In a classic case of April showers and May flowers, last month’s US light vehicle sales bloomed quite nicely following the previous month’s dip.

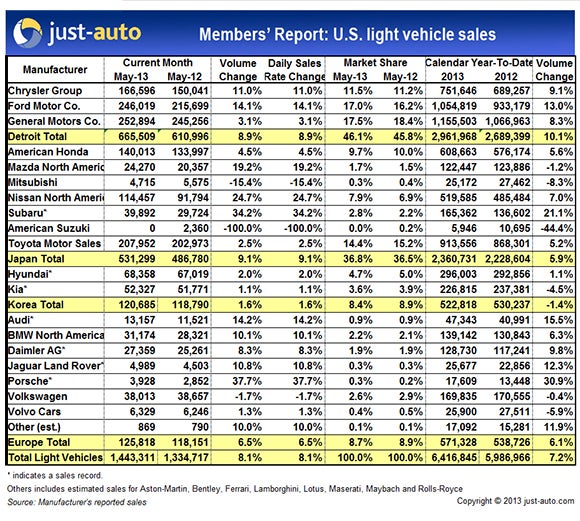

With a volume of just over 1.44m deliveries, sales were up 8.1% compared to May 2012 and 12.3% over April 2013. That produced a seasonally adjusted annualised sales rate of 15.31m units, well ahead of 13.95m last year and 14.92m in April this year.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

A variety of new sales records were set: Land Rover sales from January to May set a record for the brand in the US while Porsche enjoyed a record month, in spite of dwindling supplies of the Panamera. Nissan’s namesake brand set a new May record even as Infiniti tanked. Subaru, Mercedes-Benz and Audi set new May benchmarks, as did Hyundai and Kia, in spite of analyst expectations they would report sales declines.

Large pickup trucks continued to outperform the overall market with total deliveries up 24.7% and a healthy 12.1% of total light vehicle sales. As a group, light trucks, including pickups, SUVs and crossovers, accounted for 49.6% of the market compared to 48.2% last May.

Cadillac’s year-to-date (YTD) sales showed their strongest growth since 1976, up 37.6%, and its year over year gain was 39.9%. General Motors finished the month with a 3.1% improvement overall but a 9.0% improvement in more profitable retail sales. The new full size Impala is off to a good start and Chevrolet recently unveiled a reskinned Malibu the division hopes will reverse that model’s downward sales trend.

Ford sales climbed 14.1% in May: the strongest growth of the Detroit automakers. It’s only five months into the year, but the F-series pickup looks to have a lock on yet another year as America’s favourite vehicle: it’s more than 100,000 sales ahead of the second-place Chevy Silverado. The Fusion saloon and Escape crossover continue to outsell their Detroit competition. The new MKZ is moving briskly though the rest of the Lincoln lineup continues to languish on dealer lots.

Despite early predictions it would come up short, Chrysler delivered its 38th consecutive month of year over year gains with eight models setting new records, including the Jeep Wrangler with its record May sales.

The Americans increased their May market share to 46.1%, up slightly from last year’s 45.8%.

The Japanese automakers also picked up a slightly larger piece of the pie, going from 36.4% to 36.8% led by a 34.2% explosion in Subaru sales and Nisssan’s new record. Toyota rode a surge in Lexus sales to a small improvement. The new Toyota Avalon is selling briskly and the Camry resumed its spot as the best-selling car after a two-month absence.

Volkswagen missed its mark again though subsidiaries Audi and Porsche set records. Growth in Jetta and Beetle sales was wiped out by big deficits in Golf/GTI volume.

Mercedes racked up a fifth consecutive record month but it wasn’t enough to keep BMW from taking the top spot in the luxury segment. Mercedes still holds the YTD lead.

As just-auto noted last month, there was no cause for concern about the soft spot in April. Over the past five years, sales have slumped in every April and recovered in every May except for 2011 when the impact of the natural disasters in Japan threw a spanner into the works. There is still much that can go wrong but, left to itself, it looks like the market well is on its way to a 15m unit year.

|