UK vehicle production fell 15.5% in 2025, according to figures published by the Society of Motor Manufacturers and Traders (SMMT).

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

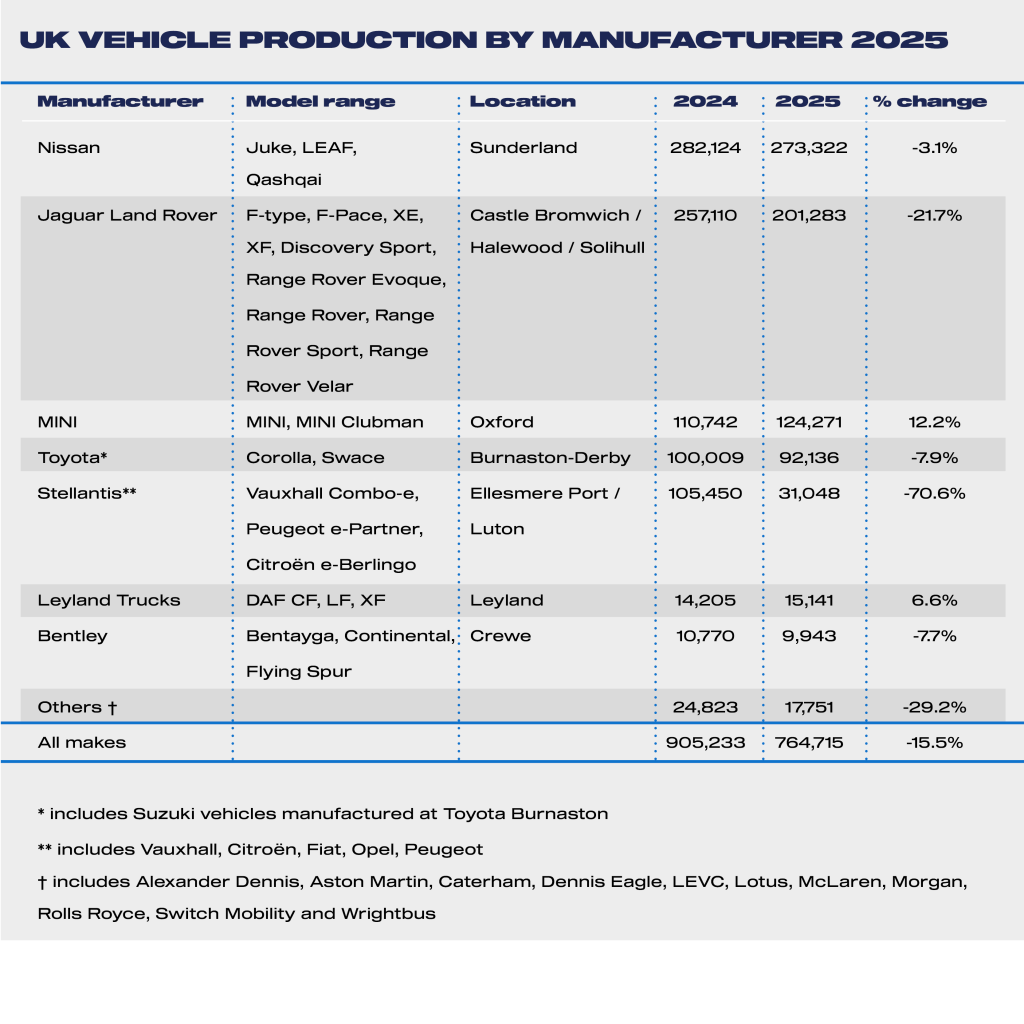

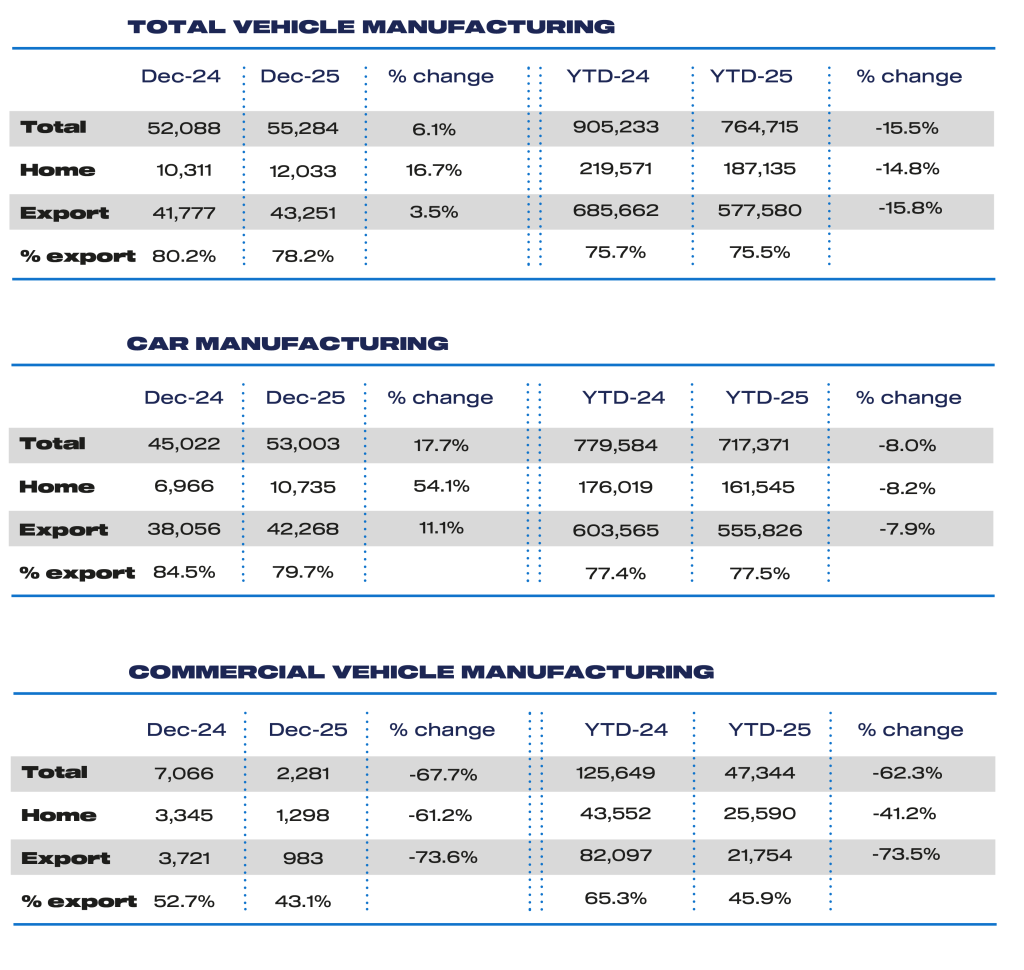

UK factories turned out a total of 764,715 units – 717,371 cars and 47,344 commercial vehicles, with output falling by 8.0% and 62.3% respectively. Volumes were constrained by a number of factors, including a cyber incident stopping production at Jaguar Land Rover; new tariffs on trade across the Atlantic; the consolidation of two CV plants into one (Stellantis/Vauxhall); and ongoing restructuring as plants shift to a decarbonised future.

December saw van, truck, bus and coach volumes decline for a ninth consecutive month, falling 67.7% to 2,281 units, but car production showed signs of recovery, rising 17.7% to 53,003 units and ending four months of decline.

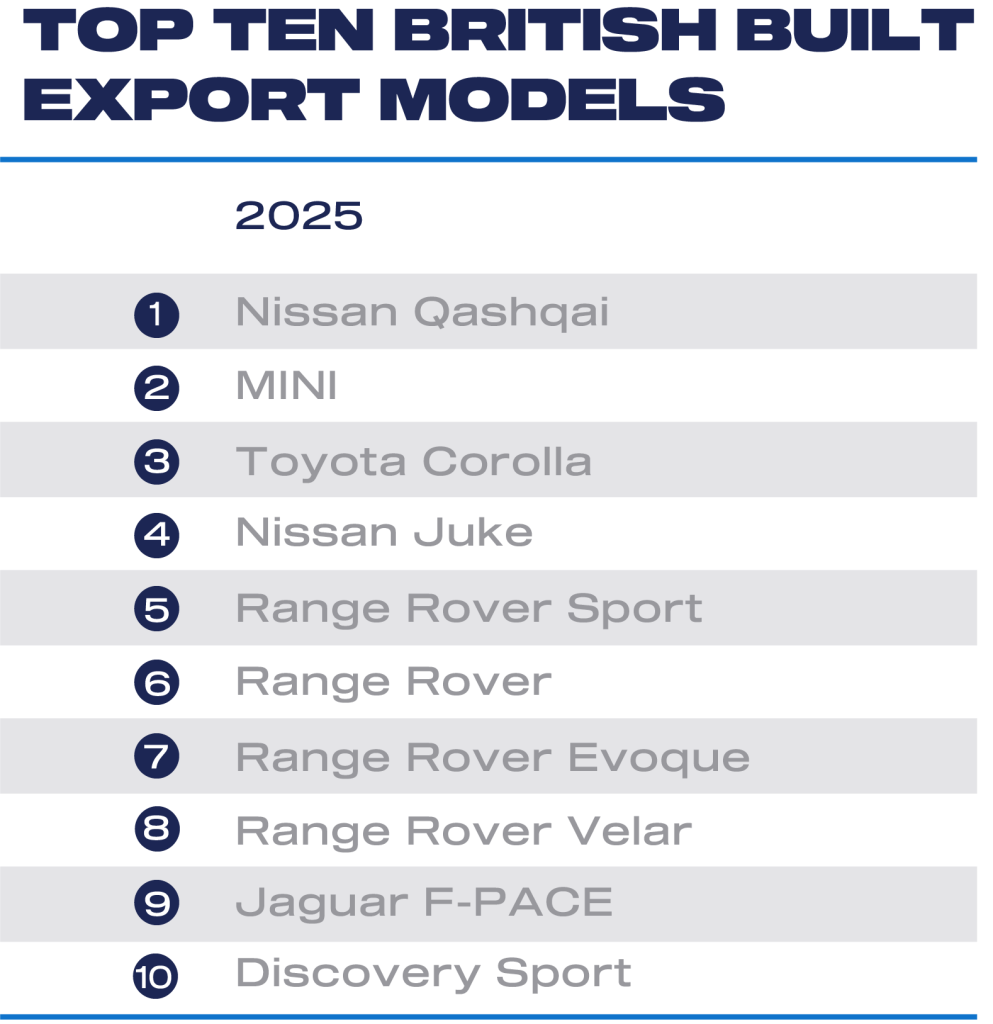

Over the year, car production for the UK market fell by 8.2% to 161,545 units while exports declined 7.9% to 555,826 units, accounting for 77.5% of output.

Europe received the majority (56.7%) of vehicles exported, followed by the US (15.0%) and China (6.3%). Exports to each were down, by 3.3%, 18.3% and 12.5% respectively – with shipments to the US impacted by tariff uncertainty earlier in 2025. Turkey and Japan rounded off the UK’s top five global export markets, followed by Canada, Australia, South Korea, Switzerland and UAE.

Production of battery electric (BEV), plug-in hybrid (PHEV) and hybrid (HEV) cars rose by 8.3% to a combined 298,813 units – a record 41.7% share of output. With the start of next generation volume electric car production in Sunderland, and the planned launch of seven new EV models across the UK, output is expected to grow in 2026.

Mike Hawes, SMMT Chief Executive, said: “2025 was the toughest year in a generation for UK vehicle manufacturing. Structural changes, new trade barriers, and a cyber-attack that stopped production at one of the UK’s most important manufacturers combined to constrain output, but the outlook for 2026 is one of recovery. The launch of a raft of new, increasingly electric, models and an improving economic outlook in key markets augur well. The key to long term growth, however, is the creation of the right competitive conditions for investment; reduced energy costs; the avoidance of new trade barriers; and a healthy, sustainable domestic market. Government has set out how it will back the sector with its Industrial and Trade strategies, and 2026 must be a year of delivery.”