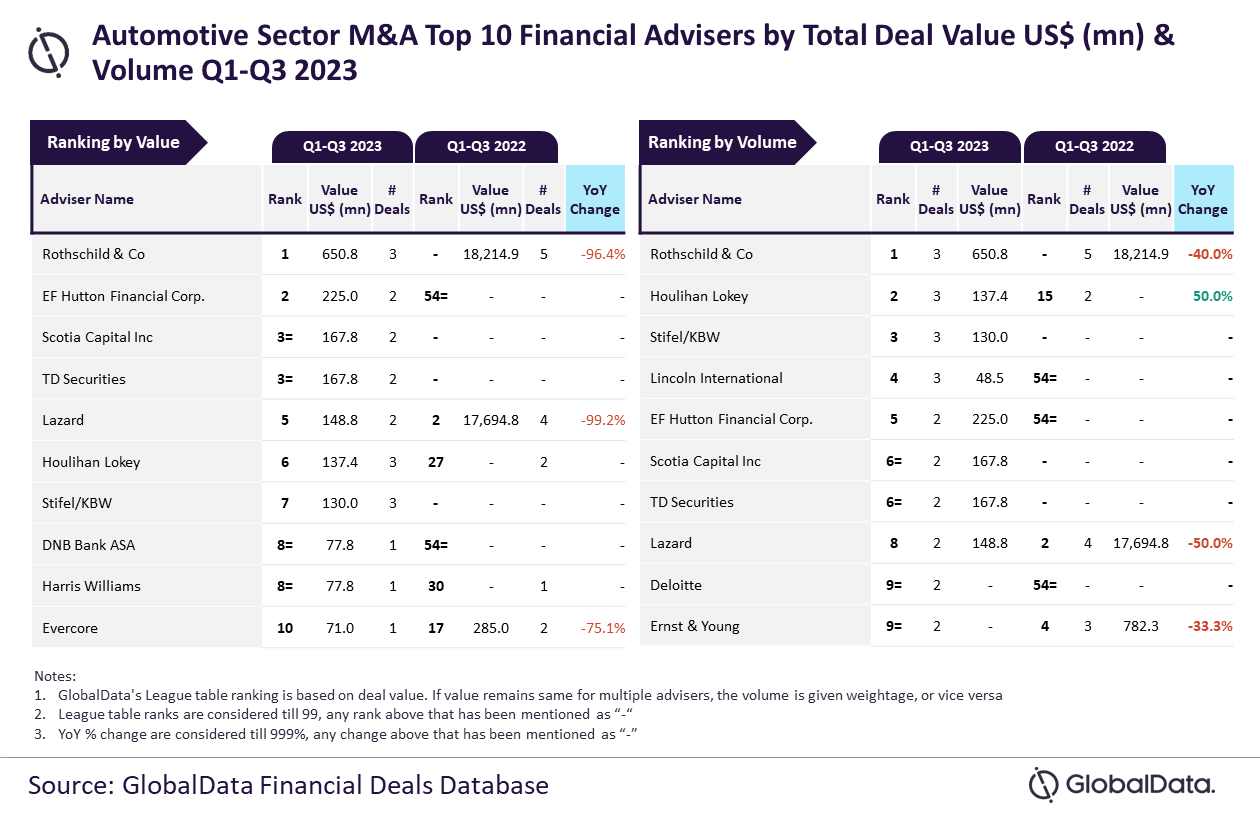

Rothschild & Co was the top M&A financial advisers in the automotive sector in Q1-Q3 2023, according to GlobalData’s ranking of leading M&A advisers. The firm achieved the leading position by advising on three deals worth $650.8m.

“Rothschild & Co witnessed a decline in both deals volume and value during Q1-Q3 2023 compared to Q1-Q3 2022, but the decline was more pronounced in the latter,” said GlobalData lead analyst Aurojyoti Bose. “Nevertheless, it registered the highest average deal value among all the top 10 advisers by value and volume.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

“Meanwhile, Goldman Sachs, which was the top adviser by value during Q1-Q3 2022, managed to retain its leadership position by this metric during Q1-Q3 2023 as well. In fact, it was the only adviser to surpass $20bn in total deal value during Q1-Q3 2023. Apart from leading by value, it also occupied the seventh position by volume.”

An analysis of GlobalData’s Financial Deals Database reveals that EF Hutton Financial came second in terms of value by advising on $225m worth of deals. Scotia Capital and TD Securities jointly held the third position by value, advising on $167.8m worth of deals each.

Runners-up measured by number of transaction were Houlihan Lokey, Stifel/KBW and Lincoln International with three deals each, followed by EF Hutton Financial with two deals.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness to the data, the company also seeks submissions of deals from leading advisers.