Western Europe’s car market was up by a hefty 13.9% year-on-year (YoY) in September as a base effect comparison with the same month last year distorted the result. LMC Automotive noted that growth in September was inevitable due to WLTP-related distortions in September 2018 (it was an exceptionally low and depleted market following a surge in August).

LMC also said that further changes to emissions testing regulations came into effect on 1st September this year, which it said appear to have pulled forward sales to August, at the expense of September.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

The regional annualised selling rate fell to 13.1m units a year in September, from a whopping 16.9m units a year in August.

The German annual selling rate was just 3.0m units a year in September, even though the market grew by a hefty 22.2% YoY, helped by extremely low sales a year ago. In the UK, the selling rate fell to just 2.0m units a year, with the market gaining a disappointing 1.3% YoY, despite the WLTP base effect. LMC said political and economic uncertainty (Brexit) appears to be ‘taking a heavy toll on the UK car market’.

In France, sales rose 16.6% YoY in September, while the selling rate fell, but only to a still respectable 2.2m units a year. Italy saw a YoY increase of 13.4%, while the selling rate dropped to 1.8m units a year. The Spanish car market experienced 18.3% YoY growth in sales in September, with the selling rate standing at 1.3m units a year.

LMC said that after the abrupt fall in the selling rate in September, it expects an improvement throughout the remainder of 2019.

LMC analyst Jonathon Poskitt told just-auto: “One positive: There are no apparent issues with the availability of models this year, unlike in 2018, when several OEMs were unable to sell certain models due to failure to achieve WLTP approval.”

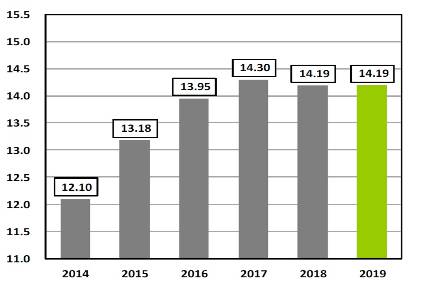

However, he also said time is running out for any meaningful full-year growth to materialise in 2019. “We believe that regional sales will be essentially flat, the market finishing at around 14.2m units,” he said.