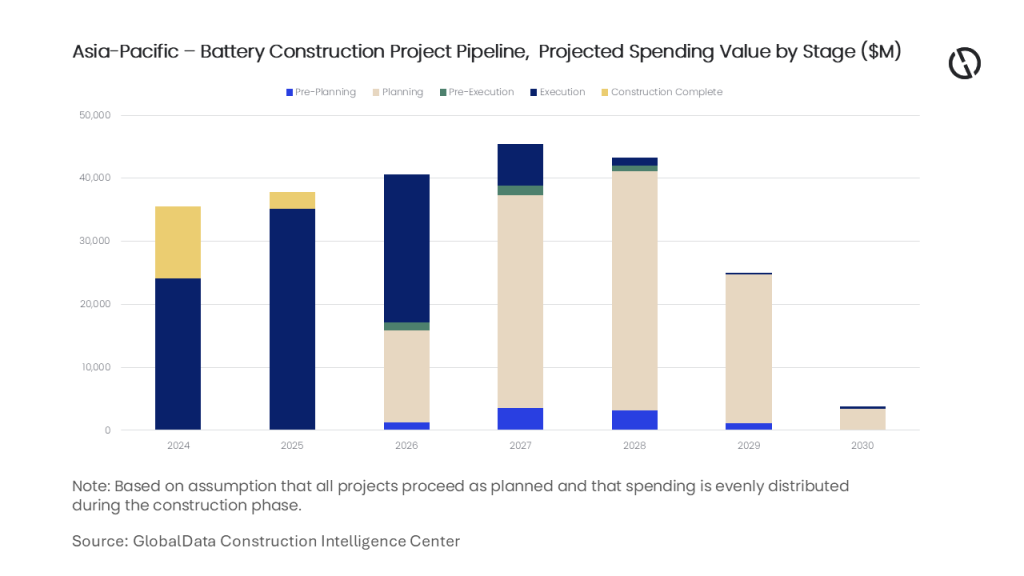

The Asia-Pacific (APAC) region’s battery manufacturing construction pipeline is set to surge, with project values expected to reach $45.4 billion in 2027, driven by rising electric vehicle (EV) demand and large-scale energy storage needs. Even as the current execution activity slows, a growing wave of planned projects signals strong long-term momentum. This trend confirms APAC’s rising dominance in global battery manufacturing and energy storage development, according to GlobalData, a leading intelligence and productivity platform.

GlobalData’s latest Project Insight report “Global Battery Construction Projects (Q1 2026)” reveals that the Asia-Pacific battery manufacturing sector is experiencing a strong upward trend in early-stage momentum, with an expansive backlog of projects now in the planning phase—setting the stage for robust long-term growth—even as current execution activity tapers off.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Kishore Chandra, Construction Analyst at GlobalData, comments: “Between 2026 and 2028, the APAC region is set to host more than 206 major projects—totaling approximately $127.2 billion in investment—largely driven by the surging demand for electric vehicles and battery energy storage systems for data centers. This wave of development is transforming APAC into a global manufacturing powerhouse.”

According to the report, China leads the way with massive capacity across raw material extraction, cathode/anode production, and cell assembly, while South Korea and Japan continue to extend their advantages in high-performance chemistries and advanced processing technologies. Indonesia and Malaysia are emerging as vital players in the supply chain due to abundant nickel and cobalt reserves, favorable policies, and large investments in domestic processing and gigawatt-hour class factories.

In 2026, execution spending remains strong at roughly $23.4 billion even though planning climbs sharply into the $14.5 billion range, while pre-planning at around $1.3 billion.

By 2028 the planning figure peaks at over $38 billion as execution drops below $1.3 billion, signaling a transition from construction toward conceptual and preparatory stages. With a substantial pipeline of battery manufacturing plants planned between 2029 and 2030, the sector’s production capacity is set for a remarkable boost.

Chandra concludes: “With novel battery chemistries set to reach mass production, the industry is poised to move beyond its heavyweight reliance on lithium. These emerging technologies promise not only to diversify raw material inputs but also to achieve higher performance—such as faster charging, longer life, and improved thermal stability. As the production scale ramps up and manufacturing hurdles subside, battery prices are expected to fall sharply, making energy storage solutions far more accessible across sectors.”