Global battery electric vehicle (BEV) sales rose 13% annually in 2024 to reach 10.4 million, accounting for 14% of new personal vehicle sales worldwide, according to the International Energy Agency (IEA). As many regions leverage state support to accelerate the adoption of electric vehicles (EVs) and reduce dependence on fossil fuels, oil and gas companies are facing growing pressure to diversify into EV-related energy solutions, including charging infrastructure and battery technologies, says GlobalData, a leading intelligence and productivity platform.

GlobalData’s Strategic Intelligence report, “Electric Vehicles in Oil & Gas,” highlights the expansion of EV and the associated supply chain shifts that are reshaping the competitive landscape for the oil and gas industry. It also provides an overview of how EVs are reshaping the oil and gas landscape. It also talks about the possible avenues for industry players to mitigate potential revenue losses and remain relevant in the long run.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Ravindra Puranik, Oil and Gas Analyst at GlobalData, comments: “The oil and gas industry needs to consider rising penetration of EVs in new vehicle sales when charting long-term growth plans. As EV technology improves and charging infrastructure expands, demand for traditional oil may falter. It could have a transformative impact on the downstream sector in coming decades, significantly altering demand patterns for refined products.”

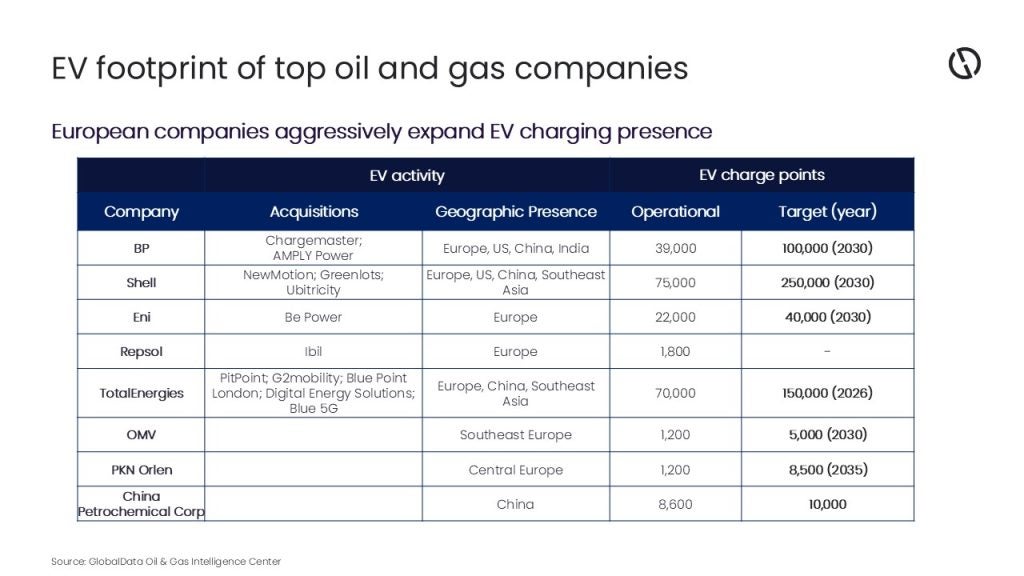

In response to growing EV adoption, leading oil and gas companies, especially European firms such as Shell, BP, TotalEnergies, and ENI, have emerged as frontrunners in building robust EV charging networks. Shell, for instance, now operates approximately 75,000 public charging points internationally, and TotalEnergies aims to install 150,000 charge points by 2026. These ventures demonstrate not only adaptation but a proactive approach to capitalizing on opportunities in the low-carbon mobility space.

Oil marketing companies can leverage their existing retail networks and infrastructure to develop EV charging hubs, particularly along highways and in urban centers. Additional avenues include investments in battery value chains such as energy storage and recycling, as well as supplying power through integrated grid and renewable energy solutions.

Puranik concludes: “Despite strong push from some countries towards phasing out internal combustion engines (ICEs) in favor of cleaner alternatives, ICE vehicles will continue to be part of the transport landscape for years to come due to their emotional connect with customers and their relatively longer operational life. Thus, demand for petroleum fuels will persist in global markets to cater to ongoing mobility and economic needs, even as the industry transitions toward cleaner solutions. The transition to EVs also creates clear opportunities for oil and gas companies.”