Ford was the most searched for automotive brand, accounting for just over 11% of all branded searches between January 2011 and March 2011 – more than any other manufacturer online – in the inaugural Experian Hitwise UK Automotive Brand Index which revealed the 20 most popular automotive manufacturers online.

The index compiles search data driving traffic to the researcher’s automotive category and aggregates market share of brand searches for the top manufacturers and models, as searched for by UK internet users.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Ford was consistently the most searched for brand in the index, and has remained so for over a year. However, German brands Volkswagen (9.87% of branded searches), Audi (9.16%) and BMW (8.27%) were hot on Ford’s heels, increasing their market share of branded searches by at least 1% over the last 12 months.

Between January and March 2011 the top 10 brands remained static. However, there was significant movement further down the table with Renault, Citroen, Kia, Fiat and Mazda all climbing the rankings during the quarter. Citroen, in particular, was the fastest moving brand of the quarter, jumping from 16th to 13th place. The company increased its market share of branded searches by nearly 1% in the quarter, improving from 2.14% in December 2010 to 3.04% of all branded searches in March 2011.

In terms of specific car models, the Nissan Qashqai increased the number of searches by 66% year on year making it the most searched for car during this period.

Robin Goad, director of research at Experian Hitwise, said: “The lack of movement within the top 10 brands in our Automotive Manufacturers Brand Index hides what is a fiercely competitive and dynamic race to win market share of online searches.

“Only a year ago, Ford and Volkswagen were head and shoulders above the competition and now there are four brands hotly contesting the top spot, separated by just 3% market share of searches. With the gap closing between manufacturers, none of the automotive brands can afford to rest on their laurels. Our research shows there is a clear connection between great marketing campaigns and improved online search performance. The kind of online insight our brand index provides can be used by automotive manufacturers to evaluate and fine tune their online marketing activities.”

Volkswagen, Audi and BMW leveraging online to drive sales

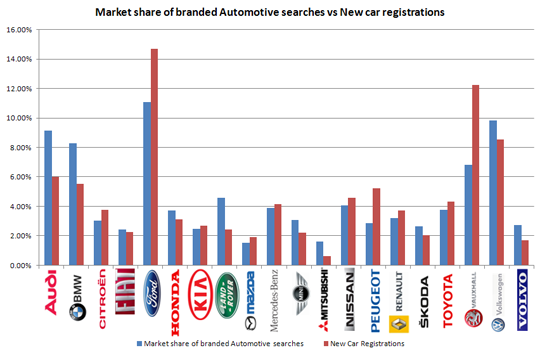

By combining this search data with the new car registration data courtesy of the Society of Motor Manufacturers and Traders (SMMT), it is possible to compare how successful automotive brands are both online and offline. Ford’s current status as the industry leader online is reflected in the SMMT data, with 80,028 new Ford vehicles registered between January 2011 and March 2011. Vauxhall was the second most successful brand in terms of new car registrations during the quarter, despite being the fifth most popular manufacturer in terms of branded searches online.

Both Ford and Vauxhall perform better offline than online with a higher market share of new car registrations than online branded searches. Exactly half of the top 20 brands in the index followed this pattern, including: Citroen, Kia, Mazda, Mercedes-Benz, Nissan, Peugeot, Renault and Toyota. Of the 10 brands which performed better offline than online, only Ford, Vauxhall and Peugeot had a significant discrepancy in market share across the two indicators.

At the other end of the scale, the brands which performed better online than offline, with a higher market share of branded searches than new car registrations, included: Audi, BMW, Fiat, Honda, Land Rover, Mini, Mitsubishi, Skoda, Volkswagen and Volvo. Of those, Audi, BMW and Volkswagen performed noticeably better in terms of online searches. The German brands demonstrate how effective investment in digital activity can reap rewards; dominating online search performance combined with strong car registration numbers.

Land Rover was the brand which showed the greatest disparity from online search behaviour to offline purchasing behaviour. In the search rankings, it was the sixth biggest manufacturing brand, accounting for 4.59% of all branded automotive searches. However, it managed only 13,264 new car registrations, ranking it in 14th place in terms of sales.

Goad added: “Comparing our data with the new car registration data from the SMMT reveals some interesting insights into which brands are really excelling online. Volkswagen, Audi and BMW stand out as the brands which have a very strong online brand presence which is converting into sales, whereas Ford and Vauxhall are leveraging their strong offline reputation to increase sales. Luxury brands such as Land Rover, which have higher pricing thresholds, may be attracting aspirational internet searches from people wanting to find out more about the cars, hence the disparity in online versus offline performance.”