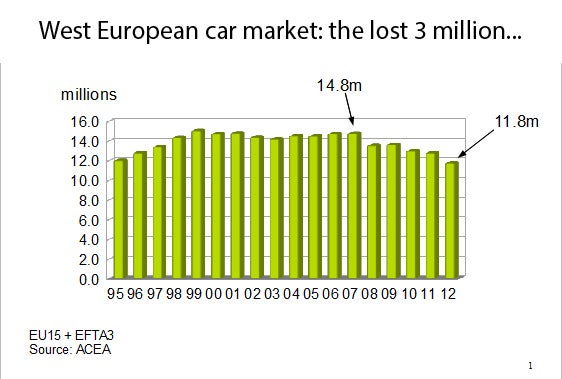

As the latest monthly car sales numbers appear to confirm a bleak prognosis for Western Europe’s car market, a new study suggests that flat market conditions will persist for some time to come. Dave Leggett reviews the underlying issues for Europe’s auto industry in the context of global automotive market trends.

While the global picture for the automotive business has its demand positives – notably in North America and Asia – the European car market and industry remains locked in the depths of a deep recession that has taken the market down 20% on its last peak. The latest market numbers for May provide little solace and appear to shut the door again after hopes were lifted by the upward ‘blip’ of April, which included a sizeable gain in the devastated Spanish car market.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

The car sales figures by market for May look bleak. Depressed markets remained depressed and the German car market is now firmly in decline, despite relatively strong economic fundamentals that suggest it ought not to be. The German car market decline will be of concern to many in the industry. With Europe’s largest market down almost 10% in May, LMC Automotive now says that weak consumer confidence in Germany could lead to the German car market declining by 3-4% this year.

|

Source: LMC Automotive

A decline of up to 5% in Western Europe’s car market is expected this year, as the market bounces along the bottom (as the year-on-year trend becomes set against a low base for comparison). Some analysts have expressed the hope that things will brighten from the second half of 2014 as the eurozone crisis continues to ease, economic growth resumes and fleet operators/consumers opt to replace cars that have been on extended replacement cycles through the recession. Could there be a sharp pickup towards the norms of the mid-part of the last decade?

A study by the consultants AlixPartners has concluded that a “flat market outlook has become a realistic scenario due to structural changes in vehicle demand”. It says that with 58% of the top 100 European assembly plants being underutilised, “the issue of overcapacity has increased at an alarming pace”.

The problems are most acute for the mainstream volume brands. Alix Partners note that the premium makers, who have been aggressively expanding product portfolios over the past decade, will emerge stronger from the current crisis in Europe. They have a significant share in growth markets, good industrial footprints, modular platforms and have the money to invest in future technologies and even more products.

In Western Europe, car sales for 2013 are expected to remain in “reverse gear” for the sixth consecutive year, says the Alix study. Going forward, it says, a flat market outlook has become a realistic scenario, as changes in demand appear to be structural rather than cyclical. At the same time, significant state-aid programs to stimulate demand are unlikely to be put in place due to well-known budget constraints in the eurozone, it notes.

Several developments, says the study, are converging to stifle automotive demand in Western Europe. These include:

- unemployment among young people has reached record levels;

- disposable income is stagnating or even declining;

- ageing demographics are likely to lower the demand for new cars;

- the decline of cars as ‘status symbols’ among young consumers.

The last point in that list and its implications is something on many people’s minds in the automotive business. Evidence is emerging of changing attitudes to cars among young people, with expensive to own cars losing their appeal in congested European cities. In Germany in the last few years there has been a 25-30% decline in new car driving licences issued to the under-25s. People are applying for driving licences much later in their lives. Car clubs and car sharing are on the rise, as is the use of public transport and bicycles.

Renault’s entry range programme director Arnaud Deboeuf, recently told a conference that car makers need to produce products that appealing to an emerging market group that is not motivated by traditional automotive product strengths. “For many years automotive companies have planned to increase their turnover, to expand line-ups, add content and raise prices,” he said. “The underlying idea was that we could raise the costs of the cars because we could increase the customer’s willingness to pay. The car was a symbol of status and achievement. More recently things have changed.

“We have seen the emergence of a large portion of car buyers who no longer show their pride in the most recent or expensive car model, but [they] would rather invest in high-tech, leisure…and they are no longer looking for status when they buy their car. They are looking for a ‘good enough’ offer, a ‘good enough’ level of feature, a ‘good enough’ level of comfort.”

Alix Partners’ study also notes the decline of cars as status symbols with younger people losing interest in cars and decreasing vehicle density in cities, in conjunction with an increasing trend towards urbanisation. These factors are contributing to a flat outlook, says the study. Meanwhile, on the supply side, constantly improving vehicle durability and rising new-car prices to meet emission and safety requirements are also contributing to these developments, Alix says.

“Flat is the new up in Western Europe; with no opposing trends, we believe that Western Europe is most likely to experience a flattish market for quite some time to come,” says Stefano Aversa, Co-President and Managing Director of Alix Partners. “Our models show Western European auto sales will reach a low point of 12m units in 2014, and largely remain there for the foreseeable future – far away from the historical peak of 2007, when 16.8m units were sold [of which, 14.8m passenger cars, see below chart]. On the other side, Central and Eastern Europe will continue to grow adding about 2m vehicles in the next five years.”

European production capacity: under-utilisation up to 58%

AlixPartners estimates that the number of under-utilised assembly plants in Europe has increased at an alarming pace. Last year’s AlixPartners study noted that an already-discomforting 40% of the top 100 plants across Europe were operating below 75% capacity utilisation. In 2013, the number of plants operating below this level is forecasted to increase to 58%. The situation is most critical in Italy, where the average plant utilisation has fallen to 46%, France is at 62% and Spain at 67%. Russia, which has an average utilisation of 60%, represents a special case, notes the study, as several older plants probably need to be taken out of production to make way for new plants which are needed to prepare for an expected total market growth of 28% between 2012 and 2018.

“The under-utilisation of plants in Europe has reached a critical level, and the announced capacity cuts to date will most likely not be enough to cure the situation,” said Stefano Aversa Co-President and Managing Director at AlixPartners. “In order to adjust production to what appears to be low sales expectations for many years to come, capacity would need to be cut back by three million units.”

Global industry forecast – the ‘three-speed world’

The automotive industry has essentially become a ‘three-speed world’ with China, Russia, Brazil, India and the United States engaging “overdrive” to account for 75% of global growth through 2018. Meanwhile Western Europe and Japan will remain stuck in “reverse” gear; and other markets in “low gear”, AlixPartners says.

Globally, the industry is likely to experience a growth of 3% this year, says the study, before entering into a period of over 4% growth per year between 2014 through 2018. Compared with 2012, the global market is set to grow by 28%, or 23m units, reaching 102m units by 2018, up from last year’s 80m units.

Despite its recent cooling off, China is still expected to be the powerful engine of this global growth, says AlixPartners. China’s market is expected to grow to 29m by 2018, a staggering increase of 10m units in relation to 2012 and accounting for almost 50% of global industry growth. India should be following suit, says AlixPartners, with 2.6m vehicles forecast to be sold in 2018 – a 79% increase compared to last year.

Pressure increases on volume segments

The AlixPartners study, which segments car brands into “premium”, “volume” and “value”, predicts that the volume segment will continue to be attacked by both premium and value brands. Between 2012 and 2018, it says, the volume segment globally is set to lose two percentage points of its market share. Nonetheless, it notes, the volume segment is still likely to remain the largest segment, with a 59% share of total car sales globally.

Meanwhile, says the study, premium brands are set to improve their market share from 9% to 10% in that period, possibly breaking the 10m-unit barrier in 2018, up from 7m in 2012. Value brands are expected to move up from 23m vehicles sold in 2012 to 31.1m by 2018, an increase of 8.1m units.

Dynamic growth will also be seen in the super-luxury market, says the report. While North America is likely to remain the most important super-luxury market, at 31,000 units in 2018, the Middle East and China will account for the largest growth of the segment. Within only 15 years, between 2003 and 2018, these regions could experience a 21-fold and a 133-fold demand increase respectively, says the study.

Gaps between companies ‘to widen’

In terms of financial performance, the study notes a widening gap between automotive companies, especially in Europe. Some successful companies are generating high earnings and investing heavily in R&D, while others are only managing to spend a fraction on these necessary measures.

“There is a clear link between the financial strength of a manufacturer and the investments made in developing new technologies and new products”, says AlixPartners’ Stefano Aversa. “Some players simply cannot afford to spend more than the bare minimum in the current market conditions, and, hence, are increasingly in danger of losing even more ground in the future.”

The study also shows, however, that the global industry has reached a high degree of collaboration and integration, as it has become common practice to source technologies, engines or even entire platforms from competitors. Today, it notes, there are more than 15 joint ventures and 25 alliances among automotive companies, covering almost every imaginable aspect of the production process – from collaborative development projects to shared production facilities to sales partnerships.

In response to cost pressures in the industry and to the need for investments in new technologies, the study notes that companies around the world must intensify their focus on partnerships and joint ventures in areas ranging from purchasing to R&D to production. Also, it notes, with a total of 152 deals in the last five years, private equity firms continue to be active in deals involving auto suppliers, with increased interest in the last year.

Primacy of “global modular mega-platforms”

According to the study, one of the main factors which will determine the winners and losers of the future will be platform modularisation. Platforms of the future will be increasingly modular and global, and more “mega” – with some able to accommodate up to 10 vehicle families. In other words, these new kind of platforms will be able to field everything from SUVs to sports cars, from entry-level to luxury and from conventional-power trains to electric drives, while also allowing for significant geographic adaptions in order to respond to local requirements and enable local parts sourcing.

Vehicle production using global platforms is set to increase by 63% over the next five years, says the study, and to account for more than 88% of industry growth through to 2018. In that year, it says, 48% of total global production volume, or 50m units, will be produced on the basis of mega-platforms. By comparison, this was only true for 37% of global production in 2012.

“Only about 10 platforms will generate 25% of global production. The key to success for automakers is to design these new architectures from the beginning in order to be flexible enough to tailor vehicles to local customer preferences whilst maintaining cost advantages,” said Stefano Aversa.

According to the study, doubling production volumes from a given platform allows cost-savings in the range of 10-20% in non-recurring costs and 4-8% in recurring costs. This can translate into several hundreds of euros in cost savings per vehicle, says the study.

Auto production ‘continues to move east’

China, despite some cooling down in the past year, is set to continue to be the global pace-setter for the foreseeable future, says the study. In 2012, the study notes, the country produced 18.3m light vehicles, compared to 10.2m in the US, the second largest production region globally. Chinese production, which was 1.85m units in 2000 (just one tenth of today’s output), is expected to grow to 28.8m by 2018, says the report.

Two other winners in the emerging markets in 2012 are India, with 3.7m vehicles produced (now ranked sixth among global automotive producers), and Thailand, with 2.8m vehicles produced (ranked ninth). Both countries were well below one million vehicles in 2000. Brazil has doubled its annual car production since 2000, to 3.2m units, thus becoming the world’s seventh largest car producer and the biggest in South America.

Europe has also seen major shifts in car production. France, Italy, Spain and Belgium saw shrinking production volumes ranging from 34% to 62%, while the Czech Republic was able to more than triple its output to 1.2m units since 2000. Italy, which was ranked 11th in 2000, has slipped out of the top 20, down to rank 22 in 2012. Germany, on the other hand, has been able to hold its ground and slightly increase its car production, by a moderate 16% over the past 12 years.