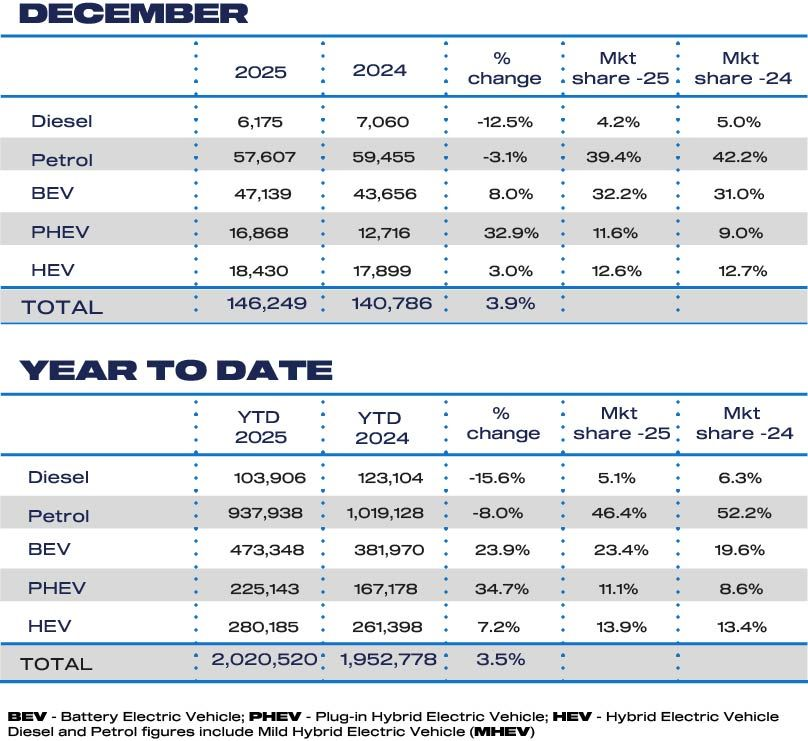

- Incentives by manufacturers drove BEV share to 23.4% in 2025, still below the UK ZEV mandate target of 28%.

- SMMT says rising EV uptake is an undoubted positive, but the pace is still too slow and the cost to industry too high.

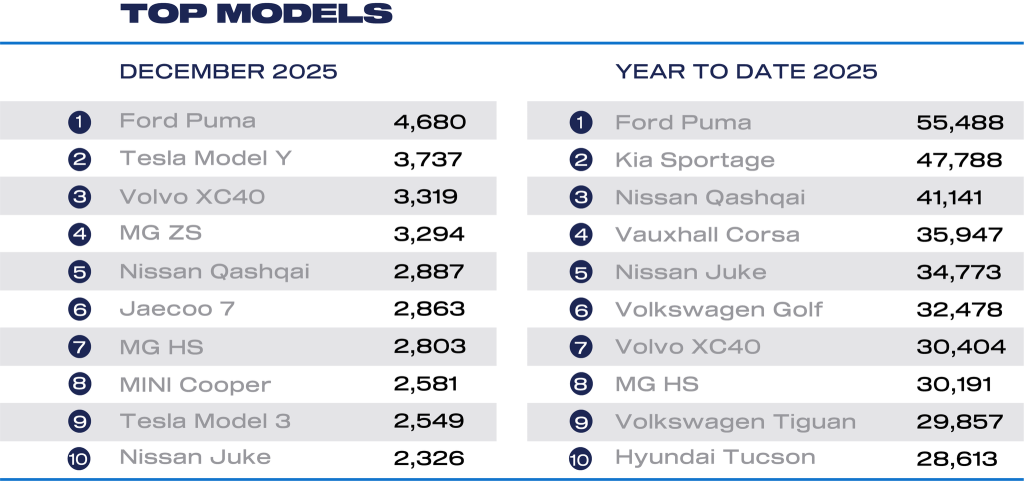

- Ford Puma was UK’s top selling model in full-year 2025, but China’s Chery Jaecoo 7 made a strong showing in the month of December (sixth place).

The UK new car market grew for the third year in a row in 2025, breaching the two million mark for the first time since the pandemic, with 2,020,520 new car registrations, according to figures released by the Society of Motor Manufacturers and Traders (SMMT).

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

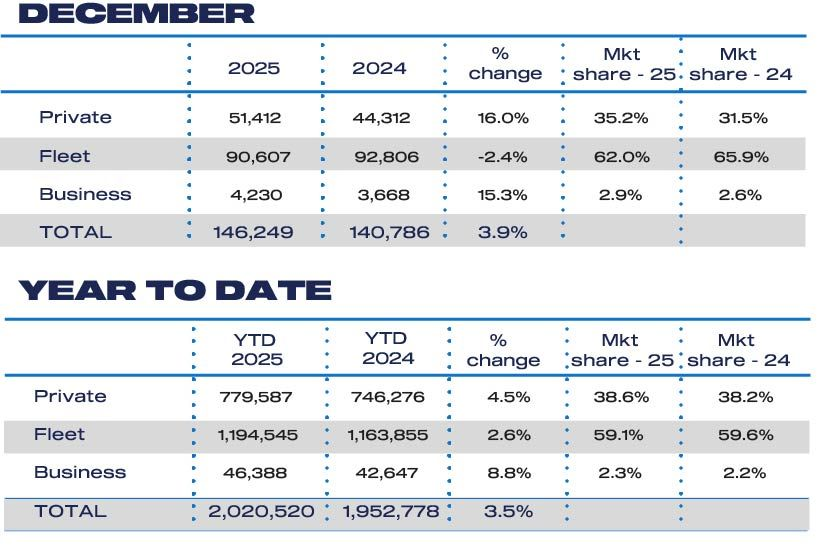

December’s market was up 3.9% to 146,249 units, with a final flourish in the private buyer market, up by 16.0%. Repeating a pattern seen in previous years, battery electric vehicle (BEV) registrations took a high market share in the final month of the year (driven by heavy manufacturer marketing and discounting), accounting for 32.2% of the market – the only time last year’s UK ZEV mandate target of 28% was exceeded in 2025.

As a result, last year’s market rose by 3.5%, with growth across all buyer types. Demand from private buyers recovered slightly from 2024 – when uptake fell below levels last seen during 2020 – with a 4.5% increase to 779,587 units, but still only comprising 38.6% of registrations. Fleet and business registrations also rose, up 2.6% to 1,194,545 and 8.8% to 46,388 respectively.

Electrified vehicles narrowly missed becoming the majority of the market despite a surge during the last quarter. Hybrid electric vehicle (HEV) volumes rose by 7.2% to achieve a 13.9% market share, while plug-in hybrids were the fastest growing powertrain, with volumes increasing 34.7% to take 11.1% of registrations.

Meanwhile, almost half a million (473,348) new BEVs were registered during 2025 – more than in the whole of 2021 and 2022 combined. This huge volume, which is likely to place the UK as the second biggest EV market in Europe by volume, saw BEV market share rise to reach 23.4% – a strong uplift, but with a mandate target of 28% the gap between demand and ambition is increasing rather than diminishing, the SMMT said.

The SMMT noted that massive manufacturer investment now provides a choice of more than 160 BEV models – up from just over 130 at the start of 2025 – with at least 60 more due in 2026. However, EV uptake has risen by only 23.9%. The long-awaited return of a grant for EV purchase has helped, although only around a quarter of models are currently eligible for the incentive at any level. It is manufacturers, therefore, that continue to shoulder the burden of driving up demand, subsidising their sale by more than £5 billion in 2025 according to SMMT estimates, equivalent to a massive £11,000 per BEV registered. Such subsidies are clearly unsustainable, the SMMT says.

The SMMT also maintains that the announcement of a new ‘eVED’ tax on EVs purchased from 2028 sends a ‘confusing message’ to consumers, undermining rather than encouraging market confidence.

While average new car CO2 has fallen by 10.1% from 2024 to 91.8 g/km, which will assist some manufacturers with mandate compliance, the UK’s zero emission sales target will next year require BEVs comprise one in three new car registrations. The UK already has the most ambitious transition trajectory of any major market and, with the EU’s proposal to revise its end of sale date from 2035, divergence between the UK and the much larger market on its own doorstep is broadening, the trade association points out.

SMMT also argues that action is needed from UK Government to ensure the British market remains attractive for investment, and one which supports consumers, the industry and the economy. Further, it says the upcoming review of the ZEV Mandate will be a ‘crucial opportunity to ensure the transition supports the UK’s international competitiveness and prosperity, as well as its shared decarbonisation goals’.

SMMT data (see below) also showed that Volkswagen was the top-selling brand in 2025, followed by BMW and Ford. The Ford Puma was the top-selling model range.

Mike Hawes, SMMT Chief Executive, said: “The new car market finally reaching two million registrations for the first time this decade is a reasonably solid result amid tough economic and geopolitical headwinds. Rising EV uptake is an undoubted positive, but the pace is still too slow and the cost to industry too high. Government has stepped in with the Electric Car Grant, but a new EV tax, additional charges for EV drivers in London and costly public charging send mixed signals. Given developments abroad, government should bring forward its review and act urgently to deliver a vibrant market, a sustainable industry and an investment proposition that keeps the UK at the forefront of global competition.”

UK 2025 new car sales by brand