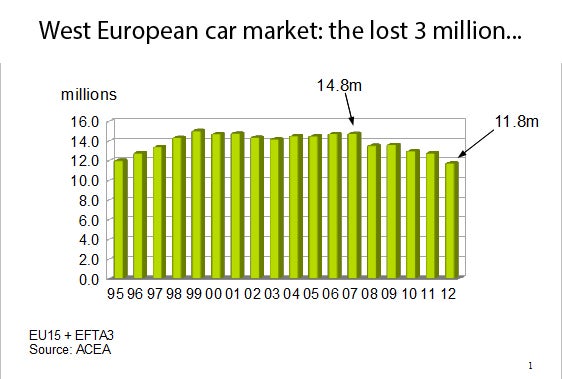

There were some positive signs for Europe last week as well as a development on Europe’s economy suggesting that the recovery track remains fragile. On the plus side, Western Europe’s car market was up 3.8% in October. That gain followed a year-on-year gain of 5.3% in September. Europe’s car market is inching up from its twenty-year low.

The forecasters at LMC Automotive said that the Seasonally Adjusted Annualised Rate (SAAR) of sales in the region is now ‘picking up well’, with the September result standing at 11.9m units a year. LMC also maintained that “we are seeing a more solid upturn in market activity, which bodes well for 2014” and raised its Western Europe market forecast for next year to 11.8m units.

That’s all nice to hear, but a projected 11.8m units in 2014 is on a par with 2012’s market. Market conditions in Europe will remain pretty tough for a while yet.

The development on Europe’s economy last week that presents additional cause for concern was the European Central Bank’s (ECB) decision to lower its main policy interest rate to just 0.25% from 0.5%. The main reason for the latest downward adjustment is emerging worries over price deflation. The euro area’s economy remains weak with its austerity budgets, high unemployment and signs of falling prices in some countries. Falling prices have got the big cheeses who control the levers at the ECB a little worried. When prices spiral down, people hold off from buying many goods because no-one wants to buy something today that is cheaper next week. Once that mindset becomes widely established and entrenched, you risk the kind of decades-long slump that we have seen in Japan.

The hope has to be that the actions taken thus far will help to stimulate demand in Europe and encourage a gradual – and sustainable – economic recovery. When people start to feel that things really are getting better, that the worst is over, that is when we could see a larger and more significant jump in car demand. If next year goes to plan, we just might see that big pent-up demand push to Europe’s car market in 2015.

For those companies who get through 2014 in reasonable shape, 2015 could mark a return to a more ‘normal’ market in Europe. The challenge by then may be to ride the rising replacement wave with the right products and packages to hit consumer sweet spots. After the battering that European consumers have taken over the past few years, it certainly won’t be a return to 2007, but it might feel a bit more like old times. The smart OEMs will be planning for the upturn now. And hoping that the ECB has some more contingency cards up its sleeve – if needed – besides ever lower interest rates (there is obviously not much more room for cutting them).

UK: Western Europe car sales up 3.8% in October