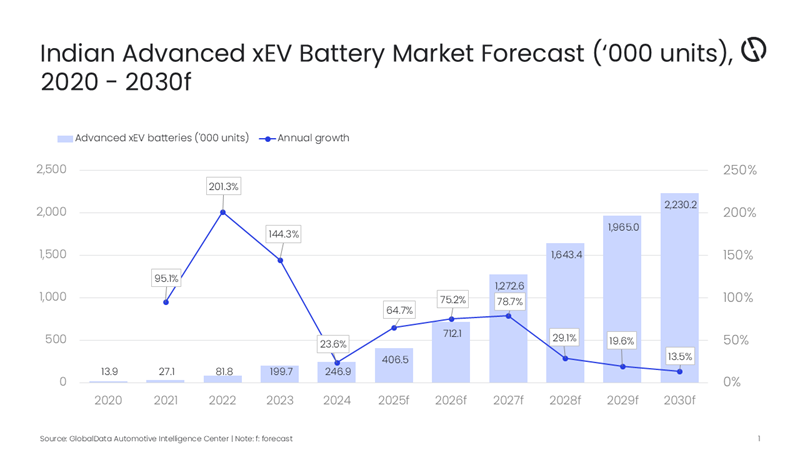

The Indian automotive industry is undergoing a transformative phase, driven by increasing demand for energy efficient internal combustion engine (ICE) vehicles and electric vehicles (EVs), and the need for sustainable transportation solutions. However, this transition is not without its challenges, as the industry grapples with rising costs of essential components and minerals. Despite these challenges, the Indian traction battery market is poised for growth over the next five years, says GlobalData, a leading intelligence and productivity platform.

According to GlobalData estimates, the Indian advanced xEV battery market is expected to expand at a compound annual growth rate (CAGR) of 25.7% over 2026-2030.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Gorantala Sravan Kumar, Associate Project Manager – Automotive at GlobalData, comments: “The government’s push for electric mobility, coupled with increasing consumer awareness and demand for sustainable transportation is expected to drive growth in the Indian traction battery market.”

Recent data from the Society of Indian Automobile Manufacturers (SIAM) highlights a significant shift in the market dynamics. While passenger vehicle production has surged by 25.5% year-on-year in 2025, the industry faces a “clean environment” premium, with the costs of exhaust-cleansing and battery-grade minerals escalating rapidly. Platinum, rhodium, and palladium prices have seen unprecedented hikes, with platinum alone increasing by 110% in 2025 compared to the previous year.

The traction battery market, a critical component for EVs, is witnessing a similar trend. The price of cobalt oxide has surged by 209% year-on-year, and refined cobalt has climbed by 146%. Lithium carbonate, essential for rechargeable power cells, has also seen a 10% increase.

Sravan Kumar continues: “Stakeholders in the industry need to focus on securing a stable and low-cost supply of essential minerals and components. Collaborative efforts between the government and industry players to develop local supply chains and reduce dependency on imports will be crucial for sustaining the momentum of the EV transition.”

Sravan Kumar concludes: “The Indian Automotive Component industry is at a crossroads, balancing short-term cost pressures with long-term structural transformation. The surge in commodity and semiconductor costs has already begun to erode margins—especially for EV producers, whose cost exposure is concentrated in batteries and high-tech components.

“While macroeconomic conditions and geopolitical dynamics remain uncertain, and challenges in component sourcing and rising costs, auto component makers and OEMs that act decisively to control material costs, optimize designs, and enhance supply chain resilience may emerge with stronger competitive positioning in the market of 2026 and beyond.”