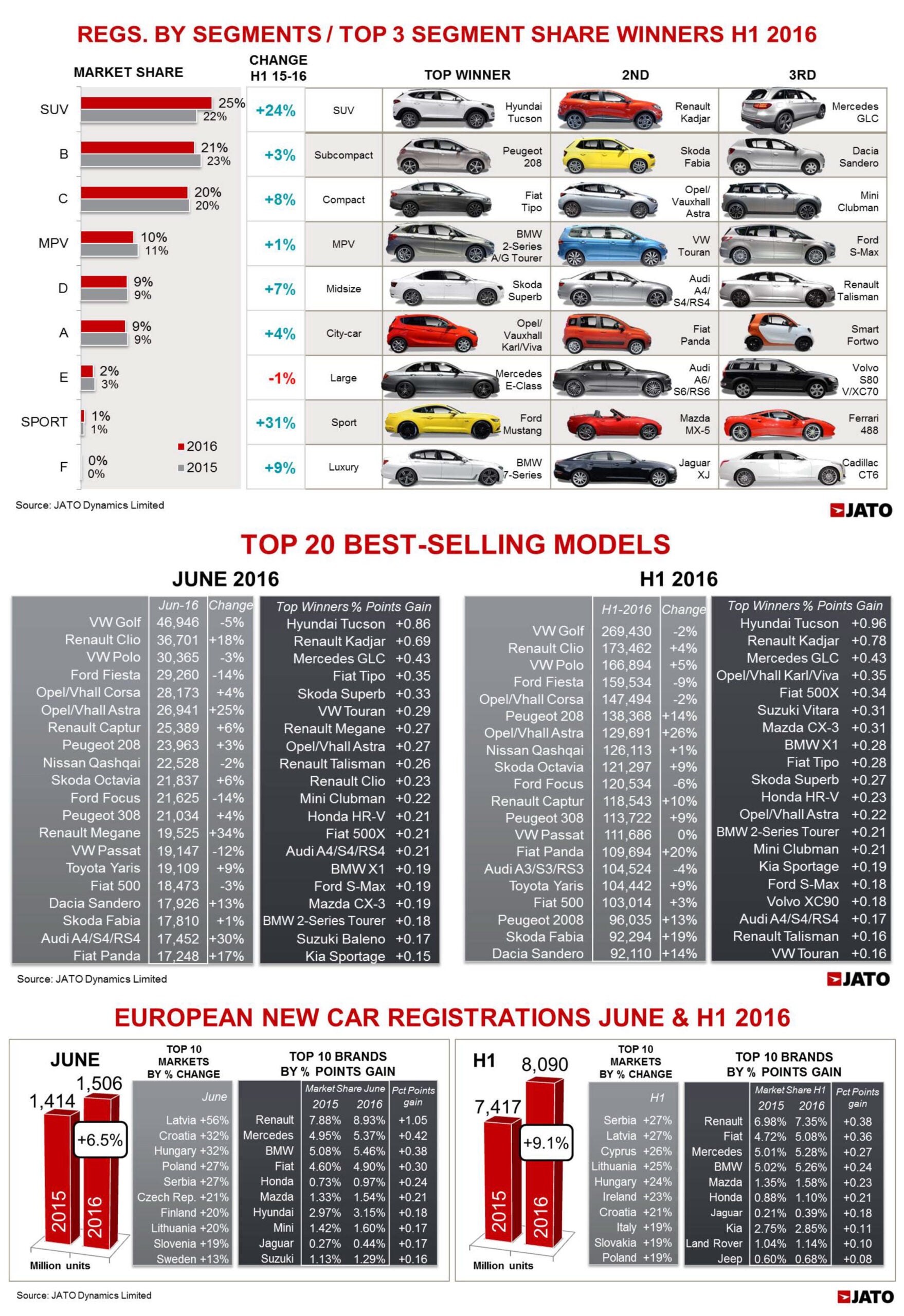

Stronger economic conditions, new products and continuing shifts in consumer taste have all helped maintain positive momentum in the European car market during the first half (H1) of 2016, according to JATO Dynamics analysts. Total registrations grew 9.1% year on year to 8.09m units, the highest tally since H1 2008. June saw a slow-down in month on month growth, however: 6.5% versus 15% in May. The UK saw negative growth following uncertainty caused by the EU referendum result while the SAAR was 15.5m vehicles.

Not all car makers benefited equally from the overall growth seen in H1, JATO noted. Most mainstream brands lost market share, underperforming against the average growth rate especially Volkswagen (+0.6%) and Nissan (-1.5%). Volkswagen market share fell almost one percentage point, due to diesel and emissions issues, from 12.1% in H1 2015 to 11.2% in H1 2016, which was its lowest H1 market share since 2010.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

“Volkswagen is not only dealing with the emissions problem but also the brand’s top-seller – the Golf – is well established while its rivals continue to overtake it with newer products,” said JATO global automotive analyst Felipe Munoz.

In contrast, Renault’s registrations grew by a massive 15%, making it the second largest car brand in Europe and clearly outpacing its mainstream rivals; Ford, Opel/Vauxhall and Peugeot – which all posted market share losses. An updated range, Europe’s strength and Volkswagen’s stagnation have all helped improve Renault’s position in the ranking. Fiat was the other big mainstream brand to gain ground during H1, due mostly to good results in its Italy home market, along with good sales momentum from its five year old Panda and the 500X mini SUV. Audi, Mercedes and BMW were ahead of Fiat, with all posting double-digit growth, and with Mercedes outselling BMW. Hyundai and Kia were also ‘improvers’ in the top 20. Other successes included Mazda, Land Rover, Honda, Jeep, Jaguar, Ssangyong, Abarth and Infiniti.

The European market continued to shift towards SUVs, with the smallest ones – B-SUVs – grabbing the biggest part of the market share gain, from 8.3% share in H1 2015 to 9.4% in H1 2016. B-Segment cars lost the same amount of market share over the same period, going from 22.6% down to 21.4%. Overall, SUVs accounted for 24.7% of the market and posted the second highest percentage growth at 24%, after the Sport cars category which grew by 31%.

The markets with the biggest gains in SUV share were Cyprus, Ireland, Croatia, Hungary and UK. SUV growth was more moderate in Latvia, Finland and Sweden. The brands whose SUV ranges gained the most were Bentley, Jaguar, Mazda, Suzuki and Honda.

The model ranking showed that most of the traditional market leaders posted very limited growth, while the latest launches, especially the new SUVs, were the biggest winners during H1. The Volkswagen Golf was once again Europe’s best-selling car with 3.3% market share, which amounted to 269,400 units. Its total was 2% lower than for the same period last year, which means that, along with the Hyundai ix35 and Ford Fiesta, it was the model that posted the biggest market share drop. The Renault Clio, Volkswagen Polo, Opel/Vauxhall Corsa and Nissan Qashqai were the other leaders that underperformed

against the market’s average growth. These models lost out to small SUVs like the Renault Captur, Peugeot 2008 and Fiat 500X, which all recorded double to triple growth.

The biggest changes are taking place in the SUV segment. Small SUVs are becoming almost as popular as compact ones (C-SUV) due to their pricing and a greater amount of choice. During H1, 40% of the SUV sales corresponded to C-SUVs, with B-SUVs just behind at 38.2% share. The fastest growing were the large SUVs (E-SUV) with 145,700 units, up by 30%. The Qashqai (+1%) was still Europe’s best-selling SUV but its sales were impacted by the arrival of the Hyundai Tucson (which has almost 1% market share), the new Kia Sportage and the Renault Kadjar. However, the Renault Captur got closer to the Qashqai with its volume growing by 10%, despite the popularity gained by its rivals Fiat 500X, Suzuki Vitara and Jeep Renegade. In the upper segments, Volvo and the German premium brands continued to dominate.

Munoz added: “These first half results show a healthy market that clearly favours new products and SUVs. The second half will be more challenging due

to current uncertainty in the UK, and possible stagnation in other key markets. New launches with innovative solutions for the driving experience will become a key factor for success.”