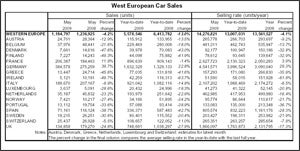

Data released by JD Power Automotive Forecasting shows that car sales in Western Europe fell by just 4.2% in May, versus last year. However, the result was distorted by scrapping incentives which provided a powerful boost to demand in a number of countries.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

JD Power said that in the midst of the most severe recession in generations May’s sales result is a remarkable result but warned that it marks a situation that will not likely be sustainable beyond 2009.

Car sales in Germany were up by 39.7% in May and JD Power said that the annual selling rate in Europe’s biggest national market topped 4.5m units.

The dose of energising incentive medicine is therefore having the desired effect, it said, at least for makers of smaller vehicles — the segments which are gaining most ground as a result of the incentives.

However, JD Power said that the 2010 car market in Western Europe will be down significantly on the 2009 level, perhaps falling to, or even below, 11.5m units next year, after achieving a full-year total of around 13m units in 2009.