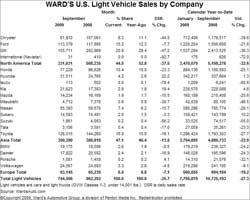

Question: After cash for clunkers funds ran out in the third week of August, how did September light vehicle sales in the US fare? Answer: off almost 25% year on year to 744,566 when adjusted for selling days. August sales, in contrast, rose almost 5% to 1,258,944.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Despite the clunkers boost, year to date, little has changed. At the end of August, sales were down 27.8% to 7,050,199 units; at end-September, the tally was off 27.3% at 7,795,819.

How went things at the Detroit Three? Yikes. GM sales down 47.2% to 155,711 units, Chrysler off 44.5% to 61,910 and Ford dipping just 7.7% to 113,379. August for comparison? GM down 17% to 245,575, Chrysler off 12.4% to 92,619 and Ford up a healthy 22.2% to 179,644.

“Our balanced new lineup of high-quality, fuel-efficient products helped us navigate through an exceptional period in industry sales,” said Ford’s sales chief Ken Czubay. “With its volatile sales peaks and valleys and dramatic segment shifts, the third quarter was a great test of our One Ford Plan – building a range of vehicles from small cars to hard-working trucks.”

“While we had some bright spots in September, it was still a challenging sales environment for the industry,” said Chrysler sales head Peter Fong.

“Low inventories of popular models at the start of the month hampered… sales, however, [we] responded with increased production [and] finished the month with increased market share compared with August 2009.

“We believe the remainder of 2009 will continue to be a challenge for the US automotive market. Credit markets have thawed slightly, but still remain tight, and consumer confidence, as we saw in September, is tenuous,” Fong added.

On the annualised basis tracked by analysts polled by Reuters, industry-wide US auto sales dropped to 9.2m vehicles in September, the weakest sales rate since April.

China’s overall vehicle sales for September were almost twice as large as the industry-wide US tally, according to a GM estimate.

Bright spots were few in Asian import brand land. Hyundai and Kia, both currently on a roll in the US thanks to new products and some sharp promotions, such as Hyundai taking cars back without penalty if buyers lose their jobs, were the only ones with positive numbers – up 22.2% to 31,511 units at Hyundai and up 19.4% to 21,623 at affiliate Kia.

“While consumer demand following the ‘cash for clunkers’ programme softened during the month of September, we are encouraged with our continued growth in retail share and overall sales through the first nine months of the year,” said Dave Zuchowski, who heads sales at Hyundai Motor America.

Toyota sales fell 16.1% to 126,015, Honda was down 23.3% to 77,229 and Nissan off 10.7% to 55,393.

“Improving economic conditions and the [clunkers] programme led to a significant increase for the industry in the third quarter over the first-half year,” said Don Esmond, head of automotive operations for Toyota Motor Sales. “Moving into the fourth quarter, we expect continued momentum will close the year on a bright note.”

“The auto sales data is not so worrisome. Rather, the market is concerned about the health of the US economy and for Japanese automakers, the yen’s moves,” Kazuyuki Terao, chief investment officer at RCM Japan in Tokyo, told Reuters.

European brands fared better. VW dipped 4.5% to 24,567 and BMW was down just 0.5% to 19,175 but Daimler sales were off 16.9% to 17,822. New models, including the Panamera luxury sedan, helped Porsche up 4.1% to 1,581.

“For now, we’ll take this first small bit of good news but the premium segment is not out of the woods yet as consumers keep on reacting cautiously to the mixed signals in the economy,” said BMW US chief Jim O’Donnell. “We expect the bumpy road to continue into next quarter in advance of 2010, when we see consumer confidence improving and a major launch of new products start to hit the market.”

“Consumer traffic at dealerships evaporated in the absence of the incentive programme, which ended in August,” Standard & Poor’s equity analyst Efraim Levy said in a note cited by Reuters. “However, we expect the September lull to be temporary, as the comparisons get easier and we see the economy improving.”

Ford economist Emily Kolinski Morris told the news agency the automaker believed recent economic indicators and the monthly sales figures pointed toward “continued gradual recovery albeit with some fits and starts.”

Ford said it would step up leasing with dealers. Analysts said they expected the blue oval brand was poised to take more share from its rivals in the months ahead.

“In the short term, I don’t see much of change for GM and Chrysler in terms of sales declines. The No. 1 reason really is their product lineup,” Truecar.com analyst Jesse Toprak told Reuters.

“The bigger question is whether they can restructure themselves to make money at lower sales levels – it’s going to be tough, obviously,” he added.

Morningstar analyst David Whiston said the auto industry would face continued economic uncertainty in the months ahead.

“With no government stimulus, you have a weak consumer who is reluctant to make a big-ticket purchase unless they have to,” Whiston said. “It’s not just a Detroit problem.”

GM said it was sticking with plans to increase production in North America by 20% in the fourth quarter compared with the third quarter.

It remained the largest automaker by US market share at 21% compared with 17% for second placed Toyota.

“Clearly, the economy is starting to gain some momentum,” said GM sales analyst Mike DiGiovanni. “But we know it’s still going to be bumpy and clearly the economy is still dependent on policy stimulus.”

Auto industry tracking firm Edmunds.com estimated that the average discount on a new car was US$2,557 in September, down about 12% year on year.

Graeme Roberts