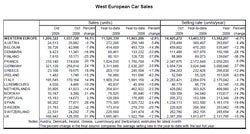

Car sales in Western Europe grew by 16.5% year-on-year in October according to data released by analysts at JD Power who also told just-auto today that the outlook for 2010 is for a market drop of 10%.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

October’s gain reflected the continued impact of temporary scrappage schemes and the fact that the comparison with last year is now against the weak sales that followed last year’s international financial crisis.

The seasonally adjusted annualised rate of sales (SAAR) for Western Europe in October was an impressive 14.4m units. However, JD Power said that this is a level which would be reasonable under ‘normal’ economic conditions and illustrates the power of the double incentive of scrappage schemes and OEM discounts.

October car sales in Germany were up by 24.1% and sales so far this year are up by 25.9%. However, JD Power cautioned that October’s strong performance may be the last before the incentive scheme support starts to fall away ‘quite sharply’.

The German scrappage scheme – by far the most important in terms of the boost to volume – stopped taking new applications on 2 September. The strong October result in Germany represents the tail end of this scheme as the remainder of incentive applications passes through the delivery system into registrations in October.

JD Power said that while there remains some uncertainty over exactly how many more deliveries (and, therefore, registrations) remain to take place in the November result for Germany, ‘our expectation is that the selling rate will begin a precipitous plunge soon and that this will be at least partly evident for November, when the results are published in early December’.

Other schemes will remain in operation for the remainder of 2009, thanks to funding top-ups in Spain and the UK, and the effects will perhaps last into 2010, depending on uptake, with some possibility of further funding.

Meanwhile, indications are that scrappage schemes in France and Italy will be renewed in 2010, but at a less generous level as officials seek to reduce support in a gradual fashion in order to prevent the sharp declines typically associated with the ending of scrappage schemes.

JD power analyst Pete Kelly told just-auto he expects to see sharply reduced car sales in Germany next year (from 3.8m units this year to 2.7m units next) and that this will mean Western Europe’s car market will decline by around 10%, (from 13.4m units this year to 12m units in 2010) because there will be limited volume growth elsewhere to counter the loss of sales in Europe’s biggest car market.

And it looks like a slow recovery thereafter.

“The outlook is for single digit percentage growth in 2011,” he says, noting that the economic environment may be encountering some significant negatives by then.

“We could be seeing the ending of the very broad economic stimulus measures and possibly we may be seeing interest rates beginning to rise by that point,” he says.

“The recovery is not expected to be robust enough to push the market up quickly.”

However, he added that JD Power sees scope for the market to try and return to normal levels beyond 2011.

“But that will take a number of years, realistically,” he says.

Dave Leggett

Dave Leggett speaks to Pete Kelly